US shares rallied again Friday night largely it seems off the back of a slightly softer PPI (Producer Price Index – i.e. inflation at the ‘factory door’). The market desperately looking for confirmation bias around an imminent Fed pivot got what they were looking for

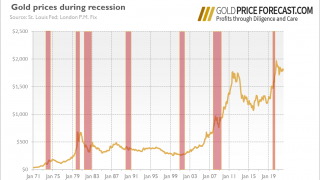

Full Article →Does Gold Know a Recession Is Coming?

Recession has already occurred or is on its way.. Somebody should tell gold about it! Is a recession really coming? We already know that the yield curve inverted last month for the second time this year, but what are other indicators of looming economic troubles?

Full Article →Overall global solar panel production has been growing over the last 10 years while the actual amount of silver in each panel is set to increase. A number of major technological changes on the horizon are set to kick industrial silver demand into overdrive

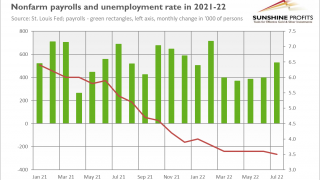

Full Article →Strong Jobs Shift Upper Hand from Gold to Fed

Strong Job Creation Shifts the Upper Hand from Gold to the Fed. The US economy generated almost 530,000 jobs in July. That’s good for monetary hawks but bad for gold bulls.

Full Article →In the wake of gold briefly passing the strong $1,800 resistance level, Equinox Partners’ Sean Fieler spoke about gold’s role in the coming financial crisis saying a sovereign debt crisis could catch some off-guard: ‘the kindling is set, and you just need one little spark to ignite the fire.’

Full Article →Gold has a unique appearance. It is also astonishingly heavy—much heavier than it has any right to be. Everyone should hold one in his hand (and own a few). But that’s not why many gold analysts today are saying you should buy gold.

Full Article →The federal criminal trial of JP Morgan executives Michael Nowak, Gregg Smith, and Jeffrey Ruffo began on July 8th. These senior bankers are accused of running a years-long scheme to manipulate precious metals prices through what is known as “spoofing.”

Full Article →US markets were shocked Friday when the NFP employment figures we discussed on Friday came in at literally more than double the expected headline print with 528,000 new jobs added in July and the unemployment rate dropping to 3.5% from 3.6% and wages rising to 5.2%.

Full Article →Gasoline prices have been dropping. As they do, some are suggesting the worst of inflation is behind us. Could June’s 9.1% headline inflation rate represent peak inflation? There’s been no shortage of concerning economic data for many months. And now we just learned the country is now in a “technical” recession.

Full Article →The Yield Curve Inverts. Time for Gold to Turn Back

Ever wondered what the yield curve’s favorite song is? Neither have I, but I bet in July it was Britney Spears’ hit, Oops, I Did It Again, as the yield curve inverted again last month, for the second time in 2022. It means that long-term rates fell below those on shorter-dated bonds.

Full Article →Recession Good For Gold – Crisis Even Better

Ladies and gentlemen, please welcome the technical recession! According to the initial measure of the Bureau of Economic Analysis, real GDP dropped 0.9% in the second quarter, following a 1.6% decline in the first quarter

Full Article →Zimbabwe has begun issuing 1oz (22-carat) gold coins as legal tender to be cashed in, used for trade, transactions, and as a security for loans. 1,500 coins were released on 25 July), and there are a further 2,000 in the pipeline.

Full Article →If you had to pick 3 things that drive the gold price many would say inflation hedge, safe haven in economic turmoil, and war. As we sit here today, 3 August 2022, the headlines are screaming all 3.

Full Article →Stanford Economics professor says that the Fed will neither stop raising interest rates nor limit rate hikes to just one or two more. Instead, he thinks the Fed needs to jack up interest rates to 9%, possibly higher, to truly deal with inflation.

Full Article →‘Wishful Thinking’ Fed Anything But ‘Neutral’

With last week’s second 75 basis-point rate hike, the Federal Reserve now claims it has achieved a “neutral” monetary policy stance. That would mean, in theory, that interest rates are neither stimulating nor restraining the economy.

Full Article →The World Gold Council’s quarterly Demand Trends report for Q2 2022 have just been released and as usual we summarise for you. Overall despite Q2 weakness, strong first quarter ETF inflows fuelled a notable H1 recovery.

Full Article →It’s Official: Unemployment Claims Are on the Rise. We keep hearing the job market is proof of our economy’s strength, but labor force participation is at a near-50-year low and unemployment claims are actually on the rise.

Full Article →Gold The Dovish Light In Fed’s Hawkish Night

Support for aggressive tightening has strengthened within the FOMC. Indeed, the current tightening cycle is much steeper than the two previous ones, in which the Fed usually raised interest rates in 25-basis point moves, as the chart below shows.

Full Article →Gold investors shouldn’t look forward to a reversal in the Federal Reserve’s tightening policies because a flip-flopping Fed would create the kinds of economic instability that not even the biggest gold investors would appreciate.

Full Article →In what feels very much like a ‘here we go again’ moment, the market was looking for any cue that the Fed will soon pause or pivot signalling a return to easy money. And so, whilst raising rates a whopping 75bps, the first sentence of the statement delivered…

Full Article →Good news, says a sizable chorus of observers: Peak inflation finally has arrived. We can count President Biden among those who are singing that tune. But does a moderation in fuel prices signal that peak inflation has been realized?

Full Article →Recession is Coming: Gold Will Come Out Stronger

An economic hurricane is coming. Brace yourselves! This is at least what Jamie Dimon suggested last month. To be precise, he said: “Right now, it’s kind of sunny. Everyone thinks the Fed can handle this. That hurricane is right out there down the road, coming our way.

Full Article →S&P Global Market Intelligence just released both their Euro and US PMI’s and at the time that both central banks are tightening monetary policy, both of two of the worlds largest economies are showing clear signs of heading into a recession.

Full Article →The dollar rose this week, from 17.87mg gold to 18.24mg (that’s “gold fell from $1,740 to $1,705” in DollarSpeak), a gain of 2.1%. In silver terms, it rose from 1.61g to 1.67g (in DollarSpeak, “silver dropped from $19.24 to $18.64), or 3.7%.

Full Article →We’re hearing an increasing number of warnings that a stagflationary event could not only materialize, but persist for an entire decade. I don’t want to believe it. Even so, it’s starting to look like a certainty. The latest 9.1% inflation reading hit the financial markets hard.

Full Article →The Bank for International Settlements (BIS), also known as the “central bank of central banks,” recently released a survey which states that at least 81 central banks around the world have been accelerating plans to release their own cryptocurrencies.

Full Article →When Fed Takes Punch Bowl Away, Stick to Gold

The hangover is coming. The best cure is – except for the broth – gold. 75 basis points! This is how much the FOMC raised interest rates in June. As the chart below shows, it was the biggest hike in the federal funds rate since the 1990s.

Full Article →Given that not a single banker went to jail in the aftermath of the GFC, any actual time behind bars for the JP Morgan trio of Michael Nowak, Gregg Smith and Jeffrey Ruffo would send a powerful message to major commercials with heavy paper shorts on the COMEX.

Full Article →