I am saddened to report today that my friend… our friend… David Smith lost his battle with cancer last weekend. David was a phenomenal yet humble man. He was a teacher, a student, and a philosopher. I have rarely a met a more optimistic, thoughtful, and wise person.

Full Article →David Smith

David H. Smith was Senior Analyst for TheMorganReport.com, contributor to MoneyMetals.com as well as the LODE Cryptographic Silver Monetary System Project.

He has investigated precious metals’ mines and exploration sites in Argentina, Chile, Peru, Mexico, Bolivia, China, Canada and the U.S. He shared resource sector observations with readers, the media, and North American investment conference attendees.

The biggest financial paradigm shift in our lives is underway, and there’s no turning back. No one knows exactly what it’s going to look like going forward nor how we’ll be able to get there. Not sure you “have enough”? Well, then don’t just stand there. Do something productive!

Full Article →Shock And Awe Inflation

The Producer Price Index (PPI) is a measure of inflation expectations by industry producers. Most investors keep an eye on the Consumer Price Index (CPI). However, the CPI gauge is not only incomplete, it is, as U.S. Global’s Frank Holmes likes to say, “backward looking”

Full Article →Would you rather enter the battlefield with physical gold and silver -encased in a metaphorical Abrams M-1 tank – or “armed” only with a sheet of paper showing you have unallocated pile of metals, possibly maybe.

Full Article →I don’t believe that the inflation we’re seeing – especially in the U.S. – is in FedSpeak, “transitory.” The indications and real-world price-increase in so many things I want to buy, if they’re in stock, are growing, and unlikely to go back down anytime soon.

Full Article →No less an establishment thinker than former U.S. Treasury Secretary, Lawrence Summers, opines, “I think there’s a real possibility that within the year, we’re going to be dealing with the most serious incipient inflation problem we have faced in the last forty years.”

Full Article →Anyone who owns precious metals, mining shares or metals’ ETFs knows the drill. First, gold and silver begin to establish an uptrend on the charts. Analysts (like us) start writing about how prices are getting ready to make an upside run…

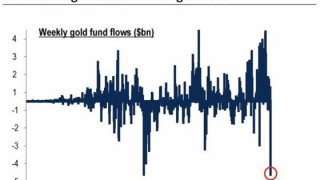

Full Article →Many investors see gold and silver ETF outflows as negative signs. But I view it as a Mr. Market’s last big effort to “shake the tree,” causing as many people as possible to fall off the galloping bull and head for cover.

Full Article →The Silver Price is Headed Towards All-Time Highs

In 1980, the U.S. bull run saw gold prices reach $850/oz and silver prices leap to $50/oz. But that was a relatively limited affair when you compare it to the global phenomenon that we bear witness to today.

Full Article →Gold & Silver Locked and Loaded – Don’t be Out of Ammo

In military terms, the phrase “locked and loaded” refers to “locking” a magazine or cartridge into a firearm and loading a round into the gun’s chamber. A variant is to “lock the safety” and then load a magazine into the weapon.

Full Article →Buffett has been the dam, holding back the great flood of investment dollars into the gold bull market. As long as Buffett steered clear, the lemming institutional money managers would avoid the sector as well. The dam broke on Friday afternoon

Full Article →Yes, maybe you’ll have another six weeks to get your metals’ shopping done before we see gold above $2,000 again and silver above $30. But then again, maybe not…

Full Article →In spite of some very powerful evidence to the contrary, the general investing public still questions both the validity and upside potential of physical precious metals and the share prices of producing miners.

Full Article →The current phase of the gold bull market, which started last year, is – we believe – the third and final wave of the secular bull run tracking back to 2001. It’s going to create a tidal bore of immense size and power

Full Article →Market sentiment has fundamentally changed. If you keep waiting and hoping for a return to last year’s prices with low premiums and plentiful supply, that’s what you’ll be doing… waiting and hoping.

Full Article →If for some inexplicable reason you’re still waiting to acquire the silver (or gold) you hope to purchase, the question right now is, “How lucky to you feel?”

Full Article →“Silver is nature’s finest germ killer. Simply by being silver, this most precious metal’s elemental properties are toxic to pathogenic microorganisms while simultaneously being non-toxic to healthy cells and probiotic bacteria. “

Full Article →Getting on Board the Silver Express!

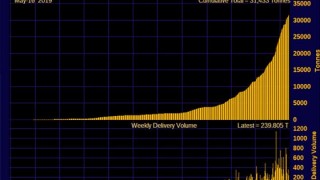

Over the last half year or so, a number of analysts, well-heeled individuals, and mega-hedge fund managers have been taking a shine to silver. So far the “restless metal” hasn’t been letting on that it’s noticed.

Full Article →In Germany buying anything more than one and one-half troy ounces of gold will now activate customer ID paperwork, and for businesses – a criminal background check…

Full Article →Understanding Gold Comes From The Heart

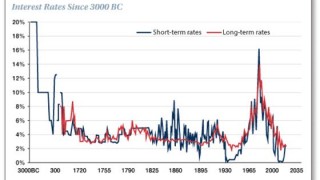

Reflect on the state of geopolitical affairs around the globe. Look at the trend in motion where banks are – or soon will – charge you for the privilege of saving some of the paper currency you’ve earned…

Full Article →Why You Should “Follow the Money” on The Yellow (and Silver) Brick Road

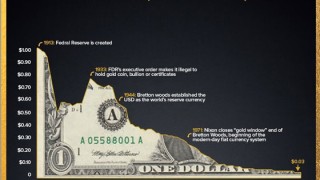

Since the Federal Reserve detached the dollar from the gold standard in 1971, the world’s central bankers – with the Fed leading the charge, have flooded the world with fiat currency to the point of diminishing its purchasing power to shadow status.

Full Article →Our chosen metaphor is the three-legged stool. Take one leg away, and the stool topples. In the case of silver, the outcome is likely to be a violent price rise of epic proportions.

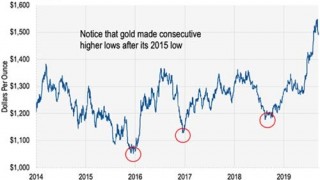

Full Article →Maybe you didn’t buy gold at $1,100, or $1,250 or $1,350. Perhaps you kept waiting for the arrival of a well-known analyst’s call of $700. (Whose tune has now changed to predicting $1,800!). What to do now?

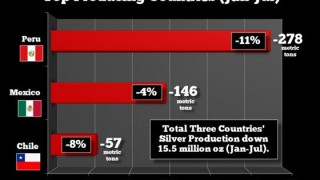

Full Article →The World Silver Survey 2019 Review said that global silver demand hit a three-year high in 2018, surpassing more than one billion ounces, up 4% from 2017. At the same time, global silver mine production fell for the third straight year, dropping 2% in 2018 to 855.7 million ounces.

Full Article →Gold is already at a 6-year high, left a series of gaps on the way up, and smashed through all sorts of technical “resistance” points on traders’ charts around the […]

Full Article →The clock on the coming eruption of the gold (and silver) market is ticking… Bullion.Directory precious metals analysis 20 June, 2019 By David Smith Senior Analyst at The Morgan Report […]

Full Article →Silver Sentiment: Is It (Your) Friend or Foe? Bullion.Directory precious metals analysis 23 April, 2019 By David Smith Senior Analyst at The Morgan Report The gold and silver bull markets […]

Full Article →When to Buy Gold & Silver (Is it a Good Time?)

No Gold and Silver? So Far, So Good… Bullion.Directory precious metals analysis 21 February, 2019 By David Smith Senior Analyst at The Morgan Report In the original (1960) classic movie […]

Full Article →David Smith

David H. Smith was Senior Analyst for TheMorganReport.com, contributor to MoneyMetals.com as well as the LODE Cryptographic Silver Monetary System Project.

He has investigated precious metals’ mines and exploration sites in Argentina, Chile, Peru, Mexico, Bolivia, China, Canada and the U.S. He shared resource sector observations with readers, the media, and North American investment conference attendees.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.