The profits in the FCX increased once again, but junior miners didn’t decline despite the S&P 500’s downswing. Why would this be the case?

Bullion.Directory precious metals analysis 03 May, 2023

Bullion.Directory precious metals analysis 03 May, 2023

By Przemysław K. Radomski

Founder of GoldPriceForecast.com

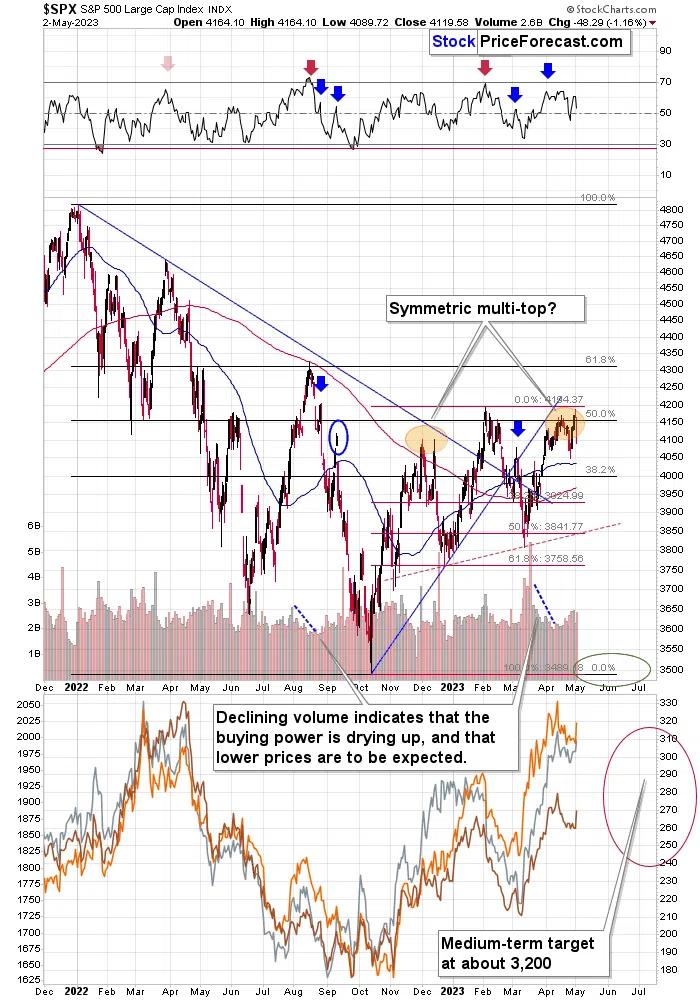

In my analysis yesterday, I warned about the volatility that we might see this week, mainly due to Fed’s interest rate decision, but the market didn’t even wait for the above data to move in a quite visible manner. Job openings were weaker than previously and weaker than expected, which caused the stock market to decline, as it indicates a possible – and likely – economic downturn.

The vision of recession just got more real.

Stocks declined after their daily reversal, just like they were likely to.

And profits on our short position in the FCX ETF just got bigger than ever.

But what does that mean going forward? It likely means that the decline in stocks is really just beginning. Yes, it means bigger profits in the FCX and likely a downturn in the precious metals market, too.

But if this is the case, then why did gold, silver, and mining stocks move higher yesterday? In particular, why did junior miners move so much higher yesterday?

Let’s take a look at how far they actually rallied.

The GDXJ moved just to its early-2023 high. It didn’t move above that high – it just touched it.

This means that this move didn’t change anything and that it was likely just a technical correction after a two-week decline. So, even though the GDXJ moved higher by about 4% yesterday, it was not a game-changer.

But why would junior miners and gold rally at all?

In the short run, markets (which are ultimately made of people) are emotional and not necessarily logical.

People see something that indicates recession, and their initial reaction might be to focus on the interest rates implications only and not on the bigger picture.

Yes, the deteriorating economic outlook could make the Fed stop raising rates or consider moving them lower, but for the time being, inflation is still the key concern that voters have, so that is what will be addressed.

And there’s really no reason to focus on the nominal rates only. The economic downturn also implies lower inflation and the ultimate effect on the real interest rates doesn’t have to be negative. The decline in expected inflation might actually be greater than the actual implications on nominal rates – and thus, real interest rates might move higher based on the lower job openings – at least for some time.

And the above would be bearish for gold, not bullish. Yet, if people look at that piece of news only through the lens that points to nominal interest rates, they will see a distorted picture. I think that it’s likely that this happened because people’s focus is on the nominal interest rates anyway, simply because the Fed’s interest rate decision is due today.

So, all in all, I’d view yesterday’s upswing as something temporary and not really sustainable. The multiple indications that I covered recently point to much lower prices of gold, silver, and mining stocks (and FCX!) in the following weeks, and yesterday’s – likely emotional – corrective upswing doesn’t change that.

The profits on the FCX are likely to increase further, and the precious metals sector is likely to join in this decline, too. In particular, in my view, the downside potential for junior mining stocks is enormous at this time.

Przemyslaw Radomski

Przemyslaw K. Radomski, CFA, has over twenty years of expertise in precious metals. Treating self-growth and conscious capitalism as core principles, he is the founder of GoldPriceForecast.com

As a CFA charterholder, he shares the highest standards for professional excellence and ethics for the ultimate benefit of society and believes that the greatest potential is currently in the precious metals sector. For that reason it is his main point of interest to help you make the most of that potential.

This article was originally published here

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply