In The Push Towards Fully Digital Currencies, What Happens To Privacy and Choice?

Bullion.Directory precious metals analysis 19 August, 2022

Bullion.Directory precious metals analysis 19 August, 2022

By Paul Engeman

Director at Ainslie Bullion

The media release on the RBA’s website states:

“The project, which is expected to take about a year to complete, will involve the development of a limited-scale CBDC pilot that will operate in a ring-fenced environment for a period of time and is intended to involve a pilot CBDC that is a real claim on the Reserve Bank.”

Initially, it wouldn’t be legal tender, but would be a claim on the assets of the RBA and could be exchanged for Australian Dollars. The RBA hopes for the project to be fully rolled out some time between 2025 and 2030.

RBA Governor Philip Lowe has said that technology has shaped the use of money, with gold and silver giving way to paper, then polymer notes, and now increasingly digits on screens. We are not living in the first society to move from a gold standard to a fiat standard, but extending this to a completely digital fiat standard is most likely the furthest that people’s concept of ‘money’ has ever been from precious metals.

The double edged sword of reduced capacity for fraud/transparency and the reduction of privacy in independence from banks is one of the major cost/benefit analyses that would come with a Central Bank Digital Currency.

Identification of individuals and ID requirements would make tax evasion, fraud, and money laundering significantly more difficult. Moreover, it may even mean that the tax office would be able to tell people what they owe/are owed, rather than asking individuals and their accountants to figure out what they owe, but then punishing them for getting it wrong.

Greater transparency comes with less privacy. If the CBDC replaces cash, then political dissidents or people who have broken arbitrary new rules introduced by governments would run the risk of having their accounts shut down with no alternate method of payment for goods and services. Initial indications from the RBA suggest that they would allow individuals and institutions to create private and anonymous wallets, but it would seem unlikely that on and off ramps for using the CBDC in practical terms would come without at least a minimum level of customer identification requirements. Certainly any form of government payment would need to be delivered to a fully identified and verified wallet address..

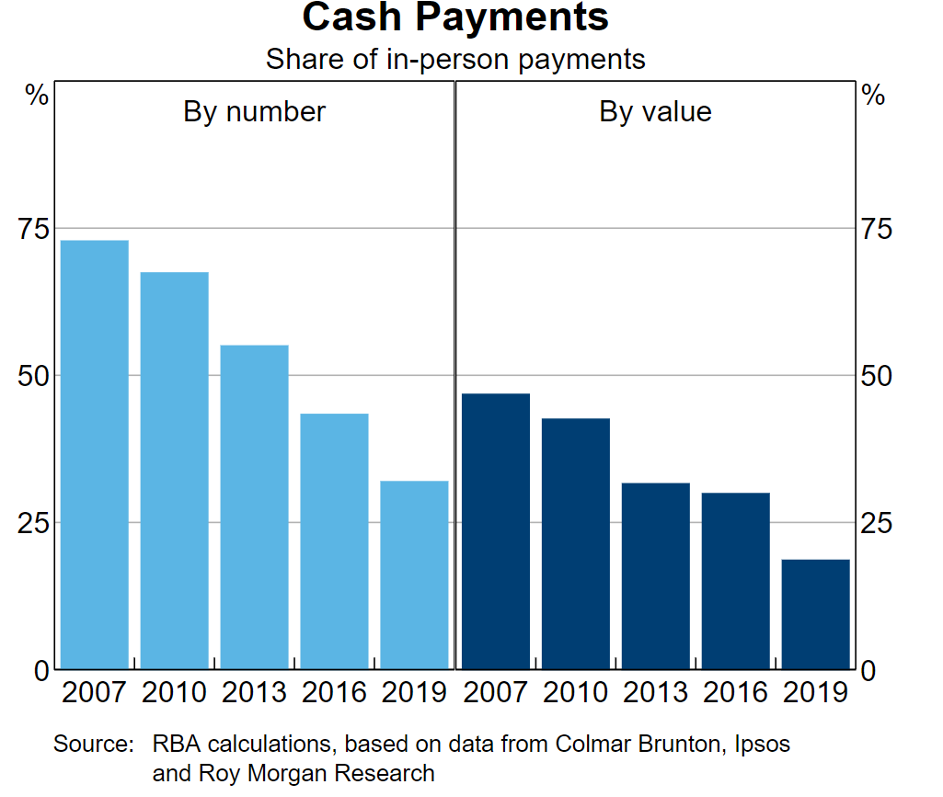

In a 2019 survey, the RBA found that Australians still preferred to use cash for 32 per cent of in person transactions, however the dollar value of these transactions was lower at 19%. This is a part of a downtrend in the use of cash in Australia in favor of digital payments. You might not have noticed, but everytime Australian consumers ‘tap’ their card, the business is charged more than 1%, which is often passed onto the consumer, but acts as a 1% bank tax on the majority of daily transactions in Australia every day. Cash takes a little longer to count and give change, but the banks are certainly far happier taking their slice out of every coffee, beer, dinner, footy ticket or pie that are tapped for.

There are certainly a number of benefits to moving away from cash from the consumer perspective, especially if the fees to middle men can be eliminated, for instant, anonymous and private transacting could be achieved. Demand for a true “digital cash” with all the benefits of cash but without the physical hassles would be very high.. The issue, however, is even if the new CBDC starts with the best of intentions, the potential for eventual misuse and overreach by governments is very high.

In 2019, the Australian Government introduced legislation: Currency (Restrictions on the Use of Cash) Bill 2019, to criminalise payments of more than $10,000 in cash. We covered it when it was first announced and as the momentum against the new laws gained momentum. There were proposed two year jail sentences and fines of up to $25,200. The government’s “Black Economy Taskforce” argued that that 10k limit would help stamp out tax evasion and other crimes.

The public outcry led to the authoritarian new laws being scrapped, but it highlights the potential problem, especially if implementing such a law was as simple as a new “software update”.

Taking this concept further, ‘Programmability’, which would enable the tokens to be used for some kinds of transactions but not others would be able to stop people purchasing illicit substances, or prevent recovering alcoholics from fueling their addiction. While there may be a few select good news stories out of programmability, there would be a much larger risk, the potential for those in charge of the currency, elected or unelected, to discriminate against certain vendors in favor of others.

Governments don’t need any additional incentives or ability to pick winners, and the potential for preferential treatment of big business at the expense of small business is a danger to competition and true capitalism in the traditional Austrian sense as opposed to the crony capitalism which rewards those closest to the centers of power. Tokens could be programmed to expire, or may be garnished automatically with no recourse – although that is already a feature of today’s banking.

According to the BIS’s May Report, 90% of nations are now ‘considering’ a CBDC of one form or another. It seems like the movement away from honest money is continuing, and the CBDC is on the next leg. For individuals not comfortable with the direction things are moving, the easiest way to ‘opt-out’ is to hold precious metals such as gold, silver and platinum. For now, individuals are able to purchase with physical cash at Ainslie Bullion, but for how much longer…

Paul Engeman

Paul Engeman is a director at Ainslie Bullion, one of Australia’s leading bullion dealers, Gold Silver Standard, the precious metals-backed crypto tokens and at Reserve Vault, Australia’s largest private secure vault facility.

Paul’s in-depth analysis is published daily on Ainslie Bullion and associated companies’ websites – where he writes passionately on our current economic situation and the solutions that gold, silver and other assets can help provide.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply