Gold’s $100+ rise to $1,760 from $1,650 last week wasn’t an intraday price move, but it feels so abrupt and rapid. And every time gold’s price surges like this, we expect there to be some crisis or calamity. After all, it was gold’s biggest weekly gain in 30 months. Remember what happened 30 months ago?

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

The Best Way To Defend Your Savings

We are living through an economic crisis that will earn an entire chapter in introductory economics textbooks in the future… As of September, 63% of Americans were living paycheck to paycheck, according to a recent LendingClub report — near the 64% historic high hit in March.

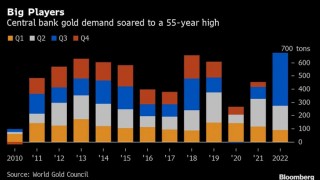

Full Article →What’s Behind the Central Bank Gold Buying Boom?

Central banks bought a record amount of gold last quarter as they diversified foreign-currency reserves, with a large chunk of the purchases coming from as-yet unknown buyers. The official sector has consistently been one of the main pillars of support for gold prices for more than a decade.

Full Article →Biden’s Gas Plans = Communism

Midterm elections are upon us, and Biden’s party seems poised for big losses. Inflation remains the #1 concern among American families. You can tell the President is a politician rather than an economist, because of his new idea for lowering fuel prices…

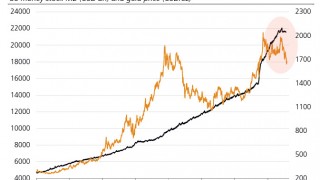

Full Article →Gold to Skyrocket When Fed Makes Announcement

All that gold needs is a cowardly Fed, current monetary supply levels suggest gold is undervalued, and what a gold standard would require in modern times. The consensus is in: gold can’t shatter its former all-time highs until the Federal Reserve does.

Full Article →Here’s Why Nouriel Roubini Recommends Gold & Precious Metals

Veteran Analyst Makes A Dire Prediction (Only Gold Investors Will Like This) – Nouriel Roubini’s recent feature in Time magazine tells us what we already know: inflation has become a trend word. It is no longer a term for resigned to economists, analysts, traders and speculators. These days…

Full Article →4 Best Reasons to Buy Gold Now?

It’s not that often that gold gets some exposure in the mainstream media, especially during a rout. So when it does, it’s almost our duty to mention it. This article breaks down and lists the primary reasons to buy gold today, specifically listing 4 things as the most important to the would-be gold investor. What are they?

Full Article →Last week, my friend Dr. Ron Paul told us about Ben Bernanke’s “gold confession.” That got me thinking about world central banks – why do they keep buying gold? I understand why everyday Americans want to diversify their savings with gold but why central banks?

Full Article →Biggest Mistake of Inflation Reduction Act?

Well, if you can’t afford a turkey AND a ham this Thanksgiving, just flip a quarter to help you decide. You — you don’t have a quarter? I guess you could use a nickel… For older Americans who are saving for retirement or have already retired, President Biden’s Inflation Reduction Act will have several potential impacts.

Full Article →How to Fight Inflation Like a Wall Street Pro

Investment bankers agree that central bank efforts to curb inflation are mostly proving fruitless. Interest rates are going up, but inflation rates aren’t going down. So what are some ways to protect oneself in this environment?

Full Article →The Fed Declares War on Wall Street

Official inflation at 8.3% year-over-year rate is either good news or bad news. Good news: it’s noticeably lower than June’s blistering 9.1% report. Bad news: it’s yet another painfully high report in ten consecutive months over 6%, continuing our most severe inflationary episode in four decades.

Full Article →New “Red Gold Standard” Threatens Dollar

As we know, sanctions have punished the West without stopping Russia’s invasion of Ukraine. This is not debatable – it’s simply fact. The U.S. has seen diminishing returns from levying financial sanctions against unfriendly nations for decades now.

Full Article →Proof that Precious Metals Are the Best Hedges

Now, this is counterintuitive if we think of gold exclusively as a safe haven investment. But it’s not. Gold is also historically one of the most desirable symbols of luxury and wealth. It’s like Wharton finance and economics professor Urban Jermann described in his new model of gold pricing…

Full Article →Powell Promises Pain, Biden Makes It Worse

Powell’s policies will bring pain to American families, one way or another. Now the Fed is openly rooting for stock and housing markets to crash – because that’s how they’ll know their rate hikes are finally deflating the “Everything Bubble.”

Full Article →During my career, I’ve watched three speculative financial bubbles inflate, and two of them pop (the dot-com bubble, the 2007-08 housing bobble and today’s Everything Bubble). These bouts of “irrational exuberance,” to use Robert Shiller’s trenchant description, are remarkably similar.

Full Article →The latest Fed meeting may have hinted towards an easier monetary policy, whether that means a tempering or altogether cessation of interest rate hikes. While Fed officials did reiterate the dangers of high inflation, they also mentioned not wanting to slump the economy with excessive tightening.

Full Article →Gold as an answer to present day trouble – it’s the only asset to claim geopolitical neutrality, and it’s not just Russia’s official sector that’s hoarding gold.

Full Article →The official consumer price index (CPI) gauge of inflation finally eased in July, slowing 60 basis points to an 8.5% annualized rate. Further upstream, the producer price index (PPI) also slowed from 11.3% to 9.8% year-over-year. Now, let me be clear: this is good news.

Full Article →In the wake of gold briefly passing the strong $1,800 resistance level, Equinox Partners’ Sean Fieler spoke about gold’s role in the coming financial crisis saying a sovereign debt crisis could catch some off-guard: ‘the kindling is set, and you just need one little spark to ignite the fire.’

Full Article →Stanford Economics professor says that the Fed will neither stop raising interest rates nor limit rate hikes to just one or two more. Instead, he thinks the Fed needs to jack up interest rates to 9%, possibly higher, to truly deal with inflation.

Full Article →Gold investors shouldn’t look forward to a reversal in the Federal Reserve’s tightening policies because a flip-flopping Fed would create the kinds of economic instability that not even the biggest gold investors would appreciate.

Full Article →We’re hearing an increasing number of warnings that a stagflationary event could not only materialize, but persist for an entire decade. I don’t want to believe it. Even so, it’s starting to look like a certainty. The latest 9.1% inflation reading hit the financial markets hard.

Full Article →Bloomberg recently did a fairly comprehensive report on insider trading of precious metals by traders (most notoriously) at JPMorgan, and other large banks as well. JPMorgan pled guilty in 2019 and paid over $920 million to settle charges…

Full Article →Goldman Sachs raises year-end gold forecast to $2,500; why gold shines bright even after a losing Q2; and Zimbabwe rediscovers gold as a cornerstone of economic stability. Interestingly enough, Goldman’s lofty forecast for gold excludes possibility of hyperinflation…

Full Article →By the time you read this, the U.S. economy will likely be officially mired in what could be a long and deep recession. Ark Invest CEO Cathie Wood said Tuesday we’re already there: ‘We think we are in a recession. We were wrong on one thing and that was inflation being as sustained as it has been.’

Full Article →Fed Desperately Wants to Postpone Return to Reality – But It’s Not Going Well. Today, we’re seeing multiple signals of economic stress flashing simultaneously. Historically, that implies a near-term economic recession…

Full Article →It’s worth remembering the Federal Reserve is not looking out for your wellbeing. They’re looking at statistics, not individuals. They see surges in food and energy prices as “normal volatility.” Chairman Powell doesn’t care it cost you nearly $100 to fill your gas tank.

Full Article →Jim Cramer has been one of the most die-hard stock bulls since 1987, and rose to national fame in the late 1990s thanks to his frequent guest appearances on CNBC during the run-up of the dot-com boom. That’s why it’s so surprising that he recently recommended diversifying with gold.

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.