Inflation moderated a bit in July, fueling hopes that it has peaked. Are they justified?

Bullion.Directory precious metals analysis 02 September, 2022

Bullion.Directory precious metals analysis 02 September, 2022

By Arkadiusz Sieroń, PhD

Lead Economist and Overview Editor at Sunshine Profits

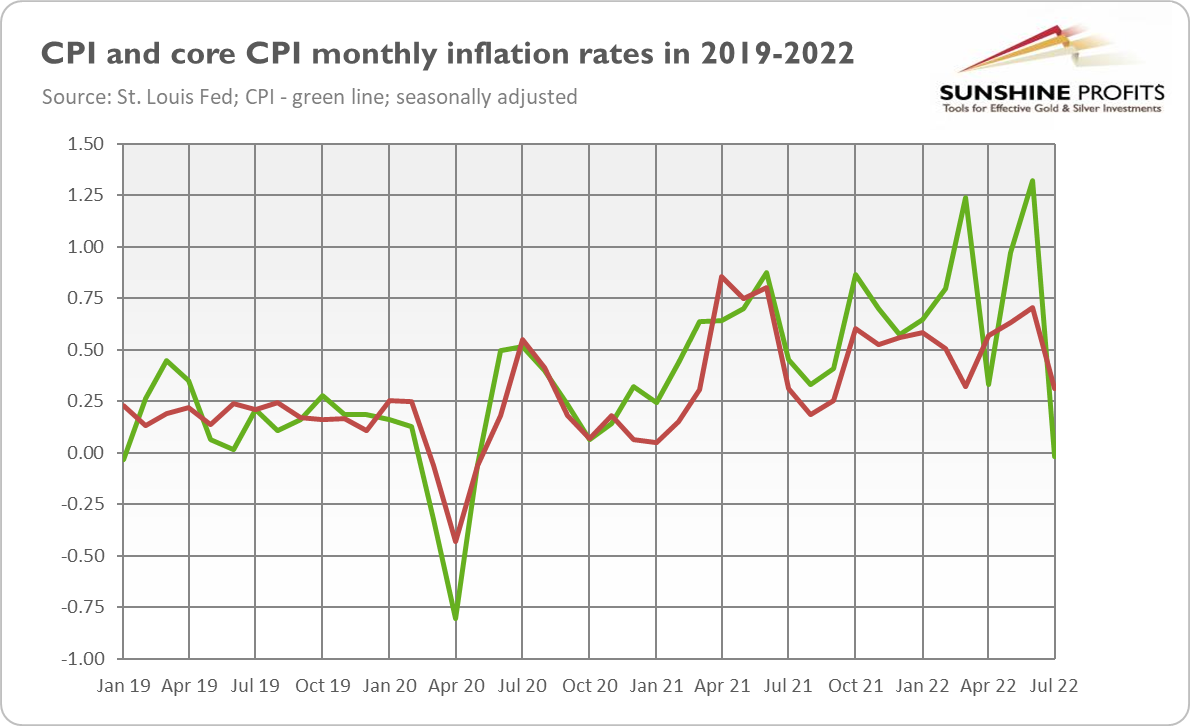

The core CPI, which excludes food and energy prices, didn’t come flat, but it still decelerated from 0.7% in June to 0.3% in July, according to the BLS.

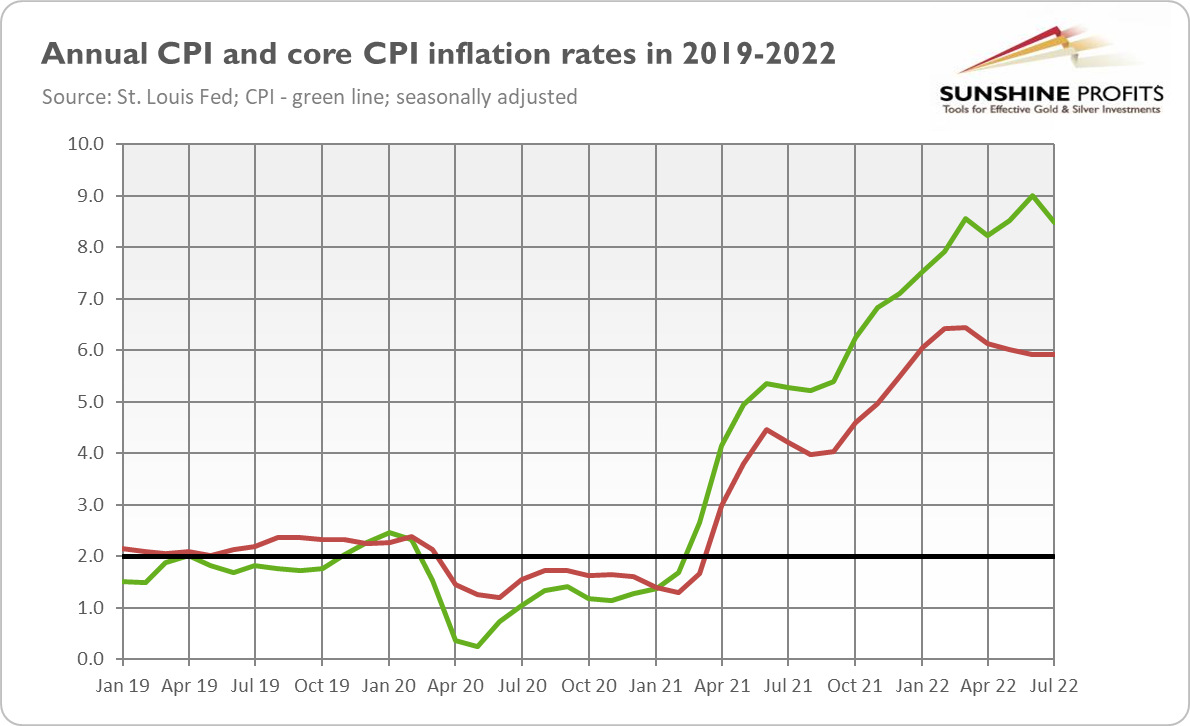

The price hikes also took a breather on an annual basis. As the next chart shows, the seasonally adjusted rate of increase in the CPI slowed down from 9% in June to 8.5% in July.

Meanwhile, the core CPI rose 5.9%, the same pace as in the previous month. This is due to a 10.9 percent increase in the food index over the last year, the largest 12-month increase since the period ending May 1979. What’s important is that the headline inflation readings came better than the markets and analysts expected.

Does it all mean that inflation has already peaked? Yes, it’s possible, at least in the short-term. After all, the Producer Price Inflation (for finished goods) has also moderated recently. As shown in the chart below, the annual PPI rate of change rose 15.3% in July, down from 18.3% in June.

What’s more, the slowing economy coupled with the Fed’s tightening cycle could negatively affect the demand side of the economy and, thus, curb inflation. Additionally, some of the supply problems have already been resolved, while the rate of increases in the money supply has returned to a more normal level than seen before the pandemic.

As one can see in the chart below, the pace of M2 money supply growth has peaked at 27% in February 2021 and since then it has decelerated below 6%.

Moreover, the monetary base has declined 8.6% in June 2022 over the last twelve months, while fiscal deficits have normalized, although at high levels.

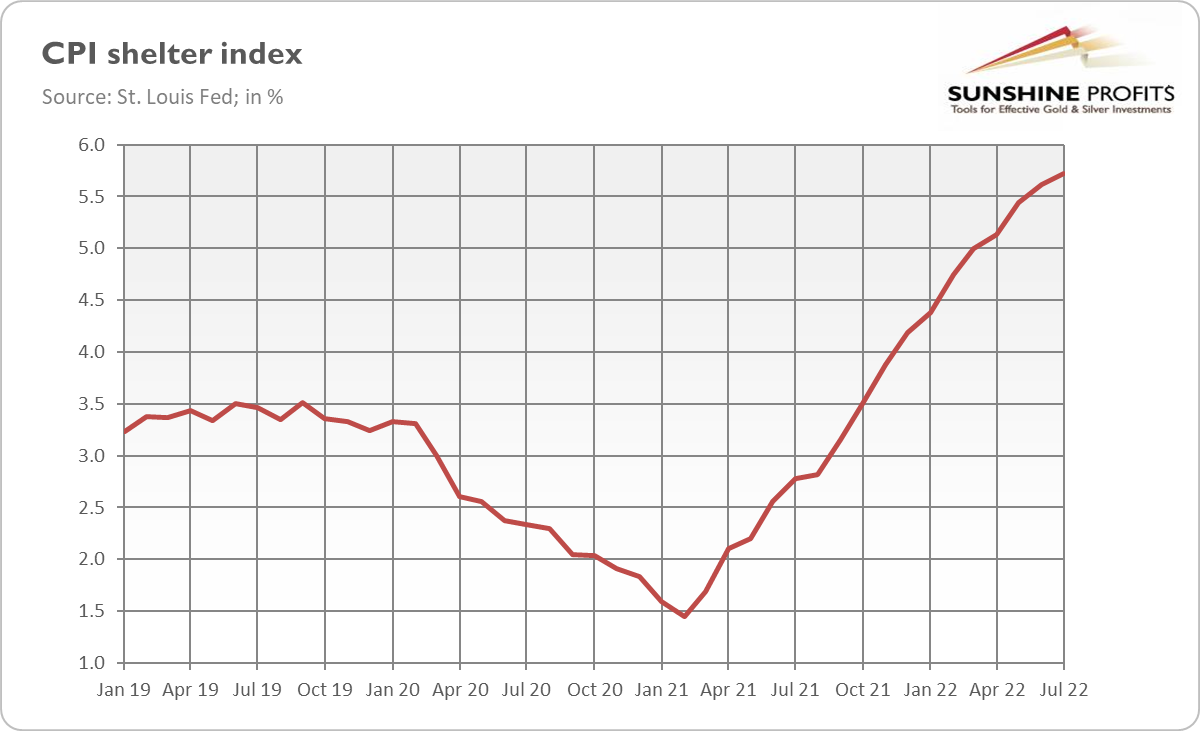

However, it’s also possible that inflation hasn’t peaked yet. There is still strong inflationary pressure, and monetary forces operate with a significant lag. What worries me is the rising home prices (which are reflected in the CPI with a lag) and shelter costs. As the chart below shows, the CPI shelter subindex accelerated slightly from 5.6% in June to 5.7% in July.

It’s really disturbing, as shelter costs are the biggest component of the CPI. They are also stickier and harder to fix than other constituents of inflation.

More generally, one month of moderation is not enough to draw any sensible conclusions about the future path of inflation, as there are always ups and downs on the way as a part of normal economic volatility. The Fed is still behind the inflation curve.

The key argument against prematurely celebrating the victory over inflation is that not all the newly created money during the pandemic has already shown up in inflation. Why? This is because people buried it in the backyard. Actually, they didn’t bury it but stashed money in their bank accounts.

However, the economic effect is similar: the fresh money hasn’t been fully spent and translated into higher prices. When people spend all these excess savings, inflation will get a second boost.

Additionally, according to the Bank of International Settlements, “as inflation rises, it naturally becomes more of a focal point for agents and induces behavioural changes that tend to entrench it.”

In other words, inflation has risen so much that it could become more persistent as self-feeding dynamics kick in. It means that “we may be reaching a tipping point, beyond which an inflationary psychology spreads and becomes entrenched.”

What does it imply? Well, as the main drivers are fading, inflation is likely to moderate somewhat in the near future. The local peak is near or it’s already been achieved. However, inflation is likely to stay elevated for some time. Actually, the top half of the population by wealth still has some excess savings. When people tap into them, inflation could accelerate again.

I’m not saying that inflation rates will continue to rise, reaching double-digit values.

My claim is that inflation hasn’t said its last word yet.

What does it all mean for the gold market? Well, the July deceleration in inflation is good news for the gold market because it may prompt the Fed to adopt a more dovish monetary policy. However, inflation is still obscenely high, which will force the U.S. central bank to continue its interest rate hikes and quantitative tightening.

The second bout of inflation, if it happens, will only reinforce the hawkish stance of the Fed. But even without it, the central bank will continue its current monetary policy, unless there is a strong and decisive slide in inflation rates. The following increase in real interest rates would be negative for gold prices.

However, the Fed’s monetary policy would lead at some point to recession or even to stagflation, which should make gold rally.

Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply