To the surprise of many, Fed chair Jerome Powell believes that “households are in very strong financial shape.” Yes, he really said that as households continue to struggle to fight the inflation gains that are exceeding their wages.

Full Article →Paul Engeman

Paul Engeman is a director at Ainslie Bullion, one of Australia’s leading bullion dealers, Gold Silver Standard, the precious metals-backed crypto tokens and at Reserve Vault, Australia’s largest private secure vault facility.

Paul’s in-depth analysis is published daily on Ainslie Bullion and associated companies’ websites – where he writes passionately on our current economic situation and the solutions that gold, silver and other assets can help provide.

What Does Currency Crisis Mean for Gold?

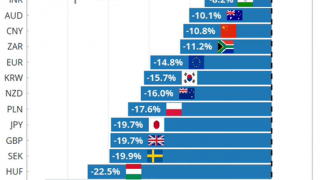

The US Dollar wrecking ball narrative continues with Friday’s USD strength saw global currencies crumble under its strength, giving rise to fears of the spread of a currency crisis to other countries with dollar-denominated debt. Gold, meanwhile, has not cracked under the weight.

Full Article →World’s Largest Hedge Fund on Gold Buying Spree

Rebecca Patterson, chief strategist at top hedge fund Bridge Water Associates, sat down for an interview with Pensions and Investments earlier in the week to explain how Bridge Water is preparing for a ‘prolonged stagflationary period’ (high inflation with low to negative growth).

Full Article →Wall St Crashes Most Since COVID

The lead up to last night’s US CPI print saw the market expecting a softening of inflation and the chances of a Fed pause or pivot sooner rather than later. Shares were climbing eagerly in anticipation of the “goldilocks” economic outcome. Nup.

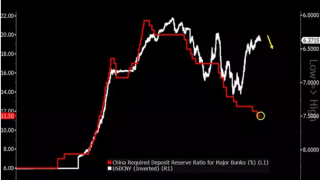

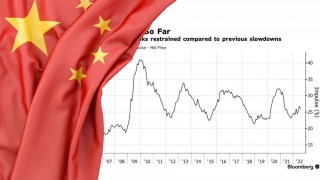

Full Article →China Facing Multiple Attacks on Currency

The world’s second largest economy is battling multiple challenges at the moment, some short term and some long. The timing however could not be worse for the global economy. China is between a rock and a hard place because the only other major economy not tightening is Japan

Full Article →Gold: The Counterparty Risk Free Investment

As bullion dealers, we are asked on a daily basis whether we think the fiat dollar price of gold and silver are going to go up or down. However, for many, if not most, bullion investors, the most important aspect of precious metals is that there is no “counterparty risk”.

Full Article →US Mid Terms & How They Affect You

Whilst there is a lot of focus on cost of living pressures, maybe a more important barometer to watch is that of the US. We are now less than 2 months away from the US mid term elections and both history and the so called “Misery Index” point to the Republicans taking control

Full Article →“No Gas For You!” Putin’s Grand Plan For Europe

Gold rallied Friday night as news broke of Russia reneging on opening the critical NordStream gas pipeline to Europe (due to a ‘leak’) and in so doing, locking in even higher gas prices and more inflation as Europe heads into winter. This appears all to be part of Putin’s grand plan…

Full Article →Moscow World Standard (MWS) Challenges LBMA

Russia and a number of former USSR nations are setting up a competing precious metals exchange, initially dubbed the Moscow World Standard (MWS) as Russia has become increasingly insistent that the London Bullion Market Association (LBMA) has been manipulating spot prices down artificially.

Full Article →Fed Chair Powell’s Jackson Hole speech ended up being as hawkish (tighter monetary policy) as you could imagine. For a market that was simply gagging for even the remotest bit of dovish note, it was nowhere to be found and EVERYTHING barring the USD fell hard

Full Article →We are not living in the first society to move from a gold standard to a fiat standard, but extending this to a completely digital fiat standard is most likely the furthest that people’s concept of ‘money’ has ever been from precious metals…

Full Article →Whilst it looks next to certain that the US and Europe are in or about to be in a recession, opinion seems divided over whether Australia will follow suit. Much of that relies on the health of our biggest trading partner, China.

Full Article →US shares rallied again Friday night largely it seems off the back of a slightly softer PPI (Producer Price Index – i.e. inflation at the ‘factory door’). The market desperately looking for confirmation bias around an imminent Fed pivot got what they were looking for

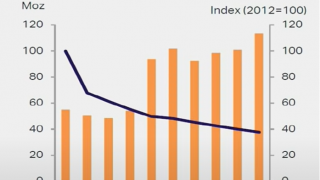

Full Article →Overall global solar panel production has been growing over the last 10 years while the actual amount of silver in each panel is set to increase. A number of major technological changes on the horizon are set to kick industrial silver demand into overdrive

Full Article →US markets were shocked Friday when the NFP employment figures we discussed on Friday came in at literally more than double the expected headline print with 528,000 new jobs added in July and the unemployment rate dropping to 3.5% from 3.6% and wages rising to 5.2%.

Full Article →Zimbabwe has begun issuing 1oz (22-carat) gold coins as legal tender to be cashed in, used for trade, transactions, and as a security for loans. 1,500 coins were released on 25 July), and there are a further 2,000 in the pipeline.

Full Article →If you had to pick 3 things that drive the gold price many would say inflation hedge, safe haven in economic turmoil, and war. As we sit here today, 3 August 2022, the headlines are screaming all 3.

Full Article →The World Gold Council’s quarterly Demand Trends report for Q2 2022 have just been released and as usual we summarise for you. Overall despite Q2 weakness, strong first quarter ETF inflows fuelled a notable H1 recovery.

Full Article →In what feels very much like a ‘here we go again’ moment, the market was looking for any cue that the Fed will soon pause or pivot signalling a return to easy money. And so, whilst raising rates a whopping 75bps, the first sentence of the statement delivered…

Full Article →S&P Global Market Intelligence just released both their Euro and US PMI’s and at the time that both central banks are tightening monetary policy, both of two of the worlds largest economies are showing clear signs of heading into a recession.

Full Article →The Bank for International Settlements (BIS), also known as the “central bank of central banks,” recently released a survey which states that at least 81 central banks around the world have been accelerating plans to release their own cryptocurrencies.

Full Article →Given that not a single banker went to jail in the aftermath of the GFC, any actual time behind bars for the JP Morgan trio of Michael Nowak, Gregg Smith and Jeffrey Ruffo would send a powerful message to major commercials with heavy paper shorts on the COMEX.

Full Article →“When will the US Fed pause or reverse and ease rates?” is quite simply most important question in global finance. This question is not simply one of US interest rate impacts, US inflation or US financial markets plunging off the back of all that liquidity being removed.

Full Article →Any discussion of gold’s price action must inevitably look at what’s happening in China, easily the worlds largest buyer of the precious metal. The softness of the metals price of late has many scratching their heads amid rampant inflation and a war.

Full Article →New technology has shown billions of dollars worth of gold perfectly preserved on the floor of the Caribbean Sea. Some experts believe there to be at least 200 tonnes of gold, silver and emeralds in the legendary San Jose galleon shipwreck

Full Article →It may come as a major relief to Australians that we still have a lot of gold in the ground, because neither the RBA nor, the Australian government, nor many Australian citizens for that matter, hold very much gold. Australia’s gold reserves sit at 80 tonnes, unchanged since 1997…

Full Article →Headlines abound overnight as H1 of 2022 closed at the worst in 60 years for the world’s biggest share index, the S&P500, down 21.2% so far this year. The NASDAQ had its worst H1 ever, down 30% and eclipsing the dot.com bubble’s 25% for the same period.

Full Article →With China, India, Brazil and South Africa fearing sanctions, the BRICS nations are forming a viable alternative to the US Dollar. Putin stated Wednesday “The matter of creating the international reserve currency based on the basket of currencies of our countries is under review.”

Full Article →Paul Engeman

Paul Engeman is a director at Ainslie Bullion, one of Australia’s leading bullion dealers, Gold Silver Standard, the precious metals-backed crypto tokens and at Reserve Vault, Australia’s largest private secure vault facility.

Paul’s in-depth analysis is published daily on Ainslie Bullion and associated companies’ websites – where he writes passionately on our current economic situation and the solutions that gold, silver and other assets can help provide.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.