You may be surprised to learn that housing is now “the civil rights issue of our time” according to some activists. The problem with activists like this is how they want the problem solved. They want more government involvement and control – which could wreck more than just the housing market…

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

“Doom Spending” Trend Casting Shadows Across Economy

You’ve probably never heard of “doom spending,” but it’s important. Doom spending is clearly a warning of an economic nosedive. Learn what it means and how to prepare now, so the consequences don’t take you by surprise…

Full Article →The spreading Middle East conflict is now one of the dominant forces driving gold and silver higher – alongside thriving central bank demand and the growing deficit of silver production. The path to $50 silver seems clear – here’s what’s next…

Full Article →Did Fed just send gold over $2,600/oz?

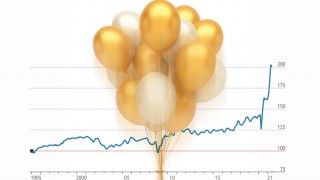

This might be the most thrilling time in the gold market since 1971. You could argue the 2008-2011 Great Financial Crisis compares, but I beg to differ. The pandemic panic and lockdowns were the much more like the GFC for gold. Besides, if gold’s current run was similar to the GFC, we’d already be two years into a sideways market.

Full Article →Why Your Social Security Is in Danger

Social Security has long been promised to be a way for the average worker to retire in comfort and maintain their standard of living even after they stop earning, but can you really depend on it, or any other government run program, to keep you and your family out of the poor house and away from soup kitchens when you retire?

Full Article →Powerful Forces Behind Gold’s Latest All-Time High

This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Gold hits $2,600 in another massive jump, the Bank of France’s views on gold, and why now is the time to watch what central banks are doing.

Full Article →Top Banker Confesses He’s Deeply Concerned

Jamie Dimon, head of one of the biggest banks in the world, expressed concerns that what many people think could be almost the worst possible scenario for the U.S. economy is, in fact, a very real possibility. Most people, when they’re trying to find reliable information, look to experts in a given field. Jamie Dimon IS that expert…

Full Article →What We’re Told About “Sound Money” is a LIE

Economists predict the Fed will soon drop interest rates because the rate of inflation has slowed. Why the slowdown? One analyst is ready to celebrate lower inflation and lower rates as “the return of sound money.” What does that even mean? Step back with me, for a moment, to just four years ago…

Full Article →What’s going on with housing? Home sales plunge to a record low – record high prices in many parts of the nation, combined with steep mortgage rates have led to a standoff between buyers and sellers. How much is a home really worth if no one can buy it?

Full Article →Remember how the Biden administration, the Fed, and corporate media kept saying the economy and job market were “strong”? Turns out that’s not true. Fed Chair Jerome Powell stepped up to the podium at Jackson Hole and announced the inflation fight was over – because the balance of economic risks has shifted. Here’s why they’re so worried…

Full Article →Gold has embarrassed quite a number of analysts in the past few days, rocketing to another all-time high to $2,509.71 on Friday, August 16. Just a week ago we reported that a number of experts were fully convinced gold might clear $2,500 this year, but probably wouldn’t until well into 2025.

Full Article →This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Saxo Bank says gold is facing biggest tailwind since the lockdowns, the normalization of the gold/silver ratio and Chinese citizens might finally get easy access to genuine gold.

Full Article →Why the Fed Can’t Win – and We All Lose. Inflation has slowed, but the economy is stagnating. With an imminent recession ahead, the Fed’s stuck between a rock and a hard place. Here’s why we’re trapped with them… If rates start falling, that would certainly get speculators excited. But let’s examine the situation a little more closely.

Full Article →Recently, investors have realized that bad economic news is in fact bad news, and the global financial system is reeling. Here’s what happens next… Recessionary fears renew as sentiment shifts in favor of gold, is the world ill-prepared for a consumer-driven supply glut, and guess who’s been fudging the news about their gold purchases?

Full Article →A new major currency will be hitting the world stage soon as BRICS – being the economic block of Brazil, Russia, India, China, South Africa, and a growing number of non-western nations – is coming closer to officially launching its collective tender. Details of the currency, which will be called The Unit, have been announced

Full Article →Bidenomics has pretty much played out as a disaster so far, especially for older Americans saving for their retirement. Now we might be able to see some light at the end of the tunnel. Unfortunately, now that Biden knows he won’t be the next president, the gloves are off. He can do whatever he wants, without much political pressure.

Full Article →Unless you live in a cave located in the remote regions of the world, you probably heard about the Crowdstrike outage. A simple IT mistake (not even an act of cyberterrorism!) took down the world’s computers on July 19, costing over $5 billion and disrupting countless lives. Here’s how to be ready next time…

Full Article →This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Gold hits $2,424 on speculations of a rate cut, shifting our understanding of the gold market, and Africa’s turn to gold is sending us signals.

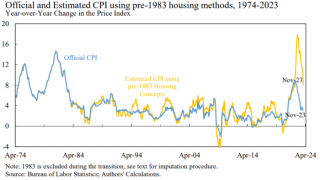

Full Article →If you have that strange feeling like the full story about the U.S. economy isn’t being told, you’re not the only one. You might even be feeling like things are much worse than the Administration keeps touting through the corporate media. In fact, in this piece we’re going to explore several examples that illustrate just how the American public is being sold

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Gold is making another run towards $2,400, emerging market central banks to continue buying gold for decades, and why younger generations are three times more likely to buy gold than older ones.

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: BofA forecasts $3,000 gold as central banks keep buying, taking apart some narratives against gold, and mysteries surrounding Chinese gold abound.

Full Article →What Happens When Rate Cuts Come Too Soon. The cost of credit is high, and all eyes are on the Fed these days. The economy can’t tolerate today’s interest rates, so everyone expects rate cuts – but when? Here’s what happens when cuts come too soon…

Full Article →As we’ve observed gold’s price gains since the start of the year, a question has been lingering on our minds. When gold left its $2,000/oz price behind six months ago, analysts wondered if this is going to be a permanent fixture. That level has mostly been forgotten now, and we could say that $2,300 is the new $2,000 – yet the doomsayers…

Full Article →Inflation has persisted so long now I’m forced to consider whether the Fed is really as concerned with it as Powell lets on. Maybe they realize the cure could kill the patient? The cost of living has risen even more… Data confirms that housing expenses, energy and vehicle maintenance costs have all increased by double digits since January 2021

Full Article →Gold prices could realistically reach $7,000 to $40,000, according to experts. The U.S. may be deliberately weakening the dollar to boost exports. Gold is unique in its inability to go to zero, making it a safe haven asset – accumulating more physical gold and silver during price drops is wise

Full Article →No matter who’s in the White House, the federal government is facing a reckoning. Here’s why “business as usual” is over… As the election approaches, I expect more people just like you will become interested in owning gold and silver. Right now, over in the UK, an upcoming election has citizens queueing up outside the Royal Mint

Full Article →This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. The world’s #2 reserve currency, the 20-nation euro, is losing ground as central banks load up on gold. Today, we ask, what’s going on? Is the dollar next? Against gold, currencies aren’t just losing value, they’re losing relevance.

Full Article →Steve Forbes believes that “the world is beginning to lurch toward a gold-based monetary system. This, despite the fact that the historical gold standard is held in almost universal contempt by economists and financial officials…” Should we be excited? Concerned?

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.