Markets Were Quick to React to Powell’s Speech.

Bullion.Directory precious metals analysis 01 September, 2022

Bullion.Directory precious metals analysis 01 September, 2022

By Arkadiusz Sieroń, PhD

Lead Economist and Overview Editor at Sunshine Profits

Jackson Hole is behind us! What have we learned from Powell’s remarks at this year’s symposium? Well, the Fed Chair delivered a decisive and firm speech that reinforced the Fed’s hawkish stance and put to rest beliefs about a quick dovish pivot:

Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy.

Although Powell didn’t specify how large the next interest rate hike will be, he said that “another unusually large increase could be appropriate at our next meeting”.

Importantly, Powell downplayed July’s deceleration in inflation, saying that “a single month’s improvement falls far short of what the Committee will need to see before we are confident that inflation is moving down”.

Powell also emphasized the Fed’s commitment for delivering low and stable inflation. He said that:

Our responsibility to deliver price stability is unconditional (…). There is clearly a job to do in moderating demand to better align with supply. We are committed to doing that job (…). We are taking forceful and rapid steps to moderate demand so that it comes into better alignment with supply and to keep inflation expectations anchored. We will keep at it until we are confident the job is done.

What’s important, is that Powell acknowledged the costs of restoring price stability in the form of drag on aggregate demand and the labor market (and that it would bring “some pain,” or the so-called hard landing), but he seemed to be ready to bear these costs in order to defeat inflation.

The logic is simple: as “the employment costs of bringing down inflation are likely to increase with delay,” the Fed should act with resolve now until the job is done:

Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions.

While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

Last but not least, Powell clearly stated that estimates of the longer-run neutral level of federal funds rate – estimated in June FOMC’s economic projections to be 2.50% – are not a place to stop or pause the Fed’s tightening cycle.

It means that interest rates may go significantly higher. This week, Cleveland Fed President Loretta Mester said that the Fed will need to raise the federal funds rate somewhat above 4% by early next year.

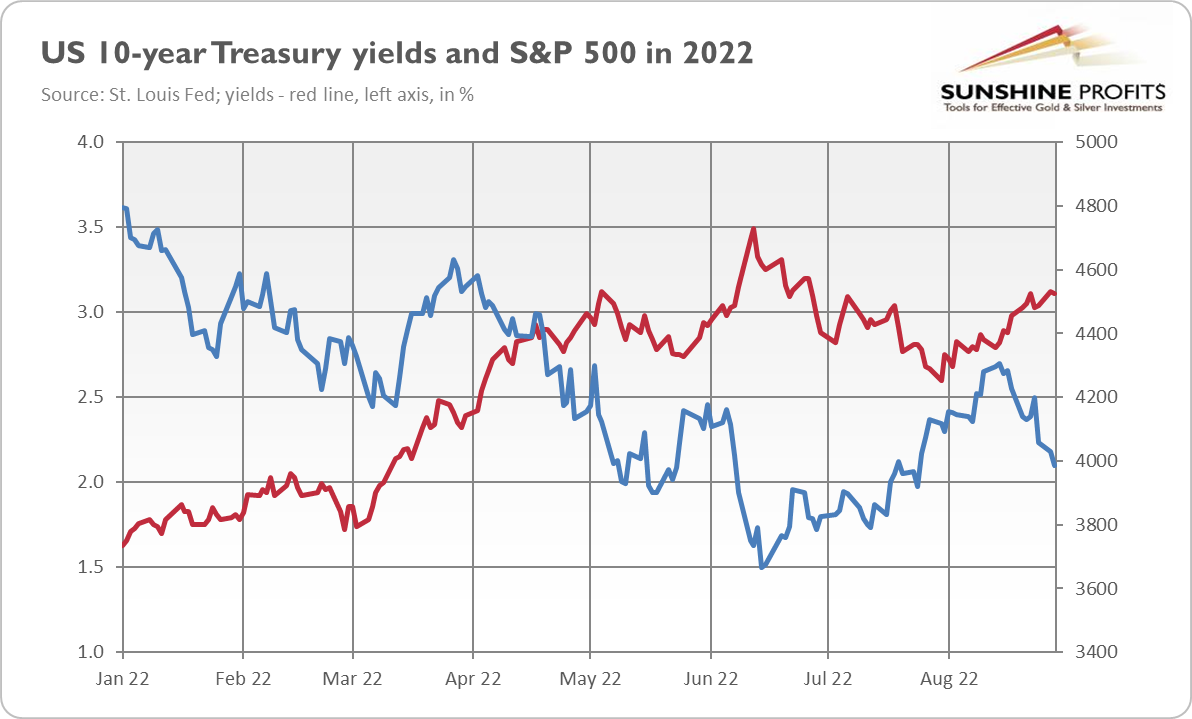

Powell’s speech at Jackson Hole pushed the dollar and bond yields higher, while equities plunged. As the chart below shows, the 10-year yield on U.S. Treasuries rose from 3.03% to 3.12%, while the S&P 500 Index plummeted from 4,199 to 3,955.

Moreover, according to the CME FedWatch Tool, the odds of 75-basis points hike in the federal funds rate increased from 64% to 72%, which also put downward pressure on the gold prices.

Implications for Gold

What do the recent Fed’s hawkish comments imply for the gold market? Well, they add downward pressure on the yellow metal. As the chart below shows, the gold prices have been gradually sliding in August from $1,800 towards $1,700. Powell’s speech at Jackson Hole has accelerated this downward trend, pushing the price of gold from $1,754 to $1,716 one week later.

Unfortunately for the gold bulls, this downward trend could continue for a while, although most of the downside risks seem to have been already priced in.

The hawkish Fed, strong greenback, and rising real interest rates are clear headwinds for gold that keep its price below $1,800 or even lower.

However, remember that talk is cheap. Powell’s speech was resolute, but the question is how is he going to sound when the data seriously deteriorates. After all, a recession is practically unavoidable, and the only question is how deep and painful it will be.

Hence, gold is likely to struggle further, but at some point, it should get a boost from recessionary and stagflationary tailwinds.

Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply