The massive monetary binge is over. The Fed is taking the punch bowl away.

Bullion.Directory precious metals analysis 15 July, 2022

Bullion.Directory precious metals analysis 15 July, 2022

By Arkadiusz Sieroń, PhD

Lead Economist and Overview Editor at Sunshine Profits

No Longer Doves

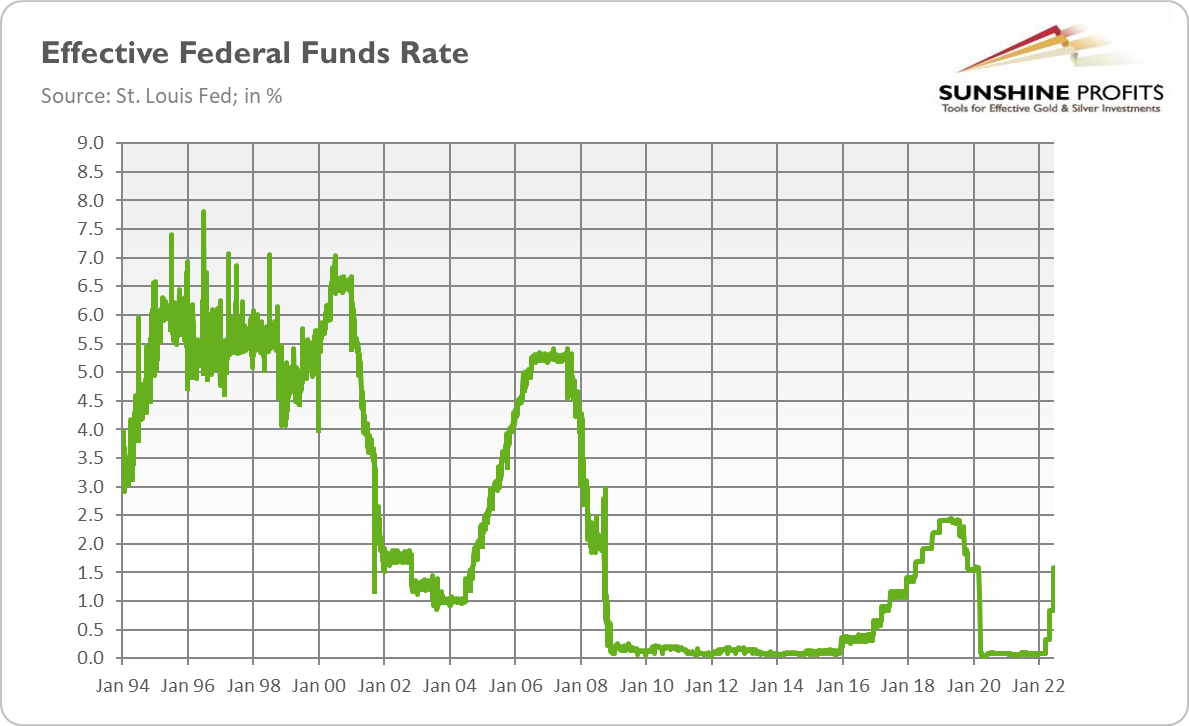

75 basis points! This is how much the FOMC raised interest rates in June. As the chart below shows, it was the biggest hike in the federal funds rate since the 1990s.

Due to this huge move, the target range for the federal funds rate returned to the pre-pandemic level of 1.50-1.75%. Given how dovish and gradual the US central bank normally is, we may conclude that the inflation threat is really serious.

The Fed has been so far behind the inflation curve that it must raise rates at the fastest pace in more than a quarter of a century!

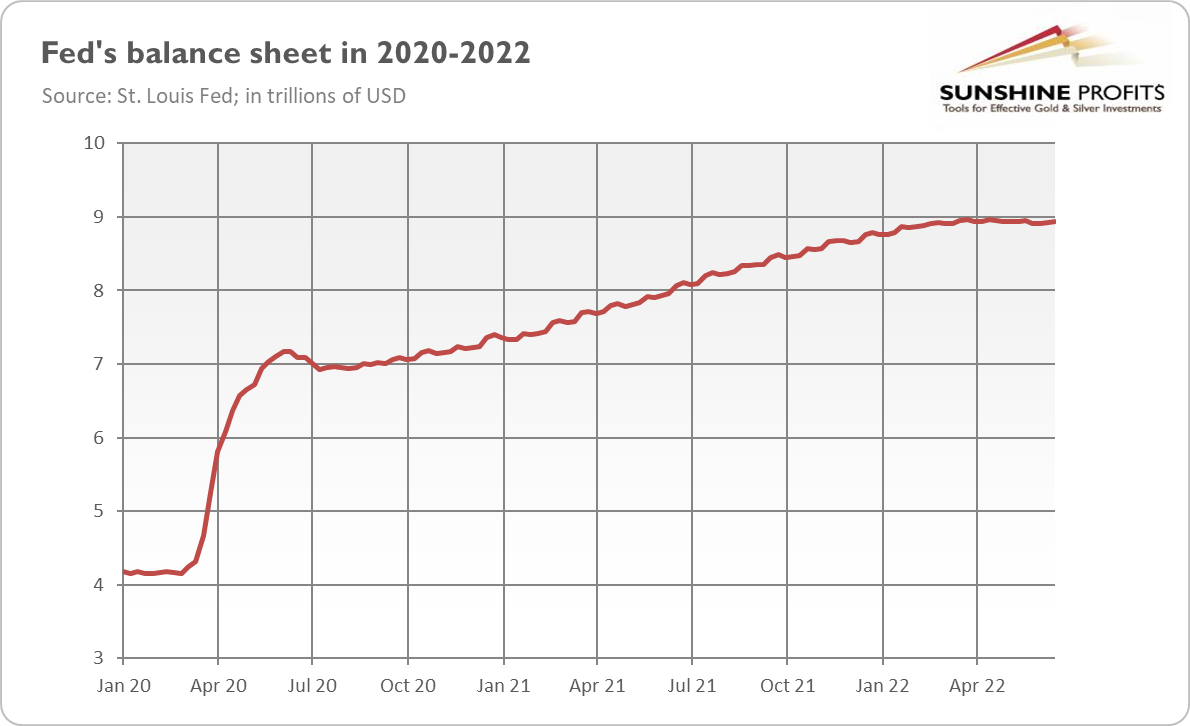

Last month, the US central bank also started reducing the size of its enormous balance sheet. Until September, the Fed will be cutting $45 billion a month from its massive holdings, and it will increase to $95 billion, almost twice as much as it did in the previous episode of quantitative tightening.

As the chart below shows, the value of the Fed’s assets has already peaked, reaching $8.95 trillion in mid-May 2022.

What does it all mean for the US economy? Well, let’s start with the observation that although the Fed is tightening its monetary policy, its stance remains accommodative.

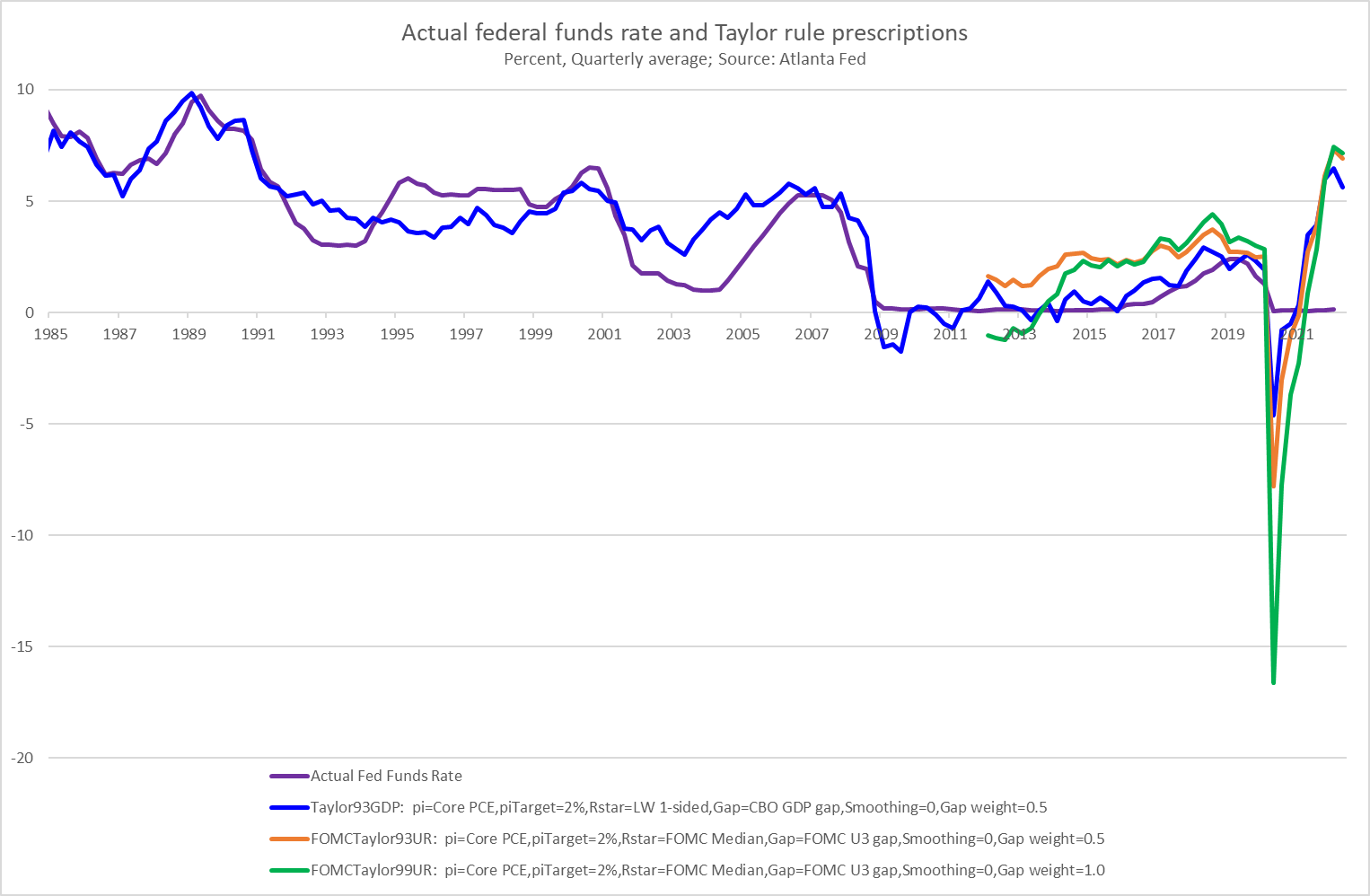

According to the Taylor rule, the federal funds rate shouldn’t be just between 1.50% and 1.75%, but at least above 5% (see the chart below taken from the Atlanta Fed)! At such a level, the Fed will be “neutral”, but to beat inflation it should be restrictive, not merely neutral!

It means that the US central bank remains behind the inflation curve and would have to raise interest rates much further to combat high inflation. However, it raises a very important question: could the Fed raise rates so decisively without triggering the next economic crisis? This is, of course, a rhetorical question.

As a reminder, the previous Fed’s tightening cycle of 2017-2019 led to the repo crisis, forcing the US central bank to reverse its stance and cut interest rates.

Given how fragile the financial system is and how much indebted the American economy is, it’s almost certain that the current monetary policy tightening will lead to a sovereign-debt crisis or another kind of financial crisis.

Right now, the commercial banks seem to be in healthy condition and with ample reserves, so the risk of a liquidity crisis in the very near future is low. However, as the tightening continues, the debt-servicing costs and share of nonperforming loans will increase, worsening the financial situation.

So far, Powell is flexing his muscles, but this is only because the labor market remains strong, but when faced with the choice between fighting inflation and stimulating a crumbling economy, I doubt whether he could withstand the pressure from both Wall Street and the government, which are heavily indebted and addicted to easy money.

Implications for Gold

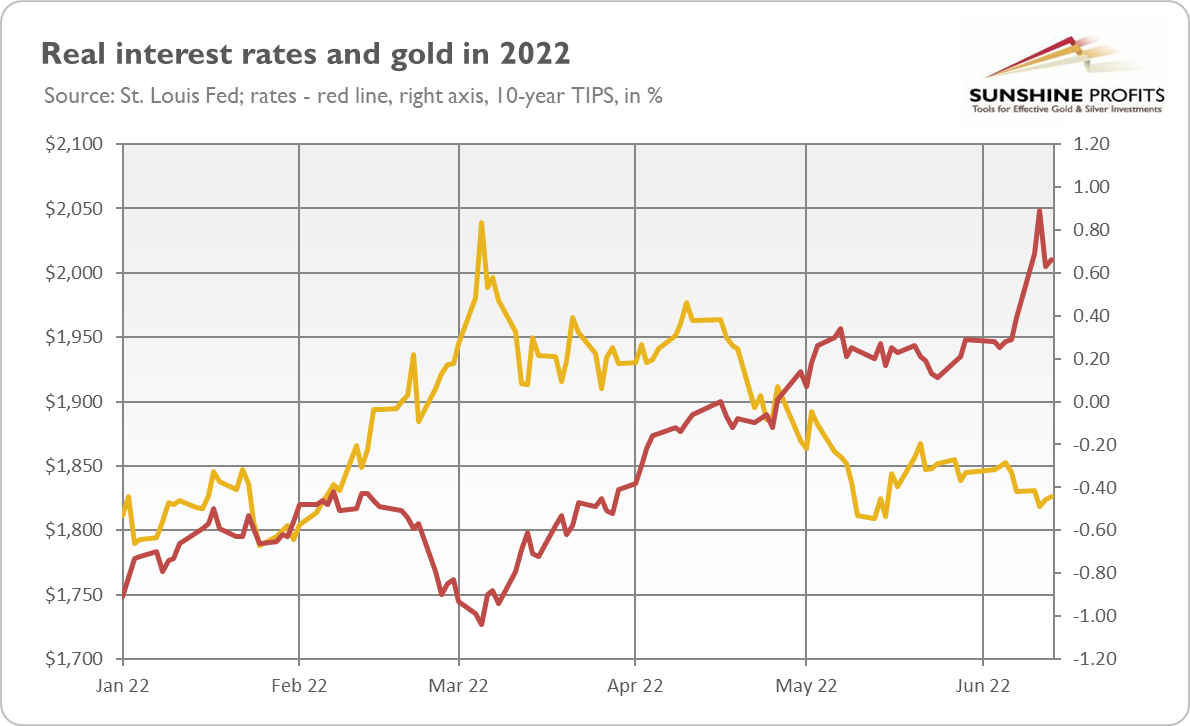

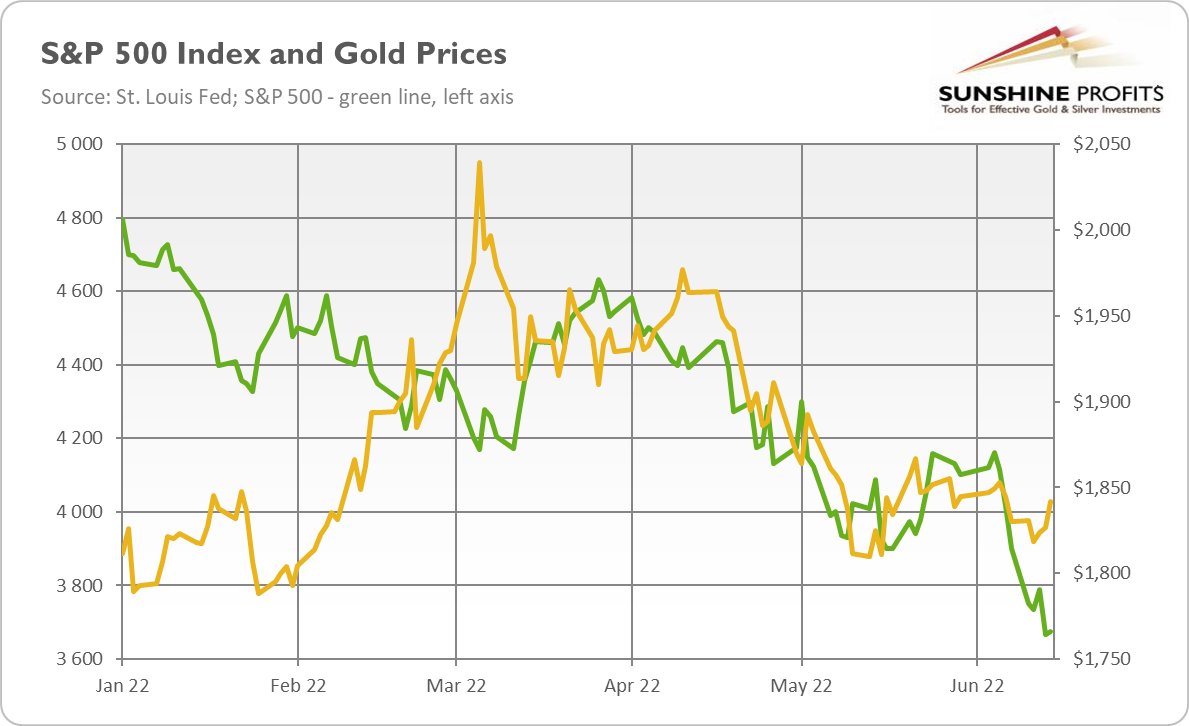

What does it all imply for the gold market? Well, theoretically, monetary policy tightening should be negative for gold prices, as higher real interest rates usually lead to lower gold prices. However, gold has been generally very resilient during the current tightening cycle.

It’s true that it didn’t rally despite the outburst of inflation, but its gave a stellar performance (even when we take July plunge in the account) in the face of rising rates and in comparison to plunging equities or cryptocurrencies, as the charts below show. By the way, it seems that the debate about whether gold or Bitcoin is a better store of value has been settled.

Powell still believes in a soft landing, but he may be the only one. You see, after a gigantic binge, there is always a hangover. When the host of the great party is taking away the punch bowl, drunken guests loudly express their dissatisfaction, which can even translate into brawling.

Similarly, after a massive increase in the money supply, there is high inflation that you cannot just wait out, lying in bed and eating broth. You have to hike interest rates, but then borrowing costs are increasing, which hits many excessively indebted companies and investors, and the economic boom translates into a bust.

Busts are awful, but not for gold.

The yellow metal rallied during both the Great Recession and the coronavirus crisis (and also during the repo crisis), and I believe that this time won’t be different.

We just have to wait until deteriorating economic conditions force the Fed to deviate from its planned course.

Initially, when the next crisis hits, there might be a panic sell-off in the precious metals market in order to raise liquidity, but after this short period, gold should rally, shining brightly as a truly safe haven.

Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply