The USD Index is on the rise, and the precious metals sector is declining…

Bullion.Directory precious metals analysis 25 July, 2023

Bullion.Directory precious metals analysis 25 July, 2023

By Przemysław K. Radomski

Founder of GoldPriceForecast.com

Big things can have small beginnings, though, and that’s normal.

In yesterday’s analysis, I focused on what’s currently most important from the medium- and short-term point of view on… pretty much all markets because (almost?) all of them are connected to the stock market and/or the forex market in one way or another. Gold, silver, and miners are no exception, of course, and we saw major weekly reversals as well.

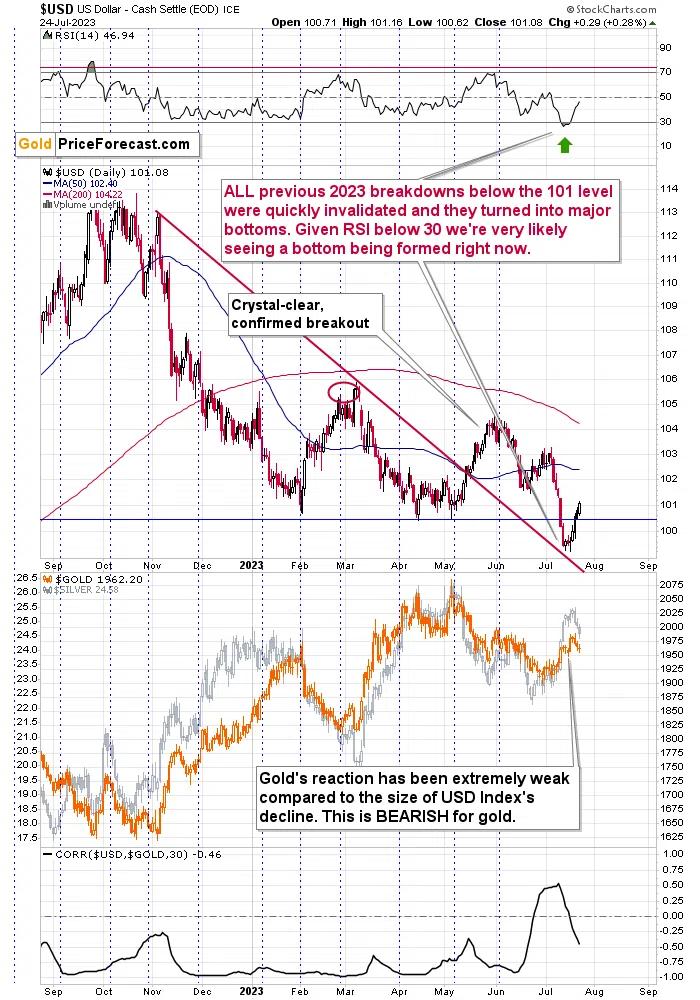

The bullish reversal that we saw in the USD Index last week was followed by a small daily rally yesterday – a completely normal phenomenon.

The USDX closed visibly above the previous 2023 low in terms of the daily closing prices, which means that the breakdown to new yearly lows has now been 100% invalidated. This is profound and very bullish.

Of course, yesterday’s 0.29 index point move higher was nothing to write home about, but it’s normal for the market to climb back up one step at a time and not shoot up regardless of historical patterns.

To be precise, this kind of rally is also in store, but they should be treated as something extraordinary, not ordinary.

“Slow is smooth; smooth is fast.”

And that’s how USD Index’s rally might be at the beginning.

Just as the USD Index is taking a measured approach to rallying, gold, silver, and miners are taking a measured approach to their declines… So far.

The $4.40 decline we saw yesterday is almost nothing, but it seems like we’re about to see gold move back below its 50-day moving average, which will serve as the final confirmation that the top is in.

Back in mid-2022, when we saw a move above the 50-day moving average and then a move back below it, it was when the decline really picked up. And we’re likely about to see the same thing. That’s why I added “so far” at the end of the last sentence above gold’s chart.

Besides, the Stochastic indicator at the bottom of the chart is already after a major sell signal.

Silver declined more visibly, sliding by 1.1% yesterday. It already outperformed gold on a very short-term basis, and it’s clear that that particular sell signal is already in place. The current weakness of the white metal doesn’t change it.

The junior mining stocks were down by almost 1% yesterday, and they are performing exactly as they were likely to based on multiple factors that I had covered previously. Quoting my comments on the previous nonfarm payroll statistics and mining stock prices:

“Most importantly, though, the above chart shows that the current situation is EXACTLY like it was after the previous surprisingly bad (low) non-farm payroll reports.

You see, there were just three cases in the recent past when the job statistics were below the expectations, and I marked all of them with red, vertical lines. See anything in common?

I sent the info to my subscribers immediately after the report was released warning about the real impact that it’s likely to have. While the immediate-term aftermath could have been positive or relatively neutral, the medium-term implications are clear. Junior miners are likely to slide.

The most bearish thing about this analogy is… The most recent rally.

“Huh, how can a recent rally be bearish?” – one might ask.

The point is that based on the recent rally, the clearest analogy is now to the 2022 top, the rally, and the report that preceded it. Well, what happened after that top? Buying GDXJ then wasn’t a good trading strategy, as the GDXJ’s value was approximately cut in half over the next several months.

And all that is on top of all the weekly reversals that I mentioned throughout today’s analysis!

Just a repeat of that would imply a move to about $20 in the GDXJ. Let nobody tell you that a move to “just” the 2022 low in the medium term is excessive – that’s actually just a part of what’s likely based on what GDXJ already did in the past.”

One thing that you might be concerned with is the fact that we saw a daily rally in the S&P 500. It should reverse after a weekly shooting star reversal, right?

Well, yes, and no.

Yes, based on the pattern itself.

No, based on the analogy of how stocks topped at the beginning of 2022. After the weekly reversal, they moved slightly above the previous week’s high only to slide shortly thereafter and close at new lows.

If history is to repeat itself, then the fact that we saw a small (0.4%) move higher is not really bullish but a part of the bearish analogy.

So, yes, the weekly reversals in gold, silver, miners, USD Index, and stocks continue to play and extremely important part in determining the near-term and medium-term fate of the precious metals market. And it doesn’t look good.

What does it all mean? In short, the counter-trend corrective upswing is likely over, and huge declines are likely just beginning. The huge profits that we recently reaped in the FCX recently are likely to be joined by massive profits from the current short positions.

Przemyslaw Radomski

Przemyslaw K. Radomski, CFA, has over twenty years of expertise in precious metals. Treating self-growth and conscious capitalism as core principles, he is the founder of GoldPriceForecast.com

As a CFA charterholder, he shares the highest standards for professional excellence and ethics for the ultimate benefit of society and believes that the greatest potential is currently in the precious metals sector. For that reason it is his main point of interest to help you make the most of that potential.

This article was originally published here

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply