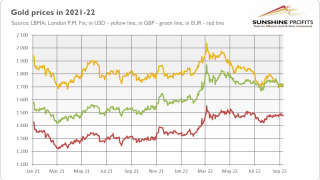

Queen Elizabeth II died, but King Dollar is the strongest in decades. Gold doesn’t like it. The price of the yellow metal declined from above $2,000 to below $1,700, a slide that occurred during the highest inflation since the great stagflation of the 1970s.

Full Article →Biggest Mistake of Inflation Reduction Act?

Well, if you can’t afford a turkey AND a ham this Thanksgiving, just flip a quarter to help you decide. You — you don’t have a quarter? I guess you could use a nickel… For older Americans who are saving for retirement or have already retired, President Biden’s Inflation Reduction Act will have several potential impacts.

Full Article →What Does Currency Crisis Mean for Gold?

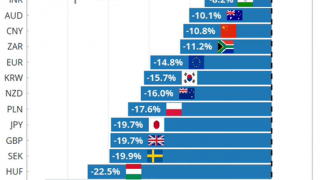

The US Dollar wrecking ball narrative continues with Friday’s USD strength saw global currencies crumble under its strength, giving rise to fears of the spread of a currency crisis to other countries with dollar-denominated debt. Gold, meanwhile, has not cracked under the weight.

Full Article →August Core CPI: Inflation Far From Over

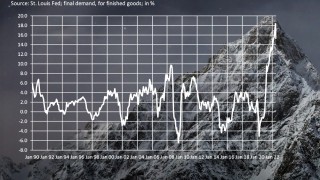

Inflation began reacquainting itself with its 40-year-highs toward the end of last year and evidence suggests inflation is spreading. Ever since, Americans have hoped that each new monthly CPI report would be the one that finally showed consumer prices were heading back to earth.

Full Article →All Gold and Quiet on the Eastern Front

The war in Ukraine has entered its seventh month and some people believe that China is gearing up for a war with Taiwan. Will bulls invade the gold market? What are the implications for gold? Well, the war shows that gold bulls shouldn’t count on geopolitical events…

Full Article →How to Fight Inflation Like a Wall Street Pro

Investment bankers agree that central bank efforts to curb inflation are mostly proving fruitless. Interest rates are going up, but inflation rates aren’t going down. So what are some ways to protect oneself in this environment?

Full Article →World’s Largest Hedge Fund on Gold Buying Spree

Rebecca Patterson, chief strategist at top hedge fund Bridge Water Associates, sat down for an interview with Pensions and Investments earlier in the week to explain how Bridge Water is preparing for a ‘prolonged stagflationary period’ (high inflation with low to negative growth).

Full Article →Interest Rates Can’t Go Up Far, Or Hold for Long

Conventional thinking calls for higher interest rates. It makes this call via two channels. One is its policy prescription. The other is a theory of how market participants will behave. There is no such thing as a good central bank policy. All central bank actions inflict harm on the people.

Full Article →The Fed Declares War on Wall Street

Official inflation at 8.3% year-over-year rate is either good news or bad news. Good news: it’s noticeably lower than June’s blistering 9.1% report. Bad news: it’s yet another painfully high report in ten consecutive months over 6%, continuing our most severe inflationary episode in four decades.

Full Article →Fight to Contain Inflation… Just How Bad?

It wasn’t terribly long ago that the hope – indeed, the assumption – of both Treasury Secretary Janet Yellen and Federal Reserve Chairman Jerome Powell was that it would take essentially nothing to rein inflation in.

Full Article →New “Red Gold Standard” Threatens Dollar

As we know, sanctions have punished the West without stopping Russia’s invasion of Ukraine. This is not debatable – it’s simply fact. The U.S. has seen diminishing returns from levying financial sanctions against unfriendly nations for decades now.

Full Article →Wall St Crashes Most Since COVID

The lead up to last night’s US CPI print saw the market expecting a softening of inflation and the chances of a Fed pause or pivot sooner rather than later. Shares were climbing eagerly in anticipation of the “goldilocks” economic outcome. Nup.

Full Article →Gold Wonders How Severe This Recession Will Be

Economic contraction is unfolding – but how painful will it be? The deeper the recession, the better for gold. Let’s make it clear: an economic downturn is coming. We are already in a technical recession despite the White House’s attempts to change its definition.

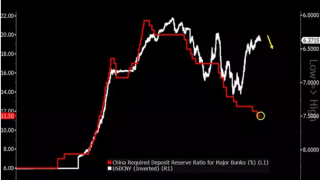

Full Article →China Facing Multiple Attacks on Currency

The world’s second largest economy is battling multiple challenges at the moment, some short term and some long. The timing however could not be worse for the global economy. China is between a rock and a hard place because the only other major economy not tightening is Japan

Full Article →Can Self-Directed IRAs Help Alleviate US Retirement Crisis?

It’s been a tough year for retirement savers. The highest inflation in decades already had been forcing Americans to suspend retirement plan contributions so they could keep up with soaring prices at grocery stores, gas stations and basically anywhere that anything is sold

Full Article →When Rising Unemployment is Not Good for Gold

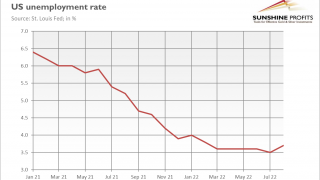

Powell, we could have a problem! According to the BLS, the U.S. unemployment rate rose to 3.7% in August from 3.5% in the previous month. It seems to be a fatal blow to the narrative of a strong labor market. What does it all mean for the gold market?

Full Article →Gold: The Counterparty Risk Free Investment

As bullion dealers, we are asked on a daily basis whether we think the fiat dollar price of gold and silver are going to go up or down. However, for many, if not most, bullion investors, the most important aspect of precious metals is that there is no “counterparty risk”.

Full Article →R.I.P. David H. Smith, Precious Metals Philosopher

I am saddened to report today that my friend… our friend… David Smith lost his battle with cancer last weekend. David was a phenomenal yet humble man. He was a teacher, a student, and a philosopher. I have rarely a met a more optimistic, thoughtful, and wise person.

Full Article →Proof that Precious Metals Are the Best Hedges

Now, this is counterintuitive if we think of gold exclusively as a safe haven investment. But it’s not. Gold is also historically one of the most desirable symbols of luxury and wealth. It’s like Wharton finance and economics professor Urban Jermann described in his new model of gold pricing…

Full Article →US Mid Terms & How They Affect You

Whilst there is a lot of focus on cost of living pressures, maybe a more important barometer to watch is that of the US. We are now less than 2 months away from the US mid term elections and both history and the so called “Misery Index” point to the Republicans taking control

Full Article →Bad News For Economy, Good News For Gold

A bad run for gold and silver markets this summer is dimming hopes for the metals being able to finish out the year with some good gains. Major economic indicators have also been trending down this summer. However last week brought some disappointing jobs data.

Full Article →“No Gas For You!” Putin’s Grand Plan For Europe

Gold rallied Friday night as news broke of Russia reneging on opening the critical NordStream gas pipeline to Europe (due to a ‘leak’) and in so doing, locking in even higher gas prices and more inflation as Europe heads into winter. This appears all to be part of Putin’s grand plan…

Full Article →Student-Loan Forgiveness: Inflation Reduction Act Revelations

If you’re a struggling college graduate burdened with mountains of student debt, it seems your load is now a bit lighter. Except student-loan forgiveness could cost more than a half-trillion dollars with the initiative expected to swell the deficit far beyond the new inflation law’s deficit-reduction benefit

Full Article →Powell Promises Pain, Biden Makes It Worse

Powell’s policies will bring pain to American families, one way or another. Now the Fed is openly rooting for stock and housing markets to crash – because that’s how they’ll know their rate hikes are finally deflating the “Everything Bubble.”

Full Article →After July Slowdown Has Inflation Finally Peaked?

Inflation moderated a bit in July, fueling hopes that it has peaked. Are they justified? Yes and no, but before I elaborate on this enigmatic answer, let’s see what happened in July. On a monthly basis, the CPI was unchanged then, after rising 1.3 percent in June

Full Article →Large Commercial Traders Positioned for Higher Metals Prices

Physical bars continue to drain from COMEX and London warehouses. Larger investors who hold deliverable bars aren’t throwing in the towel and dumping them back into the market. Instead, they continue to stack, much like retail investors buying the smaller coins, rounds and bars.

Full Article →Moscow World Standard (MWS) Challenges LBMA

Russia and a number of former USSR nations are setting up a competing precious metals exchange, initially dubbed the Moscow World Standard (MWS) as Russia has become increasingly insistent that the London Bullion Market Association (LBMA) has been manipulating spot prices down artificially.

Full Article →Gold Falls as Powell Appears Hawkish in Jackson Hole

Importantly, Powell downplayed July’s deceleration in inflation, saying that “a single month’s improvement falls far short of what the Committee will need to see before we are confident that inflation is moving down”.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.