Gold: The Counterparty Risk Free Investment

As bullion dealers, we are asked on a daily basis whether we think the fiat dollar price of gold and silver are going to go up or down. However, for many, if not most, bullion investors, the most important aspect of precious metals is that there is no “counterparty risk”.

Full Article →R.I.P. David H. Smith, Precious Metals Philosopher

I am saddened to report today that my friend… our friend… David Smith lost his battle with cancer last weekend. David was a phenomenal yet humble man. He was a teacher, a student, and a philosopher. I have rarely a met a more optimistic, thoughtful, and wise person.

Full Article →Proof that Precious Metals Are the Best Hedges

Now, this is counterintuitive if we think of gold exclusively as a safe haven investment. But it’s not. Gold is also historically one of the most desirable symbols of luxury and wealth. It’s like Wharton finance and economics professor Urban Jermann described in his new model of gold pricing…

Full Article →US Mid Terms & How They Affect You

Whilst there is a lot of focus on cost of living pressures, maybe a more important barometer to watch is that of the US. We are now less than 2 months away from the US mid term elections and both history and the so called “Misery Index” point to the Republicans taking control

Full Article →Bad News For Economy, Good News For Gold

A bad run for gold and silver markets this summer is dimming hopes for the metals being able to finish out the year with some good gains. Major economic indicators have also been trending down this summer. However last week brought some disappointing jobs data.

Full Article →“No Gas For You!” Putin’s Grand Plan For Europe

Gold rallied Friday night as news broke of Russia reneging on opening the critical NordStream gas pipeline to Europe (due to a ‘leak’) and in so doing, locking in even higher gas prices and more inflation as Europe heads into winter. This appears all to be part of Putin’s grand plan…

Full Article →Student-Loan Forgiveness: Inflation Reduction Act Revelations

If you’re a struggling college graduate burdened with mountains of student debt, it seems your load is now a bit lighter. Except student-loan forgiveness could cost more than a half-trillion dollars with the initiative expected to swell the deficit far beyond the new inflation law’s deficit-reduction benefit

Full Article →Powell Promises Pain, Biden Makes It Worse

Powell’s policies will bring pain to American families, one way or another. Now the Fed is openly rooting for stock and housing markets to crash – because that’s how they’ll know their rate hikes are finally deflating the “Everything Bubble.”

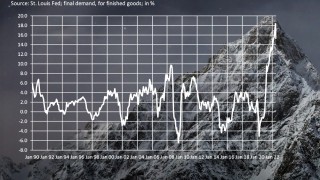

Full Article →After July Slowdown Has Inflation Finally Peaked?

Inflation moderated a bit in July, fueling hopes that it has peaked. Are they justified? Yes and no, but before I elaborate on this enigmatic answer, let’s see what happened in July. On a monthly basis, the CPI was unchanged then, after rising 1.3 percent in June

Full Article →Large Commercial Traders Positioned for Higher Metals Prices

Physical bars continue to drain from COMEX and London warehouses. Larger investors who hold deliverable bars aren’t throwing in the towel and dumping them back into the market. Instead, they continue to stack, much like retail investors buying the smaller coins, rounds and bars.

Full Article →Moscow World Standard (MWS) Challenges LBMA

Russia and a number of former USSR nations are setting up a competing precious metals exchange, initially dubbed the Moscow World Standard (MWS) as Russia has become increasingly insistent that the London Bullion Market Association (LBMA) has been manipulating spot prices down artificially.

Full Article →Gold Falls as Powell Appears Hawkish in Jackson Hole

Importantly, Powell downplayed July’s deceleration in inflation, saying that “a single month’s improvement falls far short of what the Committee will need to see before we are confident that inflation is moving down”.

Full Article →Fed Admits It CAN’T Tame Inflation

Federal Reserve chairman Jerome Powell is talking tough and warning of more interest rate pain to come. At the same time, Fed officials are now admitting that their sized-up rate hikes won’t even be sufficient to tame the price inflation they have helped create.

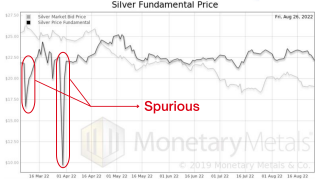

Full Article →The price of silver hit a peak over $26.50 on March 8. It spent about a month and a half breaking down, and then the bottom fell out. It’s currently down from that peak almost 8 bucks. However, the opposite has been happening to silver’s scarcity…

Full Article →During my career, I’ve watched three speculative financial bubbles inflate, and two of them pop (the dot-com bubble, the 2007-08 housing bobble and today’s Everything Bubble). These bouts of “irrational exuberance,” to use Robert Shiller’s trenchant description, are remarkably similar.

Full Article →Fed Chair Powell’s Jackson Hole speech ended up being as hawkish (tighter monetary policy) as you could imagine. For a market that was simply gagging for even the remotest bit of dovish note, it was nowhere to be found and EVERYTHING barring the USD fell hard

Full Article →Who Will Forgive the Government’s Debt?

So much for “inflation reduction.” Just a few days after signing Green New Deal legislation, rebranded as the Inflation Reduction Act, President Joe Biden has moved to completely undo its core promise by pumping hundreds of billions of dollars into another new bailout package.

Full Article →IRS Targets the Middle Class

Video Report: What Exactly is the Huge IRS Funding Increase Being Used For? According to Whistleblower, Inflation Reduction Act’s IRS Funding Will Be Used to “Shake Down” Middle-Class

Full Article →Steep Decline in PMI Didn’t Move Gold Higher

The latest S&P Global Flash US Composite PMI doesn’t bode well for the U.S. economy. The headline Flash US PMI Composite Output Index declined from 47.7 in July to 45 in August, as the chart below shows. It was the second successive monthly decrease in total business activity.

Full Article →The latest Fed meeting may have hinted towards an easier monetary policy, whether that means a tempering or altogether cessation of interest rate hikes. While Fed officials did reiterate the dangers of high inflation, they also mentioned not wanting to slump the economy with excessive tightening.

Full Article →Is JPMorgan Joining Up with Gold Bugs?

People fighting for liberty, limited government, and honest money may have an unlikely ally according to Tom Luongo of the Gold, Goats N Guns blog. He recognizes a split in the monolithic powers running the world. Commercial banks may not be on board with the effort to establish a socialist world government.

Full Article →Gold Barely Reacts to July FOMC Minutes

Although gold barely reacted to the July FOMC minutes, the Fed worries about an economic slowdown. That bodes well for the long-term outlook for gold. First, Fed officials continue to worry about inflation, believing it will remain elevated for some time…

Full Article →We are not living in the first society to move from a gold standard to a fiat standard, but extending this to a completely digital fiat standard is most likely the furthest that people’s concept of ‘money’ has ever been from precious metals…

Full Article →“The Most Overrated Silver Coin in the World”

Even as silver prices have begun to rally off their lows for the year, the white metal remains one of the best bargains in the investment universe. Few other assets are as cheap on a historical basis as silver is today. Just don’t talk about Silver Eagles…

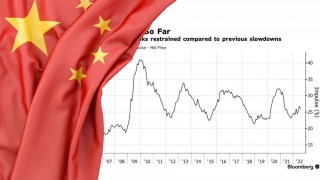

Full Article →Whilst it looks next to certain that the US and Europe are in or about to be in a recession, opinion seems divided over whether Australia will follow suit. Much of that relies on the health of our biggest trading partner, China.

Full Article →Are We in a Recession or Not?

Does the Answer Even Matter? Debate over whether the U.S. is in a recession rages on. GDP numbers say we are. Others disagree. But for earnest retirement savers, no declaration is needed.

Full Article →Gold as an answer to present day trouble – it’s the only asset to claim geopolitical neutrality, and it’s not just Russia’s official sector that’s hoarding gold.

Full Article →Weaponized IRS = Off-Grid Investing Boom

The Orwellian-named Inflation Reduction Act passed both houses of Congress and is now on its way to the White House. The politicians responsible for multi-trillion-dollar federal deficits and an out of control Fed planning to “reduce” inflation by spending another $700 billion they don’t have…

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.