The frosty reception of Biden by Saudi’s MbS last week only bolstered fears of such an alliance coming about

Bullion.Directory precious metals analysis 18 July, 2022

Bullion.Directory precious metals analysis 18 July, 2022

By Paul Engeman

Director at Ainslie Bullion

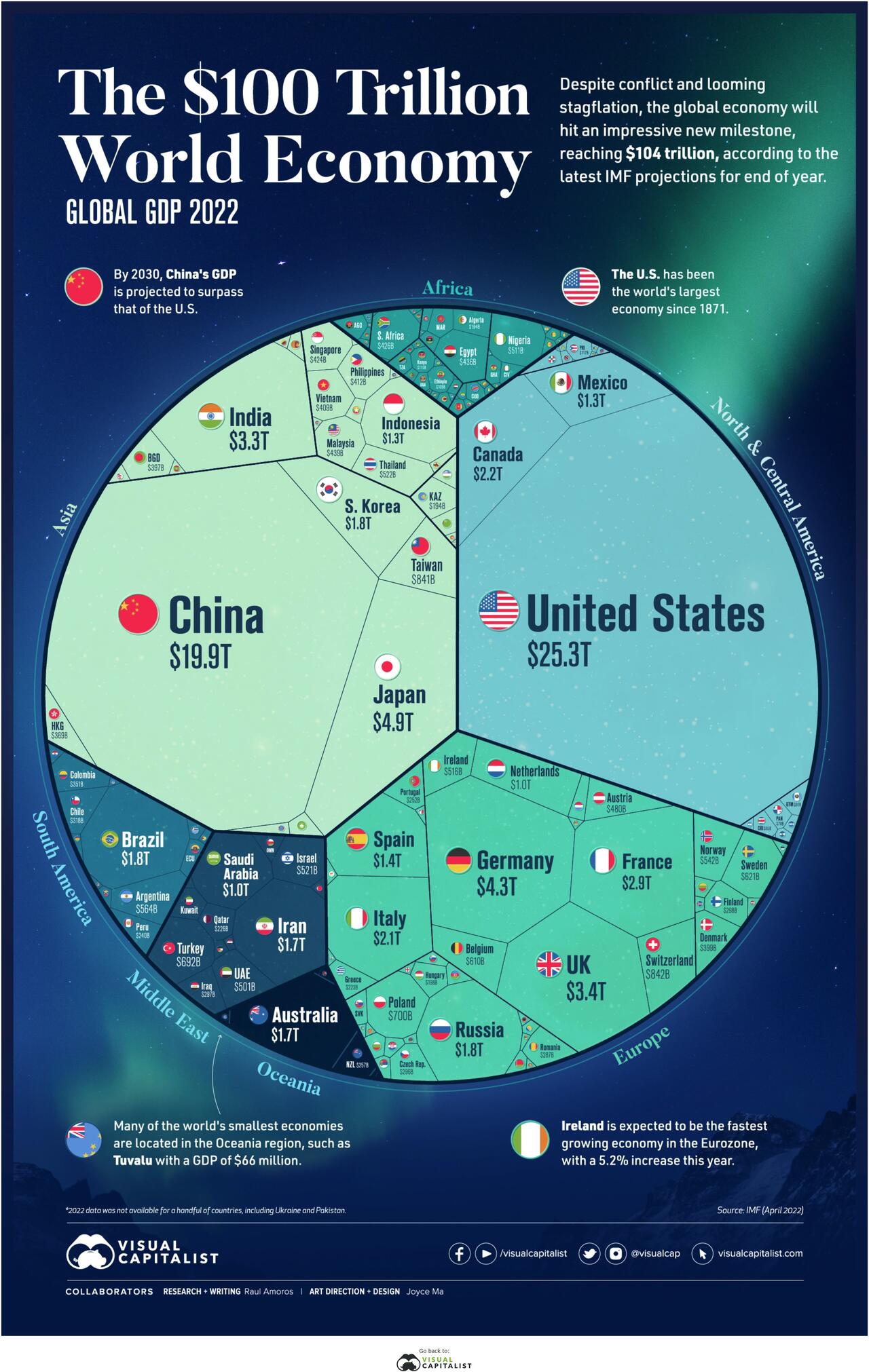

As a reminder of context, you will see below that the US equates to around 25% of the now $104 trillion global economy. Whilst you study the chart below, have a look at the collective that is Brazil, Russia, India, China and South Africa… The so call BRICS alliance…

Collectively they too equate to around 25% of global GDP but also around 40% of global population and broadly in the ‘emerging market’ category, ala growing more rapidly than the west. Over the weekend we then see reports that the BRICS president, Purnima Anand says the group is about to expand to include Saudi Arabia, Turkey and Egypt.

“All these countries [Saudi Arabia, Turkey, and Egypt] have shown their interest in joining [BRICS] and are preparing to apply for membership. I believe this is a good step, because expansion is always looked upon favourably, it will definitely bolster BRICS’ global influence” and “I hope that these countries will join the BRICS quite shortly, as all the representatives of core members are interested in expansion. So it will come very soon,”

The group is clearly dominated by China and clearly not one of them have condemned Russia’s invasion of Ukraine. Just in May President Xi Jinping said BRICS members have to:

“reject Cold War mentality and bloc confrontation, and work together to build a global community of security for all.”

The frosty reception of Biden by Saudi’s MbS last week only bolstered fears of such an alliance coming about.

In that article last week we floated the idea that ‘the world’ moves to reject this situation where the US, with 25% of GDP controls 87% of global trade and an unquantified but enormous percentage of the record high $303 trillion of global debt denominated in its currency.

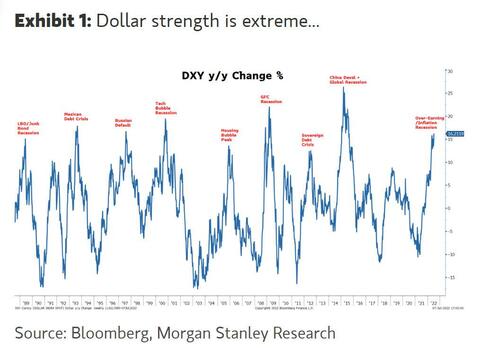

A currency they have debased with reckless abandon and now tightening into a global disaster. The result is a surging USD which you can see below is reaching previous ‘event triggering’ highs:

An expanding BRICS alliance is one symptom but arguably Europe and Japan are hurting even more. The outcome is simply unknown. Brandon Smith of Alt-Market.us gave this interesting take:

“The Bank for International Settlements (BIS), also known as the “central bank of central banks,” recently released a survey which states that at least 81 central banks around the world have been accelerating plans to release their own cryptocurrencies. Many excuses are given, including the covid pandemic, but they were actually working on these digital products well before the pandemic began.

The International Monetary Fund (IMF) has been talking about developing a global cryptocurrency system tied to their Special Drawing Rights basket for years. Numerous globalist institutions have been pursuing the technology and it’s nothing new. What IS new, though, is banks openly admitting to the plan.

The BIS, one of the most clandestine globalist organizations that still has a public face, has even admitted that it is developing CBDC tech. And what this tells me is that we are very close to a sea-change in our economic environment. Generally, criminals will not reveal their criminality unless they think it’s too late for anyone to do anything about it. With stagflation hitting our economy hard this year we have to question if the behaviour of the banks suggests much worse conditions to come?

The public would never readily accept CBDCs as money unless their existing money lost most of its buying power and the current system was in the gutter. This is how new levels of empire are born; a major crisis allows for the elites to consolidate control while the people are distracted by their own private disasters. The big picture is changed while each person is terrified by their own small picture calamity.

In the US, markets and mainstream economists are just praying that the Fed capitulates on interest rate hikes, because they think this would save stocks from collapse. However, even if the Fed did this there would still be the problem if inflation/stagflation.

If they don’t back off of rate hikes (I predict they will not capitulate or reverse course anytime soon) then there will be recession on top of price inflation. There’s no way that the current speed of rate hikes is going to slow down inflation from tens of trillions of fiat dollars flowing through the global economy. As I’ve warned for a long time now, the Fed has created a Catch-22 scenario in which the economy crashes no matter which policy decision they make.

But what if this was all by design?

With the introduction of CBDCs in the wake of a stagflationary crash, the central banks could call for a new global network of currencies to “stop such a crisis from ever happening again.” The BIS and the IMF will be ready and waiting with the SDR basket [with gold holdings a major component], or something very similar. The bankers will remove all physical money over a short period of time and a global digital system will take over. All privacy in trade will be gone, except for those people involved in barter, black markets and commodities.”

As we concluded last week, the Fed will know this is coming and will do all in its power to prevent it by again pivoting to weaken its dollar and ease the pain. The yield curve agrees and is as inverted as it’s been since 2000. The market is calling a big reversal from the Fed but not before some short term pain…

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply