Those saving for retirement need to consider the Fed’s latest shenanigans as part of their planning.

Bullion.Directory precious metals analysis 02 September, 2020

Bullion.Directory precious metals analysis 02 September, 2020

By Peter Reagan

Financial Market Strategist at Birch Gold Group

A piece at Forbes summarizes one of the potential dangers that this new change in policy could bring:

While it’s a new initiative for how the Fed views inflation, it isn’t new to how the Fed has operated through the crisis. But the decision to systemize the policy will have a far-reaching impact, as Fed decisions determine the price of borrowing, the cost of stock ownership and your savings rate.

The 4.1% increase in food inflation in July might be enough to draw the attention of retirees, but consumer prices aren’t what we’re focusing on here.

Instead, the Forbes piece suggests that, in order to increase the earning potential of your savings during a shift in policy like this, you would need to invest in riskier paper like stocks:

The increase in the stock portfolio is an effort to make up for the poor performing bond portfolio. But, by doing so, you’re needing to take on more risk, which could result in larger swings within the portfolio.

But this idea isn’t quite complete and leaves something out…

Are You Sure “You’re Needing to Take On More Risk”?

So long as risk doesn’t spiral out of control and you manage your exposure accordingly, you could do well by adding some stocks to your savings.

But it would also be smart to consider ways to protect savings, and hedge against the uncertainty that stocks can bring.

That’s where considering physical assets like gold and silver is important for both protecting your savings and hedging against the “larger swings” from stocks that the Forbes article alludes to.

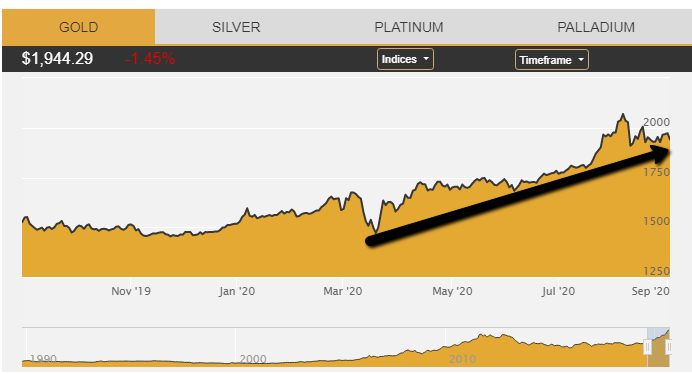

As you can see in the charts below, both of these precious metals are doing well as stores of value.

First, gold has been steadily increasing in value since March 2020:

Then there’s silver, which is on a similar trajectory:

Both precious metals are known to help diversify against other assets and can even boost the value of your savings.

And right now, some Americans are hoarding gold for just this reason, according to MSN: “Anxiety about inflation is once again in the air, particularly among individual investors.”

Bottom Line: Focus on Stabilizing Your Portfolio

Think of retirement savings like a football team: Making money is your offense and protecting your savings is your defense. You need both to make sure your retirement is successful.

Despite the potential for much higher price inflation (no matter how high it actually goes), gold and silver are looking good as potential hedges against the future of “Inflation Nation.”

So examine your savings, and see if it’s a good time to take advantage of the opportunity to diversify some of it into precious metals.

This article was originally published hereBullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply