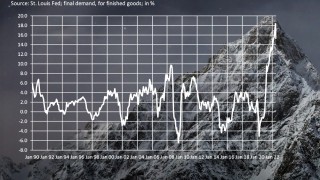

Official inflation at 8.3% year-over-year rate is either good news or bad news. Good news: it’s noticeably lower than June’s blistering 9.1% report. Bad news: it’s yet another painfully high report in ten consecutive months over 6%, continuing our most severe inflationary episode in four decades.

Full Article →Fight to Contain Inflation… Just How Bad?

It wasn’t terribly long ago that the hope – indeed, the assumption – of both Treasury Secretary Janet Yellen and Federal Reserve Chairman Jerome Powell was that it would take essentially nothing to rein inflation in.

Full Article →New “Red Gold Standard” Threatens Dollar

As we know, sanctions have punished the West without stopping Russia’s invasion of Ukraine. This is not debatable – it’s simply fact. The U.S. has seen diminishing returns from levying financial sanctions against unfriendly nations for decades now.

Full Article →Wall St Crashes Most Since COVID

The lead up to last night’s US CPI print saw the market expecting a softening of inflation and the chances of a Fed pause or pivot sooner rather than later. Shares were climbing eagerly in anticipation of the “goldilocks” economic outcome. Nup.

Full Article →Gold Wonders How Severe This Recession Will Be

Economic contraction is unfolding – but how painful will it be? The deeper the recession, the better for gold. Let’s make it clear: an economic downturn is coming. We are already in a technical recession despite the White House’s attempts to change its definition.

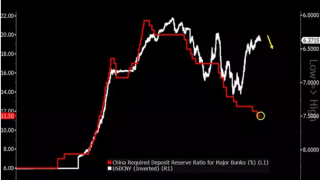

Full Article →China Facing Multiple Attacks on Currency

The world’s second largest economy is battling multiple challenges at the moment, some short term and some long. The timing however could not be worse for the global economy. China is between a rock and a hard place because the only other major economy not tightening is Japan

Full Article →Can Self-Directed IRAs Help Alleviate US Retirement Crisis?

It’s been a tough year for retirement savers. The highest inflation in decades already had been forcing Americans to suspend retirement plan contributions so they could keep up with soaring prices at grocery stores, gas stations and basically anywhere that anything is sold

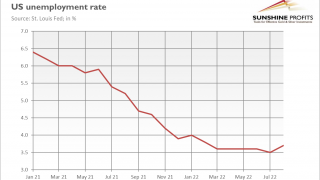

Full Article →When Rising Unemployment is Not Good for Gold

Powell, we could have a problem! According to the BLS, the U.S. unemployment rate rose to 3.7% in August from 3.5% in the previous month. It seems to be a fatal blow to the narrative of a strong labor market. What does it all mean for the gold market?

Full Article →Gold: The Counterparty Risk Free Investment

As bullion dealers, we are asked on a daily basis whether we think the fiat dollar price of gold and silver are going to go up or down. However, for many, if not most, bullion investors, the most important aspect of precious metals is that there is no “counterparty risk”.

Full Article →R.I.P. David H. Smith, Precious Metals Philosopher

I am saddened to report today that my friend… our friend… David Smith lost his battle with cancer last weekend. David was a phenomenal yet humble man. He was a teacher, a student, and a philosopher. I have rarely a met a more optimistic, thoughtful, and wise person.

Full Article →Proof that Precious Metals Are the Best Hedges

Now, this is counterintuitive if we think of gold exclusively as a safe haven investment. But it’s not. Gold is also historically one of the most desirable symbols of luxury and wealth. It’s like Wharton finance and economics professor Urban Jermann described in his new model of gold pricing…

Full Article →US Mid Terms & How They Affect You

Whilst there is a lot of focus on cost of living pressures, maybe a more important barometer to watch is that of the US. We are now less than 2 months away from the US mid term elections and both history and the so called “Misery Index” point to the Republicans taking control

Full Article →Bad News For Economy, Good News For Gold

A bad run for gold and silver markets this summer is dimming hopes for the metals being able to finish out the year with some good gains. Major economic indicators have also been trending down this summer. However last week brought some disappointing jobs data.

Full Article →“No Gas For You!” Putin’s Grand Plan For Europe

Gold rallied Friday night as news broke of Russia reneging on opening the critical NordStream gas pipeline to Europe (due to a ‘leak’) and in so doing, locking in even higher gas prices and more inflation as Europe heads into winter. This appears all to be part of Putin’s grand plan…

Full Article →Student-Loan Forgiveness: Inflation Reduction Act Revelations

If you’re a struggling college graduate burdened with mountains of student debt, it seems your load is now a bit lighter. Except student-loan forgiveness could cost more than a half-trillion dollars with the initiative expected to swell the deficit far beyond the new inflation law’s deficit-reduction benefit

Full Article →Powell Promises Pain, Biden Makes It Worse

Powell’s policies will bring pain to American families, one way or another. Now the Fed is openly rooting for stock and housing markets to crash – because that’s how they’ll know their rate hikes are finally deflating the “Everything Bubble.”

Full Article →After July Slowdown Has Inflation Finally Peaked?

Inflation moderated a bit in July, fueling hopes that it has peaked. Are they justified? Yes and no, but before I elaborate on this enigmatic answer, let’s see what happened in July. On a monthly basis, the CPI was unchanged then, after rising 1.3 percent in June

Full Article →Large Commercial Traders Positioned for Higher Metals Prices

Physical bars continue to drain from COMEX and London warehouses. Larger investors who hold deliverable bars aren’t throwing in the towel and dumping them back into the market. Instead, they continue to stack, much like retail investors buying the smaller coins, rounds and bars.

Full Article →Moscow World Standard (MWS) Challenges LBMA

Russia and a number of former USSR nations are setting up a competing precious metals exchange, initially dubbed the Moscow World Standard (MWS) as Russia has become increasingly insistent that the London Bullion Market Association (LBMA) has been manipulating spot prices down artificially.

Full Article →Gold Falls as Powell Appears Hawkish in Jackson Hole

Importantly, Powell downplayed July’s deceleration in inflation, saying that “a single month’s improvement falls far short of what the Committee will need to see before we are confident that inflation is moving down”.

Full Article →Fed Admits It CAN’T Tame Inflation

Federal Reserve chairman Jerome Powell is talking tough and warning of more interest rate pain to come. At the same time, Fed officials are now admitting that their sized-up rate hikes won’t even be sufficient to tame the price inflation they have helped create.

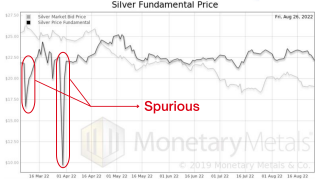

Full Article →The price of silver hit a peak over $26.50 on March 8. It spent about a month and a half breaking down, and then the bottom fell out. It’s currently down from that peak almost 8 bucks. However, the opposite has been happening to silver’s scarcity…

Full Article →During my career, I’ve watched three speculative financial bubbles inflate, and two of them pop (the dot-com bubble, the 2007-08 housing bobble and today’s Everything Bubble). These bouts of “irrational exuberance,” to use Robert Shiller’s trenchant description, are remarkably similar.

Full Article →Fed Chair Powell’s Jackson Hole speech ended up being as hawkish (tighter monetary policy) as you could imagine. For a market that was simply gagging for even the remotest bit of dovish note, it was nowhere to be found and EVERYTHING barring the USD fell hard

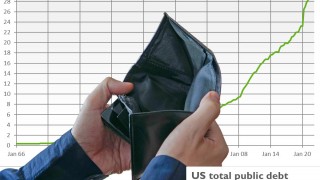

Full Article →Who Will Forgive the Government’s Debt?

So much for “inflation reduction.” Just a few days after signing Green New Deal legislation, rebranded as the Inflation Reduction Act, President Joe Biden has moved to completely undo its core promise by pumping hundreds of billions of dollars into another new bailout package.

Full Article →IRS Targets the Middle Class

Video Report: What Exactly is the Huge IRS Funding Increase Being Used For? According to Whistleblower, Inflation Reduction Act’s IRS Funding Will Be Used to “Shake Down” Middle-Class

Full Article →Steep Decline in PMI Didn’t Move Gold Higher

The latest S&P Global Flash US Composite PMI doesn’t bode well for the U.S. economy. The headline Flash US PMI Composite Output Index declined from 47.7 in July to 45 in August, as the chart below shows. It was the second successive monthly decrease in total business activity.

Full Article →The latest Fed meeting may have hinted towards an easier monetary policy, whether that means a tempering or altogether cessation of interest rate hikes. While Fed officials did reiterate the dangers of high inflation, they also mentioned not wanting to slump the economy with excessive tightening.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.