The markets are relatively calm today, but don’t let that fool you. They are about to MOVE. There are multiple clues as for the way in which the markets are likely to move next, and I’m going to discuss three of them in today’s free analysis. One of them is about the USD Index, the other is about bitcoin, and…

Full Article →Przemyslaw Radomski

Przemyslaw K. Radomski, CFA, has over twenty years of expertise in precious metals. Treating self-growth and conscious capitalism as core principles, he is the founder of GoldPriceForecast.com

As a CFA charterholder, he shares the highest standards for professional excellence and ethics for the ultimate benefit of society and believes that the greatest potential is currently in the precious metals sector. For that reason it is his main point of interest to help you make the most of that potential.

Gold, Silver, USDX: The Key April Analogies and Key Factors

“Nearly half of the fund managers surveyed (49%) see long gold, or bets that gold prices will rise, as the most crowded trade in the market right now. This marks the first time in two years that fund managers did not see the Magnificent Seven as Wall Street’s most crowded trade, according to the survey.”

Full Article →Gold Topped – But Did Silver?

Given today’s decline in gold, it appears that we took profits pretty much right at the top on Friday – at least in the case of gold – but… Was that the final short-term top? To clarify, we had gone long on Jan. 2, and I then moved the profit-take level for gold higher – to $2,733 on Jan. 3.

Full Article →What a Week in Gold! Wait, It’s Just Tuesday…

Gold plunged by almost $80 yesterday… And it doesn’t look like the decline is going to end (!) anytime soon. Sure, there will be corrections, but the bearish train appears to have finally left the station, as I’ve been expecting it too previously. Gold broke below its rising support line, which is a strong sign that the trend has changed.

Full Article →Gold Price Forecast for October 2024

Gold price likely reached its upside target, and the top is in. Yes, you read that right. And yes – this creates a bearish forecast of gold prices for October 2024. On a short-term basis, gold invalidated the move above its rising support/resistance line, which serves as a bearish confirmation.

Full Article →Tech Stocks, Return to “Normalcy” and Gold Stocks

The precious metals market moved slightly higher yesterday. But the move up was too small to change anything, especially in the case of the GDXJ and FCX. The moves higher have indeed been tiny in those two – they were barely noticeable.

Full Article →Gold’s Quick Reversal and Copper’s Major Indications

Copper is definitely the most important industrial metal out there. In the entire commodity sector, only crude oil is more widely used. This doesn’t mean that the only way in which its price can move is up (far from it), but it does indicate that this market is likely linked to multiple other markets – also to gold price.

Full Article →Perfect Combination for Dollar, Perfect Signal for Gold

It’s rare when a target is reached so perfectly as it’s the case in the USDX right now. In yesterday’s analysis, I provided a lot of contexts for the current prices moves. Today, I’ll focus on the short-term price moves and I’ll start with the market where we saw the clearest, immediate-term indication: the USD Index

Full Article →Gold Tops and Silver is… Being Silver

The USD/YEN breakout is a fact and one that’s being confirmed. Gold now forms lower intraday highs. What’s next? No surprise here – gold, silver, and miners appear to have topped, so the next move is likely to be to the downside, just as I explained it in my previous analyses.

Full Article →Gold Forecast: Surfing Extreme Sentiment Waves in Gold

Gold is rallying regardless of what’s happening in other markets. And while there are signs of a top, gold appears to simply not care about them at the moment. In particular, the gold price keeps on forming daily reversal candlesticks, which “should” be tops, but they likely aren’t.

Full Article →Gold AND USD Both Break Higher – What Gives?

Gold’s moving higher and… the USD Index is moving higher as well, which one is faking it? In the recent past I commented on gold’s performance as being similar to what we saw in 2011. Today’s move higher makes the similarity less clear, but still intact.

Full Article →Bitcoin Invalidated Its Breakout – Is Gold Next?

Gold price held up well yesterday. But will it be able to handle the USD Index’s breakout? The yellow metal moved back to the Dec. 2023 high and bounced from it, and today, it just did the same thing. Yesterday’s price action looked quite promising, as the verification of the breakout would indeed be a bullish thing.

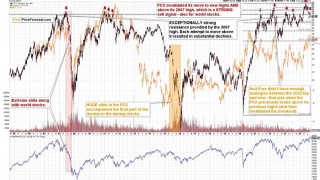

Full Article →Quarter Later: History Rhymes for Gold Stocks

Gold and gold miners moved higher yesterday, turned a few heads, and now they’re back down. What’s next? Yesterday might have seemed like a big deal, but… If you read my weekend Alert, you knew that seeing a double-top here was one of the possibilities that would NOT change the outlook. After all that’s how gold topped in 2011.

Full Article →Gold Price Forecast for March 2024

Forecasting gold prices is not easy, but right now it seems that we have quite many factors aligned. The market buys on rumors and sells on facts – even if they are positive. But if the facts are negative… Then the market sells substantially, and the price declines significantly. For now, the market continues to exaggerate its reaction…

Full Article →Gold & Stocks Might Be Doing Something Critical Here

Miners declined as expected, but today’s action is so far in gold and stocks. Both will impact miners. Let’s start with gold. From the daily point of view, we just saw another move toward the 61.8% Fibonacci retracement based on the recent decline. This level was not touched, let alone broken. Today’s intraday high wasn’t above the Friday’s intraday high.

Full Article →Stocks Try Again, But Gold Price Doesn’t

Nvidia surprised positively and it soared in overnight trading as well as in the early market trading. And while it managed to take stocks higher, it didn’t take gold higher. The S&P 500 index futures are up, and they moved close to their previous highs without breaking them. In other words, it’s “here we go again” on the stock market.

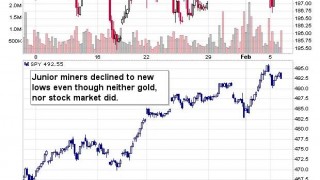

Full Article →Junior Miners Just Broke New Lows – Will Gold Follow?

What a beautiful and profitable breakdown in junior miners! And that’s not all! This part of the bigger decline is just starting, so junior miners still have some room to fall. Gold, silver, and the S&P 500 futures are calm in today’s pre-market trading, but don’t let that fool you – the market is about to slide once again.

Full Article →Gold Price Forecast for February 2024

Forecasting gold prices is not difficult if you focus on the right things. The key is knowing what. Many people are interested in commodity prices, but few know in order to predict the prices of gold, it’s great to actually analyze mining stock values. But you knew, and were not caught by gold’s fake intraday and overnight rallies in the previous days.

Full Article →Soaring Gold Price, Soaring Expectations

Gold price futures jumped higher today – was the current gold price forecast affected? In short, not really. As I explained previously, it’s much better to focus on how the market is likely to interpret whatever is coming its way, and we know this thanks to technical chart analysis.

Full Article →A Pause is a Pause, Nothing Else

Why did the miners’ decline pause? Might this be a bottom? In short, it might, but it’s highly unlikely that this is indeed a bottom. Yesterday’s pause is natural given the support that miners are encountering and given the situation in the USD Index. Let’s start with the latter…

Full Article →Rallies? Nope. These Are Breakdown Verifications

Some rallies – being breathers within declines – are not bullish. And that’s what we see in gold and silver today. Before moving to the precious metals sector, let’s take a look at the currency markets as what’s happening there is one of the key building blocks for the situation in the gold, silver and miners.

Full Article →Gold Price Bottom or Just a Breather?

Every time gold moves back up, the same question emerges – was that THE bottom? The key thing for gold is the massive weekly reversal that formed over two weeks ago, and we saw another weekly reversal last week. The implications are very bearish for the weeks to come…

Full Article →Important Analogy for the Markets – Including Gold

Some say that war never changes, and in some aspects, that’s true. But markets’ reactions to war are also remarkably similar. What I’m going to start today’s analysis with is not something you’ll read in many places. Usually, analysts are either following just the technicals or just the fundamental aspects of a given market. But the true edge comes from…

Full Article →What Happens to Gold Price When it Finally Rebounds?

After testing new highs, gold is likely to move far, up or down. Previously, I wrote that the price of gold was about to decline after its massive reversal and that’s exactly what happened. The decline is now likely to continue, but there’s a good chance that we’ll see at least a small rebound from $2,000 or slightly higher levels.

Full Article →Gold Price at New Highs? Sellers Say NO.

The huge rally in gold and the monstrous decline that followed provided a sign of epic proportions. Gold price’s huge-volume reversal is the last thing that anyone even remotely interested in the precious metals market should ignore. The Gold price was just soaring to new highs like there was no tomorrow, and then it happened.

Full Article →Don’t Buy at the Top. Analyze.

The USD Index is soaring today, so let’s start today’s free analysis with this market. You can probably already tell that it’s likely that today’s (0.6+) rally is the start of something bigger and not just a one-day event. Let’s check why – starting with my previous comments on this market as they remain up-to-date…

Full Article →Stocks and Silver Have Something to Say about Gold

Silver just shot up, and given what the stock market is doing, it makes perfect sense. Namely, it’s most likely the final part of the rally in them both, and the same is the case for gold and mining stocks. Starting with the stock market, it’s still the case that the shares are following their early-2022 path.

Full Article →A Precious Gift from Precious Metals Sector

What a powerful bearish confirmation! Not only did our profits increase yesterday, but we got this precious gift, too! What gift, you ask? The powerful bearish confirmation, of course! Did you see the… Rally in gold? The yellow precious metals moved higher by $12.50 yesterday. It happened on low volume, indicating that it was just a breather, but still…

Full Article →Przemyslaw Radomski

Przemyslaw K. Radomski, CFA, has over twenty years of expertise in precious metals. Treating self-growth and conscious capitalism as core principles, he is the founder of GoldPriceForecast.com

As a CFA charterholder, he shares the highest standards for professional excellence and ethics for the ultimate benefit of society and believes that the greatest potential is currently in the precious metals sector. For that reason it is his main point of interest to help you make the most of that potential.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.