This is a preview of our annual Gold Outlook Report. Every year we take an in-depth look at the market dynamics and drivers giving our predictions for gold and silver prices over the coming year. The talking heads are talking about recession, unemployment, and inflation, same as they’ve always done, though now perhaps with a bit more urgency.

Full Article →Keith Weiner

Keith Weiner is founder and CEO of Monetary Metals, the groundbreaking investment company monetizing physical gold into an interest-bearing asset, paying yields in gold, not paper currency.

Keith writes and speaks extensively, based on his unique views of gold, the dollar, credit, the bond market, and interest rates. He’s also the founder and President of the Gold Standard Institute USA. His work was instrumental in the passing of gold legal tender laws in the state of Arizona in 2017, and he regularly meets with central bankers, legislators, and government officials around the world.

The Gold Yield Movement Advances

I launched this business with a simple thesis. Interest will draw gold into the market; without interest, gold disappears into private hoards. The obvious reason is that people want a return. Without a return, they put their gold away and seek to avoid risk. A return provides an incentive to bring out the gold. Everyone wants to make a profit.

Full Article →Central Bank Digital Currency (CBDC, or in America let’s call it “FedCoin”) is a hot topic right now. Articles about it are everywhere, and Monetary Metals’ clients are asking about it. Gold is widely seen as a way to opt out. No doubt this is part of why the price of gold has held up so well.

Full Article →Spend any time in the gold market and you will be bombarded with all kinds of theories about what drives gold and silver prices. It’s the money supply dummy! No, it’s “real” interest rates! No, no, it’s mine production! Then there are the non-theories…

Full Article →First, it was the crypto-focused Silvergate Bank. Then it was Silicon Valley Bank. And immediately after, Signature Bank. Silvergate and Signature could be dismissed because, well, crypto. But Silicon Valley Bank is something entirely else.

Full Article →As the Federal Reserve has hiked rates from 0% to over 4.75%, the average interest rate on bank deposits has remained low, around the FDIC’s national average for savings accounts of 0.37%. This has led many to ask the simple question…

Full Article →Silicon Valley Bank (SVB) collapsed and was then seized by the California Department of Financial Protection on Friday, March 10. This came after a frenetic two days, when the bank announced a big loss, tried to raise capital, and then faced an accelerating run-on-the-bank.

Full Article →A study in April 2021 found that over 25% of U.S. companies were zombies in 2020. These undead firms have been sucking the life out of the economy. But things are about to get rough for the zombie hordes…

Full Article →Every year we take a step back from our regular business of paying interest on gold and silver to our clients to give our thoughts on the likely direction of gold and silver prices for the coming year. We provide this in-depth analysis, for free, in our annual Gold Outlook Report.

Full Article →‘Demand Destruction’: What It Means for You and Me

If you listen to financial pundits talking about the Federal Reserve and the current state of the markets you might hear this term mentioned: “Demand destruction.” What is it? And what does it mean for you and me?

Full Article →Gold Outlook 2023 Brief

This is a brief preview of our annual Gold Outlook Report. Every year we take an in-depth look at the market players, dynamics, fallacies, and drivers of markets, and finally, give our predictions for gold and silver prices over the coming year.

Full Article →The life of an entrepreneur is not what most people would call “normal”… I don’t refer to the guy who buys a fast-food franchise. Nor to the folks who have law or accounting firms. I don’t know a lot about how these businesses work, but I do know one thing. They should reach cash-flow positive very quickly; if not, something is wrong.

Full Article →Sam Bankman-Fried FTX’ed Up

This disaster is sad because it taints an entire industry that was at first, built upon the premise of providing an alternative to centrally planned money and credit. That would be the one thing cryptobugs have in common with goldbugs – they both agree there needs to be a monetary alternative to fiat currencies.

Full Article →The Fed has a Hammer, and You’re a Nail

Our present moment is precarious. Like it or not—we don’t—we live in the age of Central Banks. And as we witness, and alas participate in, the global drama to create or destroy wealth, there is a great and tragic irony at work.

Full Article →How to Destroy a Pension Fund in 22 Easy Steps

Our interest rate system is like a wrecking ball. It swings to one side of the street and destroys one side of town. Then when it swings to the other side of the street, it destroys the other side of town), without repairing any of the infrastructure it previously destroyed.

Full Article →Interest Rates Can’t Go Up Far, Or Hold for Long

Conventional thinking calls for higher interest rates. It makes this call via two channels. One is its policy prescription. The other is a theory of how market participants will behave. There is no such thing as a good central bank policy. All central bank actions inflict harm on the people.

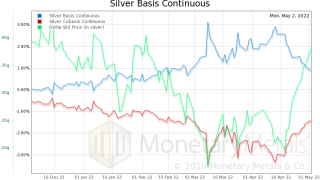

Full Article →The price of silver hit a peak over $26.50 on March 8. It spent about a month and a half breaking down, and then the bottom fell out. It’s currently down from that peak almost 8 bucks. However, the opposite has been happening to silver’s scarcity…

Full Article →Gold has a unique appearance. It is also astonishingly heavy—much heavier than it has any right to be. Everyone should hold one in his hand (and own a few). But that’s not why many gold analysts today are saying you should buy gold.

Full Article →The dollar rose this week, from 17.87mg gold to 18.24mg (that’s “gold fell from $1,740 to $1,705” in DollarSpeak), a gain of 2.1%. In silver terms, it rose from 1.61g to 1.67g (in DollarSpeak, “silver dropped from $19.24 to $18.64), or 3.7%.

Full Article →March of this year, Merryll Lynch disclosed an investment thesis called FAANG 2.0. It’s a fascinating idea and gold plays a prominent role. Why is gold considered a safe-haven asset? The answer is simple but profound.

Full Article →Something has happened which has not occurred since 2009. The silver basis—our measure of abundance of the metal to the market—has gone way under the gold basis. This means silver is less abundant to the market than gold.

Full Article →First off, bitcoin is not a Ponzi scheme. A Ponzi is a fraud, in which the sponsor promises a yield. Bitcoin is closer to a pyramid scheme. A pyramid is not necessarily a fraud, and not necessarily illegal. Like a Ponzi, the gains come from new investors…

Full Article →Senator Elizabeth Warren and President Joe Biden claim that inflation[i] is caused by greedy corporations. And they propose to solve this problem by making the corporations pay. Whether it’s extracting a “windfall profits” tax, crushing them under even more regulation, or attacking them with antitrust enforcement, the idea is the same.

Full Article →On Thursday May 12, the price of silver fell about a buck. But… As with every one of these big price moves, the question is: what really happened? There is a theory which is often touted in the precious metals community. According to this theory, the banks sell futures to manipulate prices.

Full Article →On Wednesday, six hours before the Fed interest rate announcement, the price of silver began to drop. It went from around $22.65 to a low of $22.25 before recovering about 20 cents. We wonder a bit about how they keep privileged traders from peeking at such announcements before the rest of the world gets to see it…

Full Article →The price of silver has been going down, and then down some more. From over $28 a year ago, and over $26.50 a month ago, it’s now at a new low under $22.50. Four bucks down in a month. However, it’s been behaving differently than gold behind the scenes…

Full Article →Can we all recognize the simple fact that every government price-fixing scheme, ever, has failed? For example, banana republics have declared their pesos to be worth $1. But when the market decides to redeem pesos for dollars 1-to-1, the central bank abandons the peg.

Full Article →Often, Narratives pile up lots of baggage. To effectively deal with it, one must unpack it. One bit of luggage sticking up from the heap is the assertion that now the ruble has a link to oil…

Full Article →Keith Weiner

Keith Weiner is founder and CEO of Monetary Metals, the groundbreaking investment company monetizing physical gold into an interest-bearing asset, paying yields in gold, not paper currency.

Keith writes and speaks extensively, based on his unique views of gold, the dollar, credit, the bond market, and interest rates. He’s also the founder and President of the Gold Standard Institute USA. His work was instrumental in the passing of gold legal tender laws in the state of Arizona in 2017, and he regularly meets with central bankers, legislators, and government officials around the world.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.