How will the upcoming presidential election impact the gold market? Biden has dropped out of the presidential race. It appears Kamala Harris has the inside track to the Democratic Party nomination, but that isn’t a foregone conclusion. Polling currently shows Trump and the Republicans holding an edge, but we are a long way from November…

Full Article →Unless you live in a cave located in the remote regions of the world, you probably heard about the Crowdstrike outage. A simple IT mistake (not even an act of cyberterrorism!) took down the world’s computers on July 19, costing over $5 billion and disrupting countless lives. Here’s how to be ready next time…

Full Article →On July 16, a jury convicted Senator Bob Menendez (D-N.J.) on 16 counts, including wire fraud, bribery, and extortion. At least he accepted bribes that would retain their value. Let me be clear: you really shouldn’t take bribes. But if you do (don’t), get it in gold.

Full Article →This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Gold hits $2,424 on speculations of a rate cut, shifting our understanding of the gold market, and Africa’s turn to gold is sending us signals.

Full Article →Gold and silver each retreated in price today with silver down about 3% and gold down about .25%. The significance of the gold drop is not the change from yesterday’s close. The significance is that it reached an all-time high then reversed over $25 per ounce. Buy the dip!

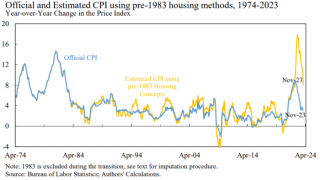

Full Article →If you have that strange feeling like the full story about the U.S. economy isn’t being told, you’re not the only one. You might even be feeling like things are much worse than the Administration keeps touting through the corporate media. In fact, in this piece we’re going to explore several examples that illustrate just how the American public is being sold

Full Article →The federal government ran another big deficit in June, as the national debt inches closer to $35 trillion. $35 trillion USD. Trillion with a ‘T.’ That’s an unfathomable number. It’s meaningless to most people. We simply can’t comprehend a number that big.

Full Article →Gold-backed exchange-traded funds (ETFs) reported net inflows of gold for the second straight month in June. With European funds leading the way, net gold holdings by ETFs globally increased by 17.5 tons last month. May was the first month of positive flows into ETFs in 12 months.

Full Article →The June employment report was released this morning and showed a continued labor market slowdown. About 200,000 jobs were created in line with expectations though continuing a downward trend. The unemployment rate edged up to 4.1% which was the highest reading since October 2021. One less talking point for Joe Biden as he …

Full Article →I’ve written a lot about the fact that silver appears to be underpriced given both technical factors and the supply and demand dynamics. Platinum may be even more undervalued, hovering around $1,000 an ounce. To put that into perspective, platinum hit an all-time high of $2,213 an ounce in March 2008…

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Gold is making another run towards $2,400, emerging market central banks to continue buying gold for decades, and why younger generations are three times more likely to buy gold than older ones.

Full Article →How do you safely and securely move billions of dollars worth of gold? Very quietly. De Nederlandsche Bank (the Dutch central bank) did just that, moving over 220 tons of gold coins and bars over 45 miles of public highway. Officials spent four weeks shuttling gold and cash from a vault in Haarlem to the new Cash Centre in Zeist.

Full Article →Investors are also gobbling up gold in Thailand for many of the same reasons. A Thai gold dealer said he has never seen such strong demand for gold during a period of rising prices. “At this price, people should be selling but everybody is buying. People are actually fighting to buy. The local consumers are very smart.”

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: BofA forecasts $3,000 gold as central banks keep buying, taking apart some narratives against gold, and mysteries surrounding Chinese gold abound.

Full Article →People like Paul Krugman keep saying Americans don’t realize how good they have it. Janet Yellen recently said she doesn’t experience sticker shock when she goes to the grocery. The White House spokesperson tells us how great the economy is. Inflation is coming down! Meanwhile, the rest of us are struggling to pay the bills…

Full Article →You can’t keep a good market down. My mantra is that nothing goes up or down in a straight line. The physical precious metals this week showed that. As of this writing, gold is up .67% for the week and silver is up .50% while the Dow Jones Industrial Average (DJIA) is up .005% for the week.

Full Article →What Happens When Rate Cuts Come Too Soon. The cost of credit is high, and all eyes are on the Fed these days. The economy can’t tolerate today’s interest rates, so everyone expects rate cuts – but when? Here’s what happens when cuts come too soon…

Full Article →As war wages across their eastern border, Poles seek safety. And they’re finding it in gold. Russian troops stormed across the Ukrainian border on Feb. 24, 2022. It was Fat Tuesday; a day Poles typically line up for jelly-filled donuts called pączki. Instead, they lined up to buy gold.

Full Article →Even Bank of America is now talking about $3,000 gold. According to a report released by the big bank, gold prices could potentially hit $3,000 an ounce in the near term as the Federal Reserve begins cutting interest rates and rising debt drives economic uncertainty.

Full Article →As we’ve observed gold’s price gains since the start of the year, a question has been lingering on our minds. When gold left its $2,000/oz price behind six months ago, analysts wondered if this is going to be a permanent fixture. That level has mostly been forgotten now, and we could say that $2,300 is the new $2,000 – yet the doomsayers…

Full Article →On June 23, 2024, the criminal organization LockBit 3.0, a Russian ransomware cybercriminal group, publicly stated that it hacked the Federal Reserve and implied it would release over “33 terabytes of juicy banking information containing details of Americans’ banking secrets” unless a large ransom is paid.

Full Article →You know gold is doing well when the mainstream sits up and takes notice. The mainstream financial pundits specifically, and the media in general, are typically apathetic about gold at best. More often than not, they’re downright antagonistic. The problem is that gold isn’t good for the regime.

Full Article →All classes of institutional investors have embraced gold. Thailand’s public pension fund adds gold as a hedge against possible ‘extreme volatility’ and large swath of U.S. public sector pension funds expected to increase gold allocations. Asset manager: Gold helps pension funds “avoid unnecessary risk.”

Full Article →A few weeks ago, gold sold off on news that the People’s Bank of China didn’t add any gold to its reserves in May. At the time, I called it a “kneejerk reaction,” and said the news wasn’t “a particularly good reason to sell gold.” Before the news, China had bought gold for 18 straight months. However…

Full Article →Inflation has persisted so long now I’m forced to consider whether the Fed is really as concerned with it as Powell lets on. Maybe they realize the cure could kill the patient? The cost of living has risen even more… Data confirms that housing expenses, energy and vehicle maintenance costs have all increased by double digits since January 2021

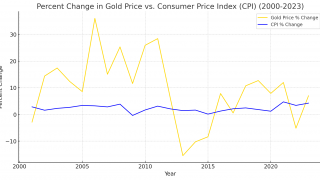

Full Article →Since mid-2021, we lived through the worst price inflation since the 1970s. CPI peaked in June 2022 at 9.1 percent. During this inflationary period, a lot of people sold gold as evidenced by the rangebound price through most of 2023. Was selling a good move?

Full Article →Gold prices could realistically reach $7,000 to $40,000, according to experts. The U.S. may be deliberately weakening the dollar to boost exports. Gold is unique in its inability to go to zero, making it a safe haven asset – accumulating more physical gold and silver during price drops is wise

Full Article →Central-bank buying has been credited as a key source of gold support for years. High-volume gold buyer China “paused” acquiring any gold in May. Analyst: “Nothing has changed for gold except the price” – Precious metals’ fundamental drivers are intact despite headwinds

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.