Hot CPI Missile Strike!

Bullion.Directory precious metals analysis 14 September, 2022

Bullion.Directory precious metals analysis 14 September, 2022

By Paul Engeman

Director at Ainslie Bullion

Nup.

The hotter than expected CPI print shocked the markets to their biggest fall since June 2020 in the heart of the COVOD crash.

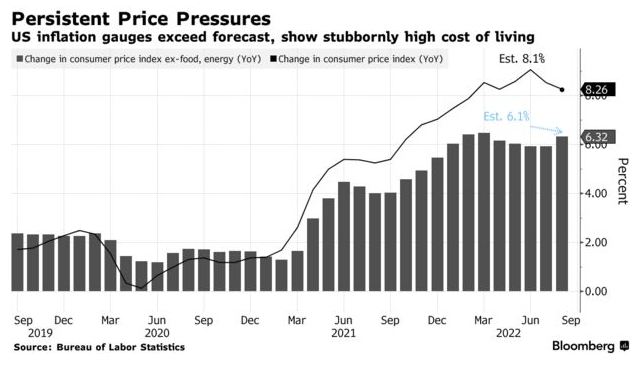

The headline CPI print was expected to cool by 0.1% for August after being steady in July, but instead it firmed a further 0.1% taking the annualised rate to 8.3% despite energy dropping after the US government’s interventions. Food was the biggest culprit, up an incredible 11.4% for the year (and ‘food at home’ up 13.5%!), the highest print since 1979.

The Fed’s preferred measure, Core CPI (excluding food and energy – because, like, who needs that stuff right!?) was even worse. It was twice as bad as expected, rising 0.6% in just the month, or 6.3% for the year and importantly its first annualised acceleration in 6 months. i.e. things are NOT getting better, and indeed far ‘stickier’ than most anticipated.

This print is just one week out from the very much anticipated Fed September FOMC meeting where until last night, few were expecting more than an already huge 75bps hike, and the market split on whether it would be 75 or 50bps. Well after last night an ‘unthinkable’ 100bps rise is now at nearly 50% odds!!

KPMG chief economist Diane Swonk, said afterwards “This report is a nightmare. This puts a one-percent rate rise definitely on the table.”

Jay Bryson, chief economist at Wells Fargo & Co said: “If there was any doubt at all about 75 — they’re definitely going 75” [re next week] and “We thought they’d be stepping it back to 50 in November. At this point, you’d say 75 is certainly on the table in November.”

So how did the market react to this news? Below is the full spectrum of equities across financial, industrials, health care, real estate, energy, utilities and basic materials. EVERYTHING was in the red barring that little bit of green being agriculture contract farming.

The S&P 500 fell 4.3%, Nasdaq 100 fell 5.5%, Dow Jones Industrial Average fell 3.9% and to show the global impact in one shot, the MSCI World index fell 3.4%. Cue similar for Australia today.

Even gold and silver fell in the sell off with the USD being the only green of substance, up 1.5% taking the DXY back up to 110! That big surge saw our AUD down and hence boosted our gold price to be up $24.75 in local terms and silver slightly higher by 2c.

The company patchwork above is a very salient reminder about true diversification. There would be many equities holders thinking they have a ‘balanced’ portfolio as they’re maybe spread amongst all the sectors listed above. They may even call it a “Balanced Fund” or similar. ‘Balance’ and uncorrelated diversification can unfortunately be quite different things.

The big question then is where to from here as the world’s biggest index, the S&P500 broke both its 50 and 100 day moving averages last night. The inevitable comparisons with 2008 are reappearing:

Should that play out of course, history would dictate that whilst yes USD gold dropped last night, in the GFC it ended up doubling whilst shares halved. Two words Kimmy…

“Uncorrelated diversification”

Paul Engeman

Paul Engeman is a director at Ainslie Bullion, one of Australia’s leading bullion dealers, Gold Silver Standard, the precious metals-backed crypto tokens and at Reserve Vault, Australia’s largest private secure vault facility.

Paul’s in-depth analysis is published daily on Ainslie Bullion and associated companies’ websites – where he writes passionately on our current economic situation and the solutions that gold, silver and other assets can help provide.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply