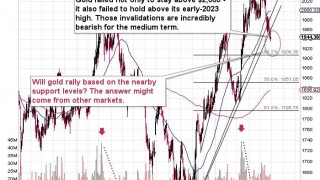

Gold didn’t just invalidate the move above $2,000. It moved even lower – that’s how we know the invalidation is real. And so are its consequences. After gold’s suspicious rally, we see a very real decline. And the decline in silver and mining stocks is even bigger.

Full Article →Przemyslaw Radomski

Przemyslaw K. Radomski, CFA, has over twenty years of expertise in precious metals. Treating self-growth and conscious capitalism as core principles, he is the founder of GoldPriceForecast.com

As a CFA charterholder, he shares the highest standards for professional excellence and ethics for the ultimate benefit of society and believes that the greatest potential is currently in the precious metals sector. For that reason it is his main point of interest to help you make the most of that potential.

Perfect (and Profitable) Reversal in Miners

Theoretically, it’s not really important to pick the exact top – it’s good to be just near it when making transactions. And to be 100% precise, all that matters is that the exit price is more favorable than the entry price for a given trade. And if the annualized rate of return is better than the risk-free rate of return (one that bonds provide), then it’s already very good.

Full Article →So, Is the Bottom Finally Near?

Gold, silver, and miners have been declining substantially recently, just as the USDX has been soaring. But all (good?) things come to an end, right? While the above is up for debate, it’s definitely true that no market moves up or down in a straight line *cough* except for silver *cough* without periodic corrections…

Full Article →New Low in Miners, New Record in Profits

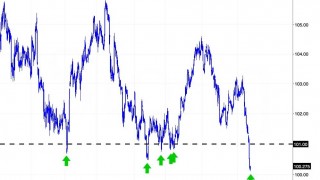

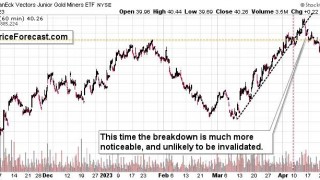

It happened! Junior miners moved to new 2023 lows! If one opened a short position in GDXJ this year and they hold it, they are profitable. The question – of course – is if junior miners and the rest of the precious metals sector are going to continue to move lower from here or will they bottom, just as they did previously when they were trading at similar levels.

Full Article →Short-Term Gold Price Outlook Remains Bullish, But…

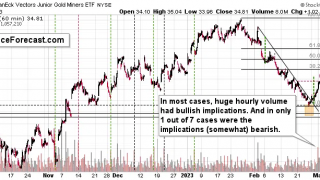

Whoever requested the extra portion of signs from gold and gold stocks certainly didn’t have to wait for long. Gold stocks severely underperformed gold once again, and this means that the end of the rally in gold is probably near. It might or might not be completely over just yet.

Full Article →2023 is a Down Year for Silver and GDXJ

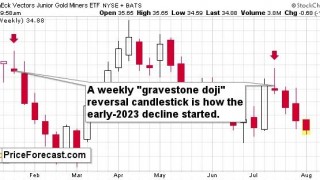

Did you notice that for the HUI Index, GDXJ, and silver, 2023 is already a down year? In today’s analysis, I’ll dig into the former. Remember how I wrote in mid-July that after the weekly reversal, junior mining stocks were likely to move lower…

Full Article →Gold Price Forecast for August 2023

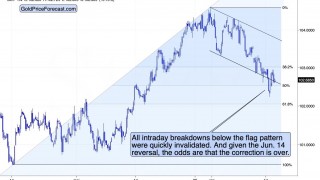

Making gold price predictions is not an easy feat, but every now and then, we get blessed with a clear signal. And we saw one in July 2023. It’s visible on the monthly chart that features not only the key parts of the precious metals sector but also one of the key gold price’s drivers – the USD Index.

Full Article →A Little Decline Here, a Small Rally There… It’s Happening.

The USD Index is on the rise, and the precious metals sector is declining. Big things can have small beginnings, though, and that’s normal. In yesterday’s analysis, I focused on what’s currently most important from the medium- and short-term point of view on… pretty much all markets

Full Article →USDX Hits New Lows, Is Gold Asleep?

And so, it happened – against the odds and rising real rates, the USDX is at a new yearly low. But is gold at a new yearly high?… The decline in the USDX was truly significant. Things are (still) very exciting on the USD Index front. Yes, it’s declining, and yes, it’s excitingly… Bullish.

Full Article →Ready for MORE Profits in Gold Miners?

So, yeah, gold, silver, and mining stocks declined yesterday. This did not surprise you, as I’ve been emphasizing multiple reasons due to which this was the likely outcome. But I admit the power with which juniors declined yesterday amazed me even more than I thought it would. And I get rarely surprised by the markets.

Full Article →Gold Price Forecast for July 2023

The month is over. The week is over. Some things changed, some things didn’t. What can one predict for gold price in July 2023? While it might appear that not much happened in gold last month, in reality, it declined by over $50 – and that’s no small feat.

Full Article →Gold Can’t Slide Indefinitely, Can It?

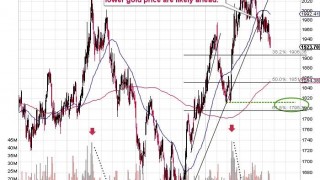

Gold price “was supposed to” hold above $2k, but it looks ready to break below $1,900. At what price can we see a turnaround? Let’s investigate gold’s chart to find out…

Full Article →It’s Not Necessarily All About Gold Price…

Boring day for precious metals, but brace yourself for some major stocks action! I’ll be honest – there’s not much going on today, at least for the precious metals market. Things are pretty interesting for stocks, though…

Full Article →Now THAT Was the Game-changer for the Price of Gold!

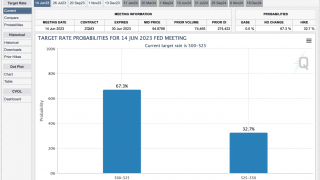

In a game-changing turn of events, yesterday’s FOMC meeting shattered hopes of a quick, dovish U-turn as the Fed announced the possibility of raising rates twice this year. Yesterday’s FOMC and the following press conference were groundbreaking.

Full Article →Will the Fed Hike? What If? Gold Price Outlook

Chirp, chirp!

Hear that? That’s the canary in the coal mine. The Bank of Canada just raised interest rates after two no-change decisions, and it was quite common for the Fed to follow the BoC.

The Tricky Rally in Gold Stocks – Don’t Be Fooled

It was only two months ago – in April – when everyone and their brother were convinced that gold stocks are going to soar? They laughed at my warnings that this kind of sentiment is what accompanies tops, not buying opportunities…

Full Article →The Debt Ceiling Deal and the Price of Gold

What are the consequences for the price of gold? Will gold go parabolic? Truth be told, though, there’s not that much to write because what we saw on the market on Friday took place in exact tune with what I wrote previously.

Full Article →Top in Stocks? Implications for Gold Miners and… Profits

The profits in the FCX increased once again, but junior miners didn’t decline despite the S&P 500’s downswing. Why would this be the case? In my analysis yesterday, I warned about the volatility that we might see this week, mainly due to Fed’s interest rate decision, but…

Full Article →Monthly Reversal in Gold Price and Gold’s Outlook

In Friday’s analysis, I wrote that gold price was likely about to form a monthly reversal – and now it’s a fact. Will gold slide? Bullion.Directory precious metals analysis 01 […]

Full Article →Once Again $2000 is Ceiling for Price of Gold

The price of gold moved higher yesterday, but did it manage to rally back above $2,000? No! Despite USDX’s weakness, it didn’t. And this means that the odds for a bigger rally from here declined while the odds for a bigger decline increased.

Full Article →What a Week in Gold Price! What an Invalidation!

Did last week’s market plunge below the $2,000 level provide the final confirmation? And why is this big news? I wrote in number of occasions that the gold price was unlikely to hold the breakout above the $2,000 level. Last week provided the final confirmation.

Full Article →Boom! There Goes the Gold Breakout Above $2,000!

Looks like we just saw the first small “boom” in a controlled demolition on the markets. The only reason it’s “controlled” is because the prices are likely to fall in a specific pattern (in tune with how they declined previously) and not crumble instantly.

Full Article →What XAU Index Tells Us About Gold & Silver Stocks

The XAU Index is great for assessing what’s really happening in the precious metals market. One of the most important (and one that we have the longest dataset for) indices present on the precious metals market is the XAU Index.

Full Article →Gold & Silver Stocks are Still… Stocks

I’ve recently written much about the link between now and 2008, and it has profound implications not just on gold and silver stocks but also on other stocks.Based on what happened in 2008, it seems that stocks are about to move much lower in the following months. Let’s take a look at the markets from a more short-term point of view…

Full Article →Pullback in Gold Stocks or a New, Powerful Decline?

What a slide! The GDXJ ETF moved over 5% lower yesterday, and it closed at a fresh 2023 low. Is the bottom in or is the slide likely to continue? Let’s take a closer look at the charts to find out.

Full Article →Relax, Take Profits Easy…

To say that junior miners were weak yesterday is like saying that the Fed printed “some money” in the last decade. It isn’t a lie, but it doesn’t convey the full truth either. Yesterday’s relative performance of junior mining stocks was a disaster

Full Article →The Rally in Gold – Did it Just End?

Let’s start today’s analysis with a very short-term chart (hourly candlesticks) featuring the GDXJ ETF – a proxy for junior mining stocks. These miners have been the most volatile part of the precious metals sector – at least, it’s the more popular part.

Full Article →How High Can the Gold Price Rally in March?

Fear and greed are common on the market, and due to them, people tend to follow specific patterns over and over again, regardless of the exact economic surroundings and also pretty much regardless of the time when it’s all taking place…

Full Article →Przemyslaw Radomski

Przemyslaw K. Radomski, CFA, has over twenty years of expertise in precious metals. Treating self-growth and conscious capitalism as core principles, he is the founder of GoldPriceForecast.com

As a CFA charterholder, he shares the highest standards for professional excellence and ethics for the ultimate benefit of society and believes that the greatest potential is currently in the precious metals sector. For that reason it is his main point of interest to help you make the most of that potential.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.