Global shares tumbled and gold rallied Friday night as news broke of Russia reneging on opening the critical NordStream gas pipeline to Europe (due to a ‘leak’)

Bullion.Directory precious metals analysis 05 September, 2022

Bullion.Directory precious metals analysis 05 September, 2022

By Paul Engeman

Director at Ainslie Bullion

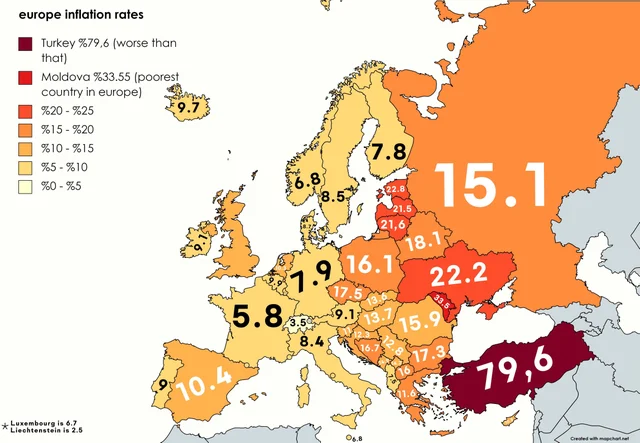

But first lets take a quick look at the current European inflation situation. The blended CPI for Eurozone sits at 9.1%, its highest since the union was formed but you can see too that is less than others sitting outside it.

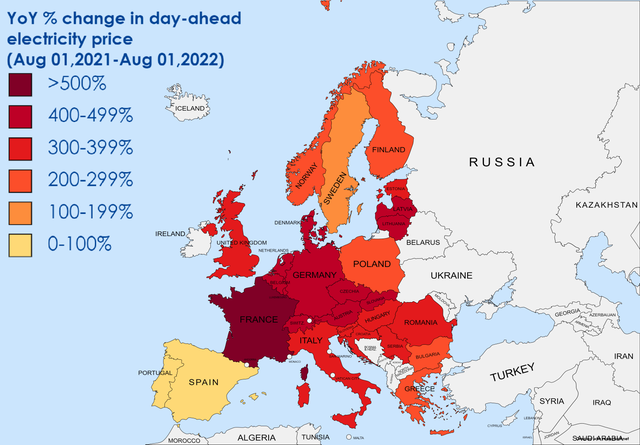

A big contributor is energy, exacerbated by the fact it is so reliant on Russian supply. The figures below are nothing short of staggering when you consider electricity sits across both manufacturing and personal consumption.

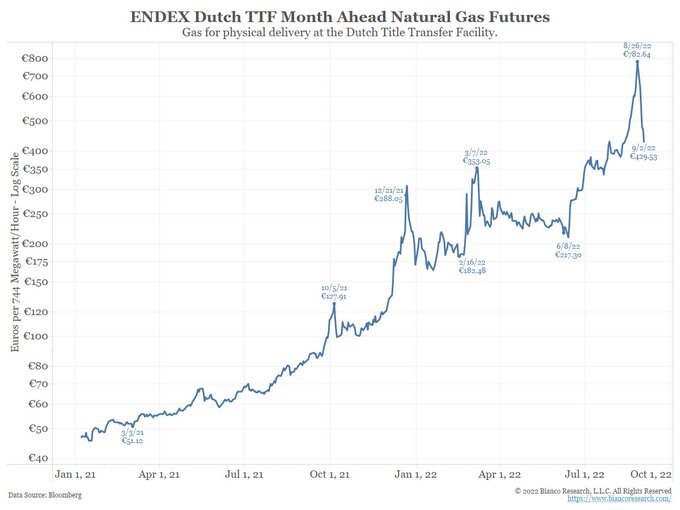

A lot of Euro power is courtesy of gas, and gas also warms a lot of houses as Europe marches toward winter. There is some commentary trying to allay fears by saying they have great storage ready, around 81% full, which is normal going into winter as they use summer to fill the tanks.

News of NordStream reopening even saw a drop in prices. That was clearly a little premature and even after that price drop you can see below the enormous cost increases to fill those tanks, around 6.5x the usual rate!

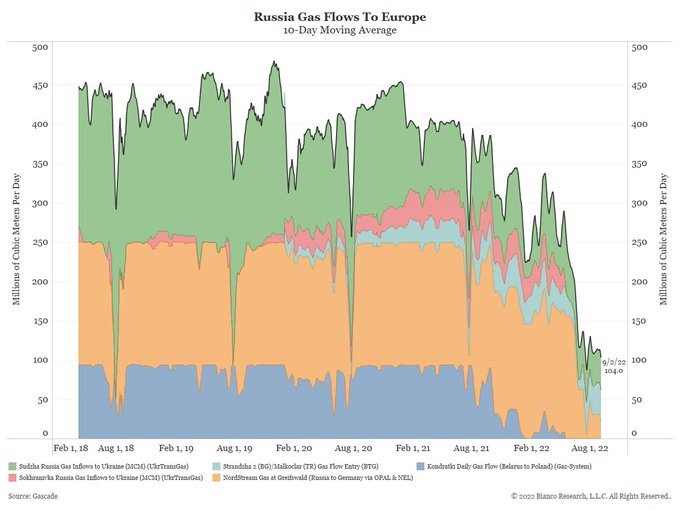

Importantly too, those 81% full tanks will still only cover around 25-30% of the winter needs. Put simply, they need more from Russia. The chart below shows Russian supply at down 75% but it still has around a third of that coming from NordStream which you can now put to zero (the orange) in the chart below:

Author of these charts and analyst Jim Bianco puts it in a perfect analogy:

“So what does this all mean? Europe has all the gas it needs, as long as they drain their bank accounts to pay for it. (akin to Ferrari makes all the supercars the world needs, as long as you have $500k to pay for one.)”

Putin put the world on notice back in June in a speech that is only now going viral on social networks. If it was any other western leader it would cause bigger shockwaves as he calls out the US on its abuse of the USD and its exporting of inflation around the world. In relation to this gas situation and gold the following excerpt is critical.

”The economy of imaginary wealth is being inevitably replaced by the economy of real and hard assets”.

His strategy is clear – “Sticky inflation -> higher (real) rates needed -> pain for hyper-financialized economies.”

We wrote last week of Putin’s move to wrangle back control of gold markets from the west as well.

We’ve written to this more broadly recently here and here .

These are huge figures and as Bianco pointedly notes – “Because the cost has already happened, it cannot be undone.”

If you haven’t watched the Putin speeches it is worth doing so (below are a couple of links). Know thine enemy should be front of mind, as should owning gold…

Commenting on this on an online forum, our own Chris Tipper nails it on the head:

Obviously the messenger is controversial, but the message is direct and accurate. The end of USD dominance and sole global reserve currency status will come faster than most expect if the USD continues rising because it benefits the US at the expense of everyone else. It’s easy to turn a blind eye when things are good (relatively) but the pressure continues to build in every other country outside of the G7 that is suffering right now much more than we are. A pivot is coming one way or another.

Either the US pivots and starts flooding the world with liquidity again so the masses calm down and carry on business as usual (but the peace will only last for a short time as the inflation will remain sticky and strong as you can’t inflate your way out of inflation!), or the rest of the world pivots away from the USD as they decide they need to get creative and find new solutions where they aren’t directly enriching the country that put them in this predicament?!”

Paul Engeman

Paul Engeman is a director at Ainslie Bullion, one of Australia’s leading bullion dealers, Gold Silver Standard, the precious metals-backed crypto tokens and at Reserve Vault, Australia’s largest private secure vault facility.

Paul’s in-depth analysis is published daily on Ainslie Bullion and associated companies’ websites – where he writes passionately on our current economic situation and the solutions that gold, silver and other assets can help provide.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply