The whole world is repricing risk (and gold, too)

Bullion.Directory precious metals analysis 14 May, 2024

Bullion.Directory precious metals analysis 14 May, 2024

By Peter Reagan

Financial Market Strategist at Birch Gold Group

Others will say that it isn’t right to call a week of $2,360-$2,400 gold “lackluster” in any way. And they’re probably right. Still, we went a whole week without a single “wow” moment.

So we’re looking at “wow” moments elsewhere. It might be that the debate has shifted to the Federal Reserve’s lack of influence.

It appears completely dominated by inflation. We’ve gone from expecting rate cuts by now to some arguing that we won’t see any for the rest of the year.

And that is still not the bear-end of the take. No, going there means acknowledging the points bestselling author Larry McDonald made in a recent interview with Kitco. It’s a long interview, but worth watching! Check it out, or keep reading for my highlights:

More than just being bound to higher interest rates, McDonald says a gradual move up and away from the 2% inflation target marks a kind of re-imagining of the global financial system.

Already prone to liquidity squeezes, the economy will now face an army of investors wanting to spend as minimal amount of a time in cash as possible.

McDonald does believe the hiking will have an effect, but not necessarily the kind that U.S. dollar holders might be hoping for.

He raises the same point we’ve come across over and over: Inflation is the preferred method of paying off unmanageable debt. It might be the only method, and now that the debt figure has climbed to $35 trillion, solutions are what’s desired.

McDonald says that the U.S. will be direct in its approach and simply maintain an interest rate that is higher than the inflation rate. This will require a formal move away from the 2% inflation target, something that McDonald doesn’t expect the Fed to waste time holding out on.

Biden’s head economic cheerleader Paul Krugman is already laying the groundwork for a revision of the Fed’s 2% inflation target:

After all, 2 percent is a rather arbitrary number (blame New Zealand!). Is it worth risking a recession to squeeze out those last few decimal points?

All of this obviously leaves gold in a good place. Yes, the Fed might raise the official inflation target to 4%. That alone could be the best thing that has happened to gold for decades. It’s a total concession that the U.S. dollar and the global financial system running on dollars is structurally flawed – the foundations are crumbling as we watch.

We’ve been keen to repeat that gold almost always does well in hiking cycles:

2015-2018: Nine rate hikes, gold rose 17%

2004-2006: 17 rate hikes, gold rose 49.6%

Gold price today is increasingly unaffected by U.S. interest rates – which isn’t surprising, considering the whole world seems to be preparing for a post-dollar financial system. Which means that you may never be able to buy more gold with your dollars than you can right now…

Britain sold its gold two decades ago, and it was costly

Britain liquidating its gold reserves is one of those things in the gold market people don’t like to talk about. An awkward moment, like Roosevelt “exchanging” all of our gold for dollar notes. But it happened, and the losses sustained as a result are probably larger than even gold bugs have been expecting.

According to a recent report, a “sell-then-vs-now” comparison leaves Britain £21 billion ($26 billion) short as opposed to deciding to hold onto its bullion.

It was a decision made by Chancellor Gordon Brown, who wanted to diversify Britain’s portfolio towards something more fashionable.

Though it was apparently the BoE’s idea, not everyone was on board. Bim Afolami, economic secretary to the Treasury, said of the sale:

Twenty-five years on, the British people are still paying the price for Gordon Brown’s poor mismanagement of our economy.

But while $26 billion is a very lofty sum to miss out on, the loss of a gold reserve itself is turning to be the real issue!.

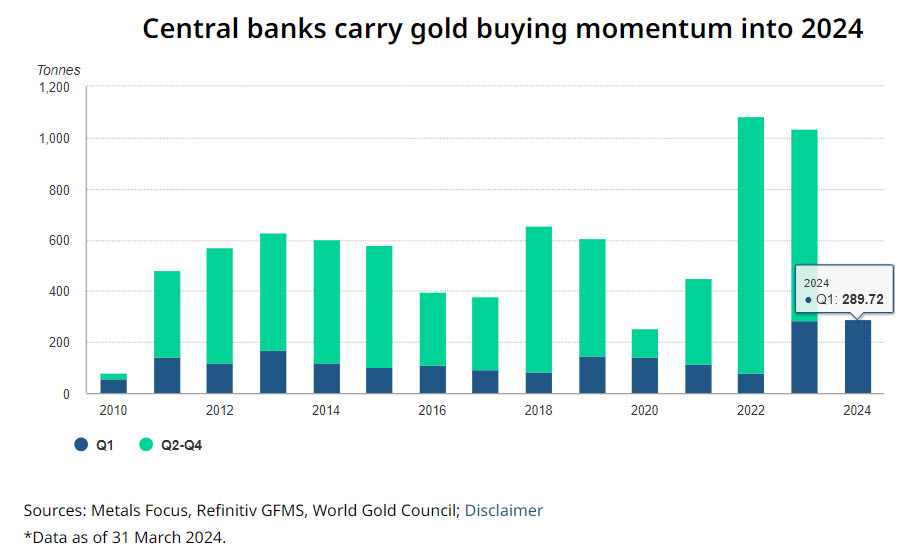

The last two decades have seen a dramatic shift in central banks’ approach to gold. An economist with a very modern outlook in 2006 or 2007 might have believed that gold is being eliminated from the financial system. Central banks were net sellers.

But their approach changed in 2010, with selling becoming rare and reserved for cases of emergency. Stories like these, which are found often enough, remind us that gold has returned to its role as a factor of sovereign wealth. We wonder if it ever left.

After two consecutive record-setting years of central bank gold buying, we just saw a new record for greatest first-quarter gold purchases in history:

Russia and Turkey are two countries that parted with some of their gold stockpile in the last few years, and in both cases it was out of dire need. So a story that a nation parted with its gold stockpile in 1999, which wasn’t that long ago, for no particular reason becomes stranger and stranger.

Apparently, it was a liquidation and Britain needed the money. We’re sure it still does, based on debt and deficit figures that have ballooned in Britain as elsewhere. What was raided when the gold was gone?

So it’s quite something to see that a $26 billion loss story isn’t primarily a lesson on not being hasty to sell. Rather, it’s a strange example of a country willingly parting with its sizeable gold hoard for reasons besides application of force. Seeing a country do the same today is almost unimaginable, which tells us how far gold has moved in some 20 years.

Zimbabwe’s “gold-backed” currency and why we should watch from the sidelines

Currency markets are never short on intrigue these days. That’s not such a good thing for the holders of currencies, generally speaking. In this case, it shows that issuers have given up on creating a stable currency and have turned to this or that for a solution.

Whereas El Salvador accepted Bitcoin as their sovereign, Zimbabwe turned to gold, kind of. We probably won’t hear it mentioned often enough that the ZiG is Zimbabwe’s fourth currency attempt, with the previous one failing miserably. It was named Zimdollar, and its decline hasn’t correlated with the greenback’s strength on international markets.

Knowing all of this going in, we see how gold might end up taking the blame should the ZiG project fail in any way. Detractors will say that this serves as proof that gold can’t work as the basis of a monetary system in modern society.

Yet the outcome of Zimbabwe’s experiment is mostly independent of gold’s performance as an asset, stable as it might be. Zimbabwe will rely entirely, as before, on officials enforcing the new policies without any concessions.

Because of this relative independence from gold, we can get on to observing it freely, and we’re in for a ride once we do that. Zimbabwe has gone all in on the ZiG, a gold-backed currency that avoids immediate pitfalls by using the greenback as a price-setting proxy.

Setting the currency’s value as fixed in gold priced in U.S. dollars gives it two layers of stability, meaning this project will be harder to manipulate with bribes and the like. The government seems to understand the importance of keeping the peg, issuing fines to any business using an exchange rate for ZiG higher than the official one.

The ZiG has been met with mixed reception, which we believe stems from its CBDC status. According to current historical record, nobody has yet had to concede to the drawbacks of digital money in order to enjoy sound money.

That’s more ammo to the fuel of any critic arguing that the ZiG, along with gold, is being set up to fail. Still, we shouldn’t let it detract from what it represents: one of the closest modern-day analogues for a gold standard.

If Zimbabwe’s economy stabilizes, gold will no doubt receive some of the lavished praise. Is it too much to ask for?

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply