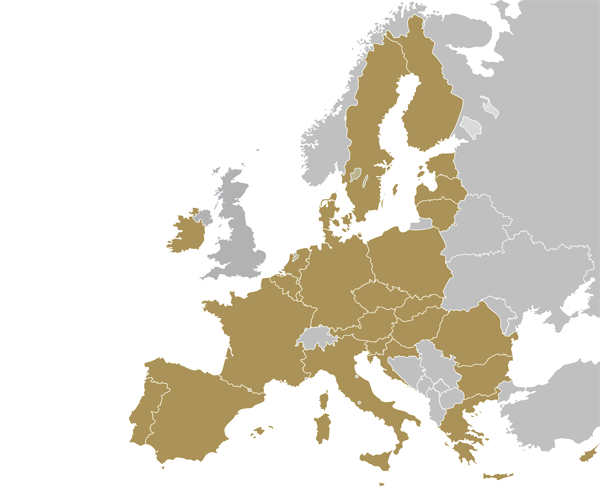

Search 137 EU Bullion & Precious Metal Dealers:

EU Gold and Coin Dealers

We aim to list all precious metals dealers and coin (numismatic) dealers across the European Union. This section is currently under construction with new sections and companies being added daily

EU bullion dealers are listed by both county and the services offered meaning you can set search results to only show results you’re looking for, ie Coin Dealers in Germany, Scrap Gold Buyers in Spin or for areas with many dealers you can search by city such as Gold Dealers in Berlin – with detailed listings based on consumer rating scores and reviews.

Whether you’re building an investment portfolio, a collector of numismatic coins or looking to diversify your retirement plan into precious metals – finding trusted precious metals dealers locally or across Europe takes just a few clicks.

Looking for the Best Gold Dealers in Europe? Our annual Bullion Dealer of the Year public vote typically sees over 30,000 votes cast globally – and for the upcoming 2020 vote we’ll be introducing voting for our new European categories.

Are Bullion Sales Taxed in the EU?

The tax situation on EU bullion varies enormously depending on the metal, the bullion product, the ownership vehicle – and thanks to a variety of VAT rates across the EU – the location country.

EU SALES TAX ON BULLION

As far as sales tax goes, investment-grade gold bullion is zero rated for VAT across the EU. This applies whether the bullion is in the form of coins or bars. To qualify for exemption, the gold must be of a fineness greater or equal to 995, or for post-1800 legal tender coins of a purity over .900

To further qualify as investment-grade bullion a coin’s sale price should be no greater than it’s intrinsic gold weight plus up to 80%. Numismatic coins and collectibles are therefore not exempt (See OFFICIAL LIST of tax free gold coins in the EU).

New Silver, Platinum and Palladium bullion bars, rounds and coins, plus non-qualifying gold and numismatic coins are all rated at the full standard VAT rate for the country. Some countries treat legal tender silver coins differently, charging either zero, or a lower rate.

This becomes an issue when one country charges VAT at 25% on legal tender silver bullion coins, whilst another charges 0% – and a thriving cottage industry now exists to enable citizens of high VAT countries to buy their investment metals in another EU-member state, take “delivery” in that country and then ship to their home country side-stepping local VAT.

Although perfectly legal, this is now becoming a grey area and some countries, notably Sweden are clamping down on this trade.

The only other way for EU bullion dealers to offer truly zero-rated silver coins – and indeed silver, platinum and palladium bullion at zero VAT, is by ensuring the metals remain vaulted outside of the EU, otherwise VAT will be payable at the full local amount.

Standard VAT rates for EU / European Free Trade Association (EFTA) countries: Austria 20%

Belgium 21%

Bulgaria 20%

Croatia 25%

Czech Republic 21%

Denmark 25%

Estonia 20%

Finland 24%

France 20%

Germany 19%

Great Britain 20%

Greece 24%

Hungary 27%

Ireland 23%

Italy 22%

Latvia 21%

Lithuania 21%

Luxembourg 17%

Malta 18%

Netherlands 21%

Norway 25%

Poland 23%

Portugal 23%

Romania 19%

Slovakia 20%

Slovenia 22%

Spain 21%

Sweden 25%

Switzerland 8%

Turkey 18%

Some EU / EFTA countries treat silver bullion differently. Estonia charges 0% VAT on legal tender silver coins. In Germany and The Netherlands, VAT is only applied to the dealer’s margin for eligible silver coins. Some UK dealers (notably Chards) sell pre-owned silver bullion bars using a similar margin scheme. Although outside of the EU, Norway is an EFTA country and like Estonia, charges VAT at 0% on silver coins when delivered in-country.

EU CAPITAL GAINS TAX ON BULLION

As with VAT, Capital Gains Tax (CGT) varies depending on the bullion product and country. Typically there is full CGT paid on all precious metals bars and rounds, however coins that are “Legal Tender” can be exempt from any CGT – this is the case in the UK.

This leads to confusing situations where legal tender silver platinum and palladium coins can be exempt from CGT, but liable for VAT. Gold legal tender coins on the other hand, are exempt from both CGT where applicable and VAT – the #1 reason UK Gold Sovereigns and Britannias are such popular coins with UK investors – even when allowing for their often higher premiums compared to bars and rounds.

Some other countries such as Spain charge additional CGT-like taxes on assets when a citizen leaves the country permanently. If you intend to leave Spain and have lived there for at least 10 years in the prior 15 years, you may face an “exit tax”, which is applied to unrealised gains on certain assets wherever they are in the world – including gold.

IMPORTANT: The above tax details are listed for information purposes only and are believed correct at time of publication. Bullion.Directory are not tax experts. All enquiries about European taxes should be addressed to the appropriate body. Taxes and taxation are subject to change.