Corey Keller needs little by way of introduction…

Bullion.Directory precious metals news 02 September, 2020

Bullion.Directory precious metals news 02 September, 2020

By Spencer Campbell

Founder / CEO at SE Asia Consulting

Many of us in the precious metals industry know him personally, everyone else either knows of him or have heard the legends…

Many of us in the precious metals industry know him personally, everyone else either knows of him or have heard the legends…

I’ve been lucky enough to have worked with Corey Keller on a number of projects and can honestly count him as a good friend! I’d be remiss not to use my in to open up a conversation with Mr. Corey Keller like never before, I mean how many of you know he had his own bullion line called Keller Gold Bullion (KGB)?

1. We usually kick off with so tell us about your company but since you are the Keller in Keller Consulting why not tell us about your background in the precious metals space?

I represent several customers and companies but NDA’s do not afford me the opportunity to advertise this. Nor should I.

I bring value to them through experience and analysis and they decide to adjust or not adjust and they reap rewards or do not.

I bring value to them through experience and analysis and they decide to adjust or not adjust and they reap rewards or do not.

If they adjust and see a reward then they call me for the next project. I have 30+ years in precious metals refining and I turned 50 this year. I still have all my hair and most of my clients.

I have built, re-designed or fixed refineries on 5 continents…Australia has their own experts (the Daily Mail has them on retainer) and Antarctica doesn’t have one. I am not an engineer, nor an MBA holder.

My education is journalism and communications. It has served me well and I prefer the commercial side of operations over the operations itself.

BUT, the first rule of running or representing a gold refinery is to lose no Gold! So, if you are not versed in the operations, you better get up to speed quickly or the snow will fall in Summer before you ever see a Winter. Truth told, I know enough to know when some is snowing me and I have been around long enough to hire the right people for the job. I can buy the right equipment, write the procedure, pull a wrench but the real added value is the team of experts that work with me that make it happen.

2. What are you working on currently that’s keeping you busy during Covid?

A lot of design & build for smaller facilities now that they can see the uptick in physical off-take and couldn’t pause their day-to-day responsibilities to consider expansion.

I love those folks and try to do my best work for them even though I prefer the commercial side of the business.

I love those folks and try to do my best work for them even though I prefer the commercial side of the business.

Also, tin foil hat folks that think they are going to buy gold mines in Africa and Peru and be the next Billionaire. They send me projects occasionally and it’s fun to advise them to buy gold directly from a respected dealer.

A gold miner once told me in a bar at the Alaska Bush Company bar in Fairbanks that the best way to become a Millionaire is to take 5 Million dollars and go mining.

3. From your experience in building precious metals refineries where is the best place right now to start building a gold refinery?

I like a few places. Macro-speak would be SE Asia, India and any alphabet island near South & Central America.

I like a few places. Macro-speak would be SE Asia, India and any alphabet island near South & Central America.

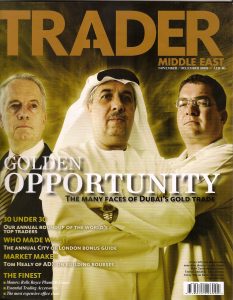

I really can’t speak more about that due to current projects. I will add that Dubai, though saturated with capacity, is a great place for refiners.

Turkey and HK too… but for a new build I don’t like the longer term instability of government.

4. You have set up precious metals refineries in the UAE, how was that experience for you?

Dubai was much more easy than Abu Dhabi, I have done both.

The DMCC and the licensing out of other Emirates for traders is straight forward and streamlined. I want to send a shout to Mahesh at Creative Zone and John and Walid when they were at G4Si for helping me out.

The DMCC and the licensing out of other Emirates for traders is straight forward and streamlined. I want to send a shout to Mahesh at Creative Zone and John and Walid when they were at G4Si for helping me out.

We were turning over 950 Kilos of gold and 5,000 Kilos over silver a day 7 days per week and without recruiting the advice and services of key vendors I would have been in a world of hurt.

There were several other government agencies that made your life in gold easy or more difficult (Dubai = Easier / Abu Dhabi = Difficult).

This was mostly regional pressures and certainly not corruption. I am sincere about that.

No single person associated with the agencies I had to deal with ever asked for a bribe, favour or kickback.

I would love to return one day but the market is finally balancing themselves and have well run operations. I usually only get a phone call when something has gone terribly wrong. The UAE is liquid, fair, balanced and more than adequate for any small, medium or large private miner. I raised my kids there and one still remains in a different industry and he is doing well, so I have a lot of love for the UAE.

5. Are you seeing any developments in the industry that you think are worth discussing?

Absolutely! But like most people in this industry, we are demonized by old school traditions, institutions and general intimidation so I will take a pass on that question.

I will say, GATA has it right and that the future of physical DOES NOT live in New York or London, I guess my job interview with JP Morgan will now be canceled.

6. What sort of refinery projects do you enjoy working on and why?

There are four types of gold refinery projects:-

- A) Fraud – They are laundering money and have been or will be eliminated from all lists and banks by continuing to send suspicious gold to third party refiners.

- B) Government – Local government has a need or want to monitor export and/or secure local produced bullion to their vault or Central Bank

- C) Vanity – A rich person wants to build a gold refinery to discuss with his friends at dinner parties and to tour the curious buddies through the halls of the building

- D) Necessity – A real need to meet capacity in a certain region or nation and to build value into the product refined. Not necessarily to be LBMA Good Delivery but to harness the resource that is regional, provide value to the miner and add value by providing a product that can be used in their Central Bank or citizens as a store of value or to provide a wholesale or commercial product that can be accepted by regional exchanges to the benefit of miners, traders, regional partners and the refinery owner

To be clear. I DO NOT do “A.)” but I have no issues with B-D. You just need to identify the client as one of these types and inform the client what return they can expect from their investment.

7. We have seen over the years a number of regulatory bodies spring up that govern and give guidance to the precious metals industry, what’s your take on how Dubai is treated by the industry?

The UAE and Turkey are treated poorly, unfairly and in a very disrespectful way.

It makes me wonder, even when I sat on the steering committee of the DMCC Good Delivery Committee in Dubai, if the establishment was scared of what we were doing or nervous about how well we did it.

Dubai and SE Asia has liquidity, physical and banking that is all decoupled from London and New York. Who needs whom more?

8. Where can people contact you online?

As to not be kidnapped or run over by a Brinks truck randomly on my way to a conference I am available on LinkedIn at Corey Keller in Niagara Fall, Ontario, Canada or Providence, Rhode Island, USA.

I split my time between them. I don’t do fancy websites as they typically get ripped off by folks that pretend to be me like the last time I was in Uganda and met myself at the bar and had a large Argentinean man hand me a version of my own business card.

I can also be reached on Gmail at kellergoldconsulting@gmail.com

kellergoldconsulting@gmail.com Sketchy, I know…but so is meeting yourself in a bar in Uganda.

Now available by popular demand on Twitter as Keller Gold https://twitter.com/keller_gold

This article was originally published hereBullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

I enjoyed your article

Someone should contract this guy. What a career!

Great article!