Gold reacts to interest rates as a Vampire does to a wooden stake.

Bullion.Directory precious metals analysis 30 September, 2014

Bullion.Directory precious metals analysis 30 September, 2014

By Christopher Lemieux

Senior FX and Commodities Analyst at FX Analytics

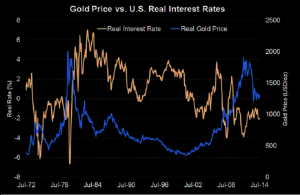

Why does gold react this way? Because gold has to compete against yield bearing assets.

Gold, in general terms, does not pay the investor anything for holding it offering only capital appreciation, meaning there is no protection against capital losses. Money is only made when gold increases in value, while a yielding asset pays interest, which could protect against any downside loss or add to profits.

Theoretically, gold will take a clobbering ahead of a rate increase.

However, the Federal Reserve (and the ECB, BoJ, and BoE) have conducted unorthodox monetary policies, such as ultra-low interest rates – meaning investors have had to seek out alternative ways to seek yield, including high risk credit instruments, junk bonds, real estate investment trusts (REITs) and sub-prime loans.

Bubbles in these areas are apparent, and the risk of contagion are unknown.

It is important for investors to know the relationship between gold and interest rates, but this relationship can change.

For instance, when the Fed increased rates in the early-to-mid-2000s, gold prices increased. Gold prices increased even more after rates rebounded following cratering in 2008.

Gold investors generally take a longer-term outlook and use it as a hedge against the uncertainty of economic downturns or the risk of inflation.

Investing in gold receives a bad rap because when prices decline, those looking for short-term capital appreciation panic and try to unload their bullion. Gold has had an outstanding performance of returns over the years, and not everyone is destined to be a trader.

Small portions of gold have always been prudent within a portfolio because the global economic dynamic change change suddenly, almost overnight in the case of Lehman Bros. and the 2008 financial crisis.

When protection is cheap, like gold (or put options, for instance), losing the opportunity to buy when low will be costly.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply