Depending on the source you check, the U.S. debt ceiling has been lifted or modified approximately 102 times since its inception in 1917. By June of this year, that number is likely to increase by one, and that means the U.S. debt is poised to skyrocket after it happens. But what if things don’t go according to plan?

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

Steve Forbes demands a return to the gold standard, gold’s fair value is closer to $3,000 than its current price, and U.S. states aren’t waiting for a national gold standard – they’re busy authorizing their own.

Full Article →Owning physical gold and silver outside the banking system makes sense to me, not so much because I’m concerned about the imminent collapse of the global financial system. Because it’s smart protection. I have a fire extinguisher in my kitchen, but not because I think the oven is about to burst into flames.

Full Article →Markets are now pricing in a 1.5% cut in Fed funds rates in the next 15 months. It’s an interesting forecast on the markets’ part. Can the Fed really hold off so long? And when the Fed throws in the towel on the inflation fight and cuts rates, will the U.S. dollar have anything left in the tank anymore?

Full Article →After almost 15 years of Fed-fueled cheap money offered at near-zero rates that was leveraged into overinflated speculative bubbles, the lights are on, the crowd is dispersing – and the party might finally be over.

Full Article →A stable gold price over $2,000/oz means that something has gone wrong. Either the greenback crumbled further, or there is some kind of issue that isn’t going away and that is driving haven demand. So often investors see asset prices rising and, fearful of missing out on a new bull market, buy in and drive prices even higher.

Full Article →Over 95% of Silicon Valley Bank’s deposits are not insured by the FDIC (due to being over the $250,000 limit) That is over $160 billion in uninsured customer deposits. About half of all venture capital-funded startups in the U.S. are customers of SVB. That’s 65,000 startups.

Full Article →The magazine recently published a story about how the wealthy invest in gold that offered no real surprises but plenty of confirmation that the super-wealthy share the same economic concerns as most of us.

Full Article →Here’s the thing: the money you contribute to Social Security doesn’t go into an account in your name. Rather, it goes into a giant pool of money that’s used to pay benefits to those who’ve already retired. In fact, the Social Security trust that funds your benefit has been running a deficit for a while now.

Full Article →Despite the Fed’s best efforts thus far to raise rates and cool off inflation, I don’t expect relief any time soon. With that in mind, let’s look into the past to see what a longer period of inflation looks like. The best place to start in the U.S. is to take a brief look at an extraordinarily long period of inflation that took place from the 1970s

Full Article →500-Year-Old Law is Gold Investor’s BFF

I think about Gresham’s law a lot. Back in the day of the first Queen Elizabeth (1533-1603), her banker, Sir Thomas Gresham, made an observation about currency debasement: Bad money drives out the good. You see, back in the 16th century, money was still “sound”…

Full Article →Hidden In the Inflation Numbers: The Next Gold Price

The same people who told us inflation was “transitory” two years ago are still capable of being surprised when reality fails to meet their expectations. Even returning inflation to 2 percent won’t make absurd prices any lower – rather, prices will still rise, but at a slower pace.

Full Article →Bloomberg’s Gold Investment Advice Is Spot On

Do Bloomberg’s readers really need a primer on gold investment? Aren’t they all experienced economists and investors who know every asset inside and out? Judging by Bloomberg’s latest step-by-step gold investment guide, we’d say not.

Full Article →Gold Up 18% in Three Months – Will It Continue?

Low volatility plus a strong upward trend is a recipe for slow, steady price growth. You’re looking at an 18% increase in gold compared to a 5% increase in the S&P 500 – in just three months. That’s not enough for some people.

Full Article →We’re Just One Step Away from $5,700/oz Gold

MoneyWeek’s Dominic Frisby is an analyst to watch. His precious metals analyses are full of insights, and his latest observation on gold’s price is fascinating. Frisby shows off his decades of experience by reminiscing about gold’s price trajectory from the late 1990s to now.

Full Article →Revealed: The Secret Reason Governments Love Inflation

When people spend beyond their means, they increase the likelihood that they will suffer severe financial consequences – including foreclosure and bankruptcy. But when the U.S. government spends beyond its income, that doesn’t happen.

Full Article →Shock: Raging Inflation Still Robbing Americans

It’s official: Inflation is easing up from the historic pace it reached back in June 2022. The latest report from December 2022 has it running at “only” 6.5%. But even that is still running hotter than any month since the early 1990s.

Full Article →Why Are Analysts Predicting Higher Gold Prices?

Strange as it might sound for a year when gold posted a new all-time high, many thought 2022 was a “tepid” or “disappointing” year for gold’s price. That makes the price gains so far in 2023 all the more promising…

Full Article →Gold’s price jumps over the past week were difficult to ignore. When gold rose past $1,800, there were some immediate concerns that its price might fall a bit in the coming weeks. Instead, it did the opposite. Closing Friday around $1,870, the next benchmark of $1,900 appears within easy reach.

Full Article →Gold ended an otherwise dull year by surging from $1,650 to $1,820 rather abruptly. Will 2023 include another rapid rise in price? A slow, steady climb? About the only consensus from the forecasts I saw was that gold will rise in price. The overall bullishness of these forecasts varies, but not the result.

Full Article →Why 2022 Was the Worst Year For Investors

We’re in for a rough start to 2023. Still-hot inflation, high mortgage rates, and rising personal debt can slow down even the most stable economy. (Let alone a volatile, teetering and still-frothy economy.)

Full Article →How American Millionaires Are Outsmarting the Collapsing Economy

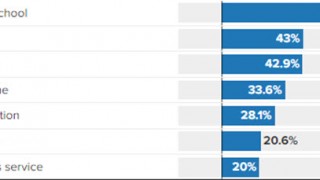

According to a recent poll by the Wall Street Journal and Impact Research, 65% of voters say the economy is headed in the wrong direction. Financial strain was affecting more than half of respondents, with more suffering on the way if things keep getting worse

Full Article →Will Gold Shine Bright in 2023?

Investor Peter Schiff and politician Nigel Farage recently shared their thoughts on why gold is scheduled to emerge as an outperformer in 2023, and why it’s already doing what it’s supposed to. Both gold’s 50-day and 200-day moving averages show it outperforming inflation

Full Article →Wall Street Insider Shares His 2023 Gold Strategy

Gold’s whiplash couple of years have almost made everyone forget just how big of an outperformer it is. It has risen by 450% since 2000, having spent most of 1999 around $255. Still, even gold investors can perhaps fall prey to recency bias.

Full Article →When Did Less-Bad Become Good?

And Why the Media Is Desperately Hiding the Truth About the Economy? The idea that the bad news has ended is a dangerous illusion to support with your savings (“The Fed will pivot, rates will drop, stocks will surge and inflation will go away – better buy now!”).

Full Article →2 Reasons Why Social Security Is Anything but Secure

We’ve been reporting on the likelihood that Social Security will suffer from a series of setbacks in the 2030s for quite some time. Now, the Social Security Trustees are beginning to confirm the fears we’ve expressed since 2019. In this year’s report, they summarized the main problem…

Full Article →2023: Gold’s Best Year Ever?

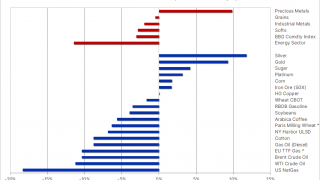

Numerous analysts have said that commodities crashing is a kind of necessary ingredient in the current market fiasco – but just as gold was seemingly left out of massive gains that other commodities experienced, it’s likely to be one of the very few commodities not falling in the kind of recessionary environment we’re anticipating.

Full Article →Inflation Reprieve Won’t Last Much Longer

Inflation is still orders of magnitude too high, and not declining appreciably. (Should CPI continue to come in 0.2% lower every month, we’re still looking at over two and a half years of prices rising faster than the Fed’s targeted rate.)

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.