Back when inflation was heating up to historic levels in July 2022, President Biden tried to downplay inflation as “unacceptably high” but “not as bad as it looks.” The truth was actually pretty dire back then, as an increasing percentage of Americans were struggling to afford putting food on their tables. In fact, they still are right now.

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

There is a phrase you will hear a lot over the coming decade: Artificial Intelligence (AI). Not that you haven’t heard it already. But thanks to multiple major breakthroughs in 2017, like how language is used across different AI development efforts, innovation has accelerated at a breakneck pace. And there’s no sign of it slowing down.

Full Article →Why Gold and Silver Just Surged

This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Reflecting on recent gold price changes, China’s obsession with safe-haven gold and could central banks break last year’s gold buying record?

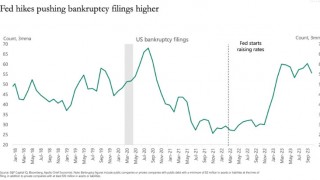

Full Article →Bidenomics is Bankrupting the Nation

Back in July, we reported on the Bidenomic “pay cut” of $5,600 per year that every American has suffered during Biden’s term. Unfortunately, the failures of Biden’s economic policies are starting to pile up. They’re almost impossible to ignore already. The media won’t be able to put a positive spin on it for much longer…

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Gold passes $2,100 to post a new all-time high, the only two solutions to the global debt crisis aren’t applicable, and a recent government study returns some very rough inflation data.

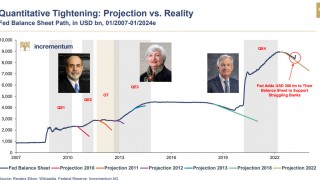

Full Article →Despite President Biden’s insistence that the U.S. is experiencing the “greatest economic recovery ever,” the evidence suggests otherwise. In fact, the U.S. economy could be heading for one of the most painful periods of economic turmoil of the last 15 years. And it’s all thanks to the disastrous policies known as “Bidenomics.”

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Gold’s downside doesn’t sound so bad these days, where we are on the 1970s track, and gold demand surging as Indian buying returns to pre-pandemic levels.

Full Article →With all of the unanswered questions floating around in today’s economy (like “When will the recession start?), one thing is fairly certain – Today’s economic uncertainty is likely to stick around for a while. With that in mind, at some point you might wonder if you’ve saved enough to enjoy a comfortable and stress-free retirement in the face of that uncertainty…

Full Article →This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Gold as sentiment-driven as ever, $34 silver soon, and U.S. Mint’s gold sales have already outpaced last year’s figures. The U.S. federal government is indebted by over $33 trillion, and it matters…

Full Article →Dollar Weakness Could See Gold Surge to $2500

Experts forecast a shaky dollar will send gold to $2,500 next year. This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Gold forecasts ahead of the election, Powell feints as U.S. economy crumbles, and Kuwait bolsters its place on the list of gold consumers.

Full Article →Why US Heading Into Another Great Depression

First it was the COVID economic panic that started in March of 2020. Then it was Biden’s disastrous mishandling of the military withdrawal from Afghanistan in 2021. Almost immediately following that disaster, the Biden administration went on a multi-trillion-dollar deficit spending spree that dramatically worsened inflation. Not long after, Biden led …

Full Article →If you want to build a house that can withstand the test of time, you can’t have a weak foundation. So you have to build a solid foundation. The same idea holds true for your financial “house.” Your retirement savings plan has to be built on a strong foundation. Don’t spend money you don’t have – Live within your means!

Full Article →Central Banks Making HUGE Gold Moves

This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Central bank gold buying on track to shatter last year’s record, a different take on gold’s price and who wants a gold token instead of physical gold? 2023 may set another new record for central bank gold buying

Full Article →Why When Investors Sour on Risk, They Buy Gold

This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Gold doesn’t want to leave $2,000, how the U.S. government has indebted you by around $100,000, and Canada releases 2023 coin from single-source mine, while firms like Citi are resuming the purchase of Russian metals

Full Article →BRICS Pay Propels Half the World into Dedollarization

If you don’t already realize that dedollarization is happening, there’s no clearer proof than BRICS Pay. BRICS Pay is a new blockchain-based payment system that enables members of the BRICS countries (Brazil, Russia, India, China, and South Africa) and their partners to make financial transactions in a whole new way.

Full Article →The True Costs of a “Cashless Economy”

There is a lot of talk in financial circles about the shift in the U.S. economy toward a “cashless society.” Naturally, there are both benefits and drawbacks to such a radical change. Because of the required technological progress, many reports focus on the advantages of an economy that goes cashless. For example, the IMF claims…

Full Article →4 IRA Mistakes That Could Destroy Your Savings

Once you receive a retirement plan distribution, then you have some planning to do. One part of that planning is deciding how you are going to roll over the funds into any new vehicle(s) and begin to enjoy the fruits of your labors. The IRS website nicely summarizes the main reason why many Americans who are saving for a stress-free retirement would do this…

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: The not-so-hidden Chinese crisis, what we can expect from gold in the near-term, and a reminder on why only gold bullion cuts it: The Chinese economic slump and the accompanying rush to gold

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: The Costco gold rush, the indebted legacy of the modern statesman and unpacking IMF data surrounding the U.S. dollar’s global forex share. What we learned from Costco’s foray into gold bullion…

Full Article →How Much Will the Imminent Government Shutdown Cost You?

Here’s something you don’t want to hear from your political leaders, especially in the federal government: “Our financial ship is sinking.” Yet that’s exactly how Tennessee Representative Tim Burchett recently described the situation. He made this statement because the U.S. government can’t reach a resolution that would keep its own operations funded.

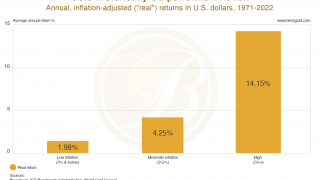

Full Article →Everyone Would Buy Gold If They Knew This

This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Investors under-educated on gold, an update on Russia’s gold dealings, and who owns the London Metals Exchange?

Full Article →Paul Krugman Insists Inflation is in Your Imagination

Despite his accolades, Krugman has made some wildly inaccurate forecasts. For example, he claimed in 1997 that the Internet’s impact on the economy would be about the same as the fax machine. In 2012, he said the euro would collapse “in a matter of months, not years.” I can forgive him for failed economic projections, but this?

Full Article →Inflation Burns Through “Safe” Sectors – What’s Next?

Since May 2021, inflation persistently above the Fed’s 2% target has devoured our purchasing power, day by day. Making the cost of living impossible to predict and planning for the future increasingly uncertain. After a short period of cooling off, inflation is heating up again on multiple fronts. One rather unexpected price surge will make budgeting a challenge…

Full Article →The Biggest Con Job in Banking: The Savings Account

Savings accounts today offer the highest yields in 15 years. Even so, they may not be the best way to protect your savings from inflation. When the Fed raises interest rates to curb inflation, ripple effects spread across the economy. Some of the impacts are negative (especially if you owe a lot of money), but others are positive for savers…

Full Article →Insider Gold Buying Reaches New Record Level

This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Global gold holdings rise to highest level since 2012, a one-way flood of gold from West to East and are we missing out on platinum’s comeback?

Full Article →Here’s Why Everyone Will Need Gold Soon

This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Investment firm sounds off on gold investment in a commodities era, gold standard and why we might have been here before, and did you notice gold hit another ATH in the Japanese yen?

Full Article →Bidenomics Has Failed In The Worst Way Possible

Corporate media headlines like Biden’s Economy Is the Best Ever or The Bidenomics Success Story leave one big question unanswered… Who is better off? (Lest we forget, “the economy” isn’t a citizen.) Are you better off than you were thirty months, two and a half years ago?

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Gold’s price holding up even though interest rates keep rising, the real story of inflation, and gold remains a key asset for the new global economy.

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.