Today we look a little deeper at the global economic problem that is China.

Bullion.Directory precious metals analysis 12 September, 2022

Bullion.Directory precious metals analysis 12 September, 2022

By Paul Engeman

Director at Ainslie Bullion

We have talked repeatedly about the ‘USD wrecking ball’ as the surging USD exports inflation from the US and applies maximum pain to all the countries around the world, particularly vulnerable emerging economies, holding record levels of USD denominated debt.

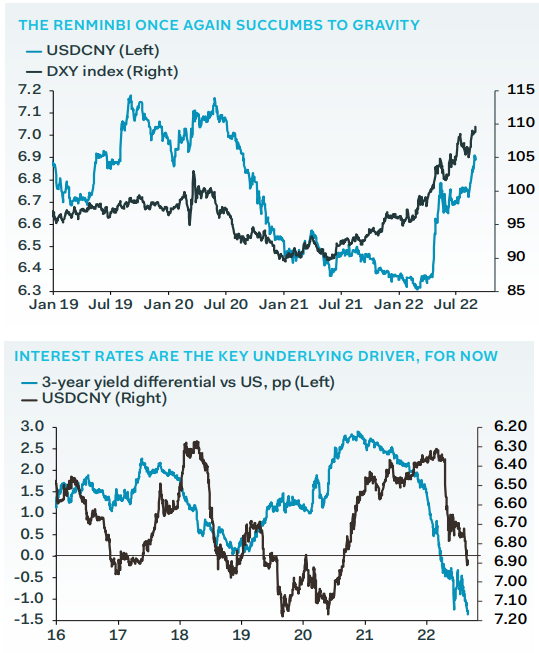

On the flip side, as China is one of the only major economies easing monetary policy, the Yuan is in itself a wrecking ball as it devalues drastically and now at the ‘line in the sand’ 7.0 CNYUSD everyone fears it will cross.

China is then caught between a rock and a hard place because the only other major economy not tightening right now is Japan, China’s political foe and major export competitor. If you think the Yuan has dropped, that’s nothing compared to the Yen, at a low not seen since 1998.

However a weak Yuan is certainly something China doesn’t want to see either despite it’s obvious export competition benefits. A weak Yuan threatens major capital outflows as they saw in 2015. The problem is, the only way to stop a weakening Yuan is to tighten policy and China is facing a number of immediate economic headwinds that make that difficult.

The following charts from Pantheon make that abundantly clear:

China is battling a number of fronts at the moment. The much publicised extended drought has seen not only pressures on food supply and prices now, but coincides with the normal wet season that sets up the rice harvest now. Perhaps more importantly is it has dried up watercourses vital to the nation’s hydro-electric power generation responsible for nearly 10% of their power.

This has seen them impose rolling blackouts and forced them back to coal at record price levels, both major impacts on GDP.

On top of this their zero COVID policy has seen city after city locked down in very strict conditions with the inevitable impacts on GDP. Indeed, investment bank Nomura last week cut its forecast for 2022 growth to 2.7% from 2.8% along with Barclays at 2.6% from 3.1%, directly blaming the Covid lockdowns.

This from a country used to 6+% growth and a world fuelling that.

On top of this is the property crisis that continues unabated. China’s CCP deliberately tried to reign in a property market out of control but they seem to have gone too far. From Aljazeera:

China’s property woes pose a substantial risk to its economy, which is already under strain due to Beijing’s harsh “zero-COVID” policies and slowing global growth. By some estimates, real estate accounts for 30 percent of GDP – about twice the equivalent share in the United States.

While some analysts believe the market has reached the bottom, the sector’s woes are expected to persist for some time. In July, S&P Global Ratings estimated that property prices would decline 30 percent this year – a worse decline than during the 2008 financial crisis.”

At the heart of the problem is developers having insufficient cashflows to service the huge debt they carry. Obviously tightening policy would exacerbate that very problem.

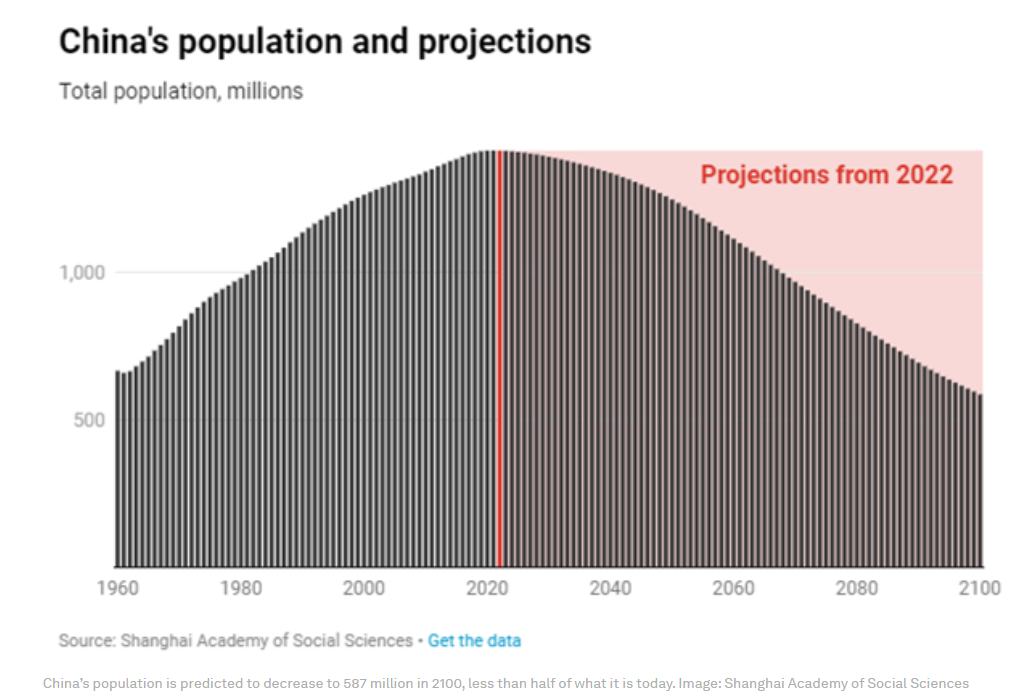

And what is the worst thing for a property crisis? Declining population. Just last month China finally admitted they have a demographic crisis before them. Years of 1 child policy set up a challenging environment for fertility rates well beyond that period.

Despite the 2016 reversal from 1 to 3 children and even tax incentives, fertility rates are very low. From WEF:

Theories differ about why Chinese women remain reluctant to have children in the face of state incentives. One involves having become used to small families, another involves the rising cost of living, another involves increasing marriage age, which delay births and the dampens the desire to have children.

In addition, China has fewer women of child-bearing age than might be expected. Limited to having only one child since 1980, many couples opted for a boy, lifting the sex at birth ratio from 106 boys for every 100 girls (the ratio in most of the rest of the world) to 120, and in some provinces to 130.”

In other words there is not quick fix.

And so their population is now on track for its first decline since the great famine of 1959-61.

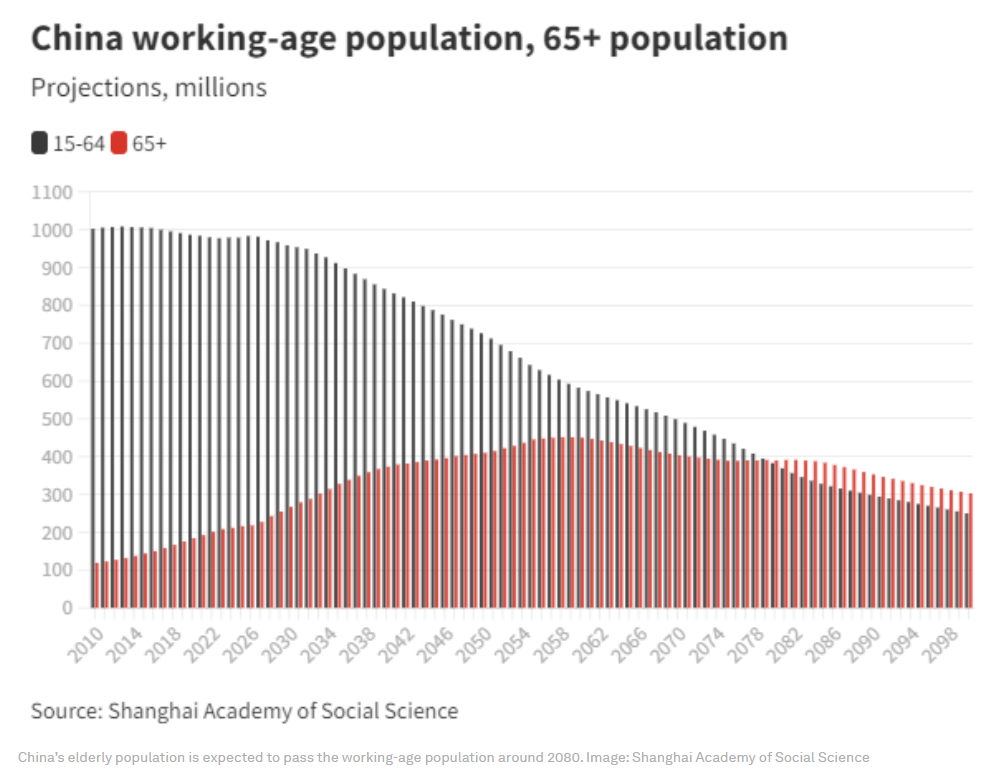

Further their elderly will outnumber their working by 2080.

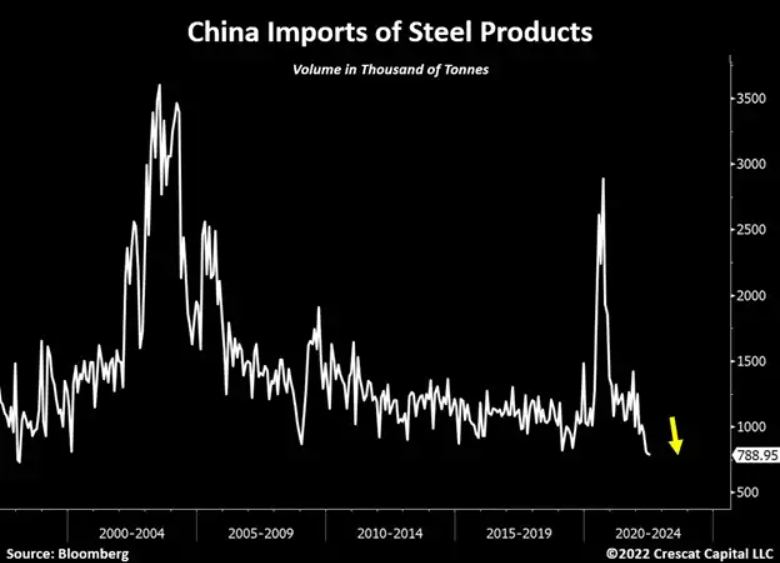

This all portends a structurally weakening manufacturing sector for China which is bad news for Australia.

From Crescat:

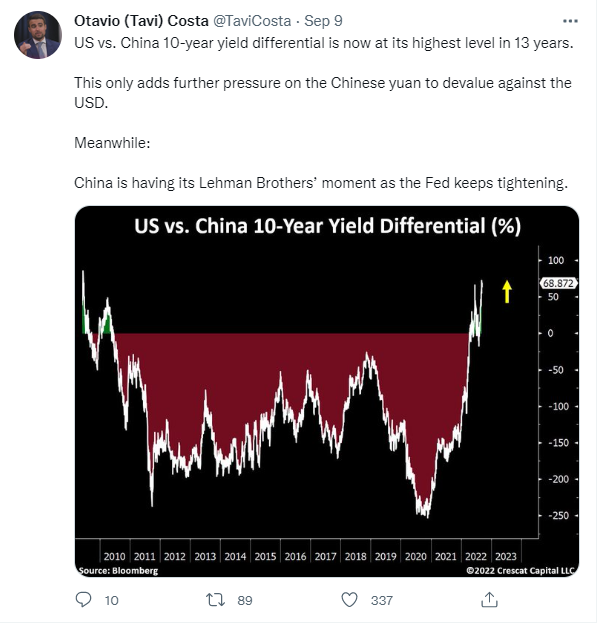

China is currently facing a full-blown balance sheet recession due to an over-levered banking system and real estate market. The unwinding of its severe macro imbalances has forced the PBOC to loosen monetary conditions not only in an inflationary environment but also with a significantly more restrictive Fed policy. In our strong view, a devaluation of the Chinese yuan is the next wrecking ball that very few investors are positioned for.

Note how China’s imports of steel products are now at the lowest level in 24 years.

The Fed is Tightening While the PBOC is Easing

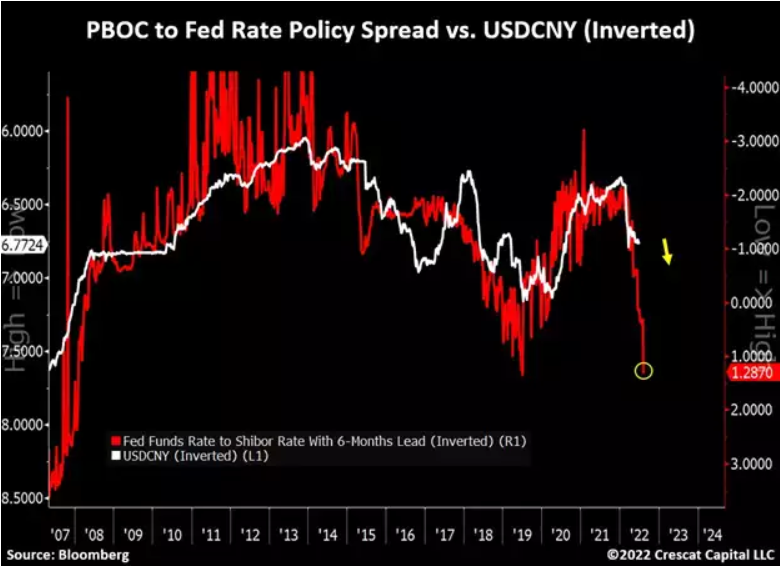

The PBOC-to-Fed’s interest rate policy spread has consistently led the changes in USDCNY by 6 months. Such divergence in central banks’ stance is likely to add major pressure on the yuan to depreciate relative to the dollar.

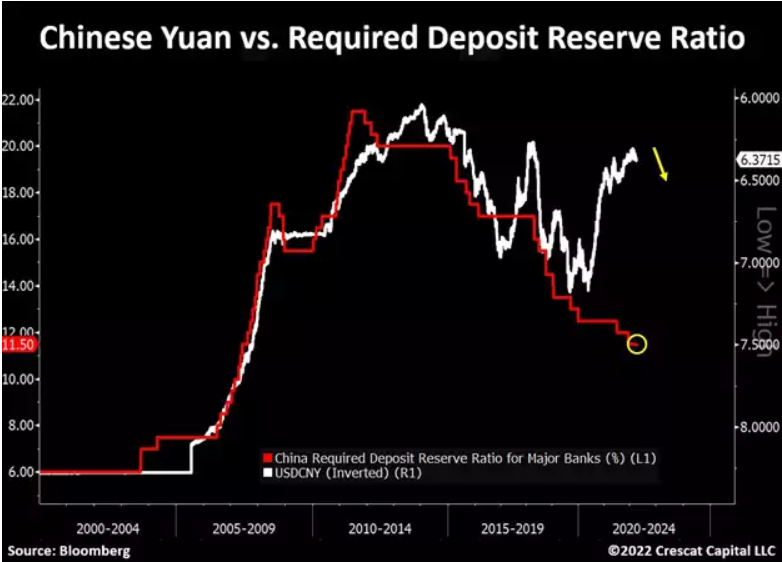

The disconnect between the Chinese yuan and the required deposit reserve ratio for major banks remains one of the most important charts in the current macro environment.”

Watch this space carefully as it affects all investors, not just Australia with its biggest commodities customer.

As pressure mounts on the impacts of the “USD wrecking ball” look to gold as well….

Paul Engeman

Paul Engeman is a director at Ainslie Bullion, one of Australia’s leading bullion dealers, Gold Silver Standard, the precious metals-backed crypto tokens and at Reserve Vault, Australia’s largest private secure vault facility.

Paul’s in-depth analysis is published daily on Ainslie Bullion and associated companies’ websites – where he writes passionately on our current economic situation and the solutions that gold, silver and other assets can help provide.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply