The US economy fell into a technical recession. As a safe-haven asset, will gold soar now?

Bullion.Directory precious metals analysis 04 August, 2022

Bullion.Directory precious metals analysis 04 August, 2022

By Arkadiusz Sieroń, PhD

Lead Economist and Overview Editor at Sunshine Profits

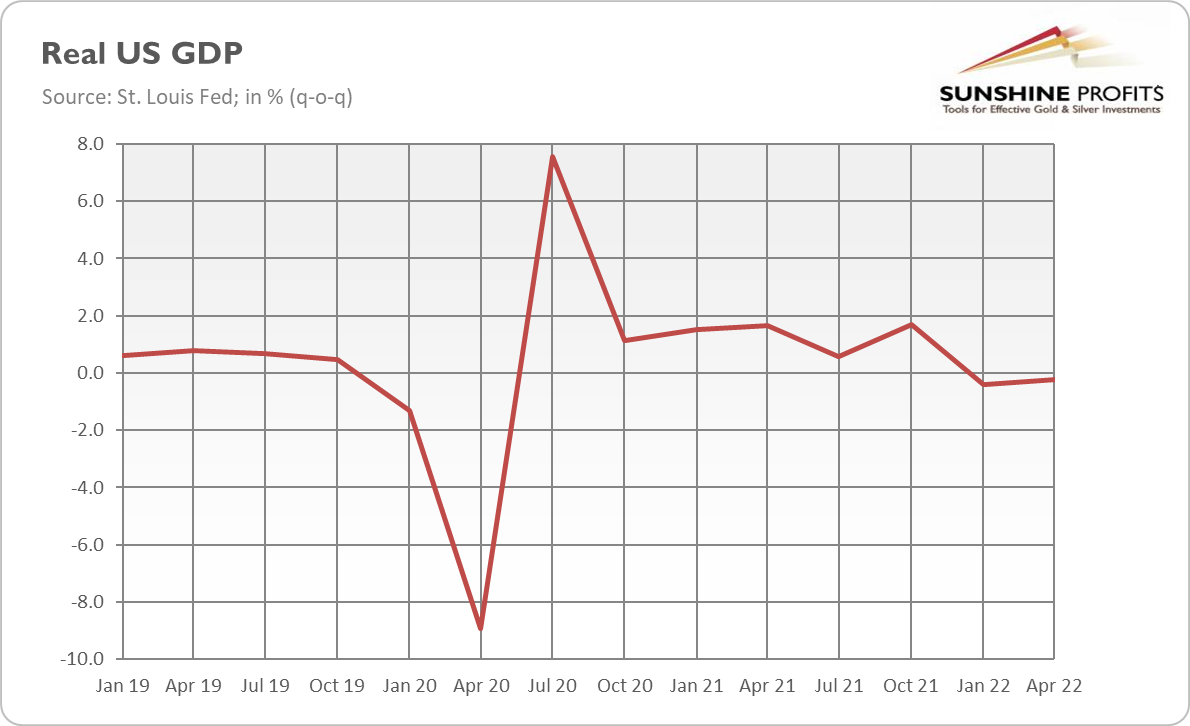

As the chart below shows, on a quarter-on-quarter basis, real GDP decreased by 0.4 and 0.2 percent, respectively. Thus, the US economy recorded two quarters of negative growth, which implies a technical recession.

However, are we really in a recession? The Fed and the White House deny that. For example, President Biden said last week: “We’re not going to be in a recession, in my view.” Similarly, Treasury Secretary Janet Yellen said that the US economy is not in a recession, instead it’s “in a period of transition in which growth is slowing”. Yeah, sure! But what else could the officials say?

There is a grain of truth in their statements. After all, with a very low unemployment rate and several economic indicators still relatively strong, the picture isn’t very gloomy. However, unemployment is a lagging indicator, so I wouldn’t seek comfort in the labor market. As well, I wouldn’t trust the officials this time, as they are the same guys who were claiming that high inflation would be only transitory.

What Is Recession, Anyway?

Sure, a true recession is defined by the NBER, which determines when the US economy is in such a state as “a significant decline in economic activity that is spread across the economy and lasts more than a few months.” In this light, we are not yet in a total recession, as the scale of the decrease has been too small – so far.

However, this can change when the impact of high inflation and the Fed’s interest rate hikes is fully transmitted into the economy. The monetary policy operates with a lag, so the worst is yet to come.

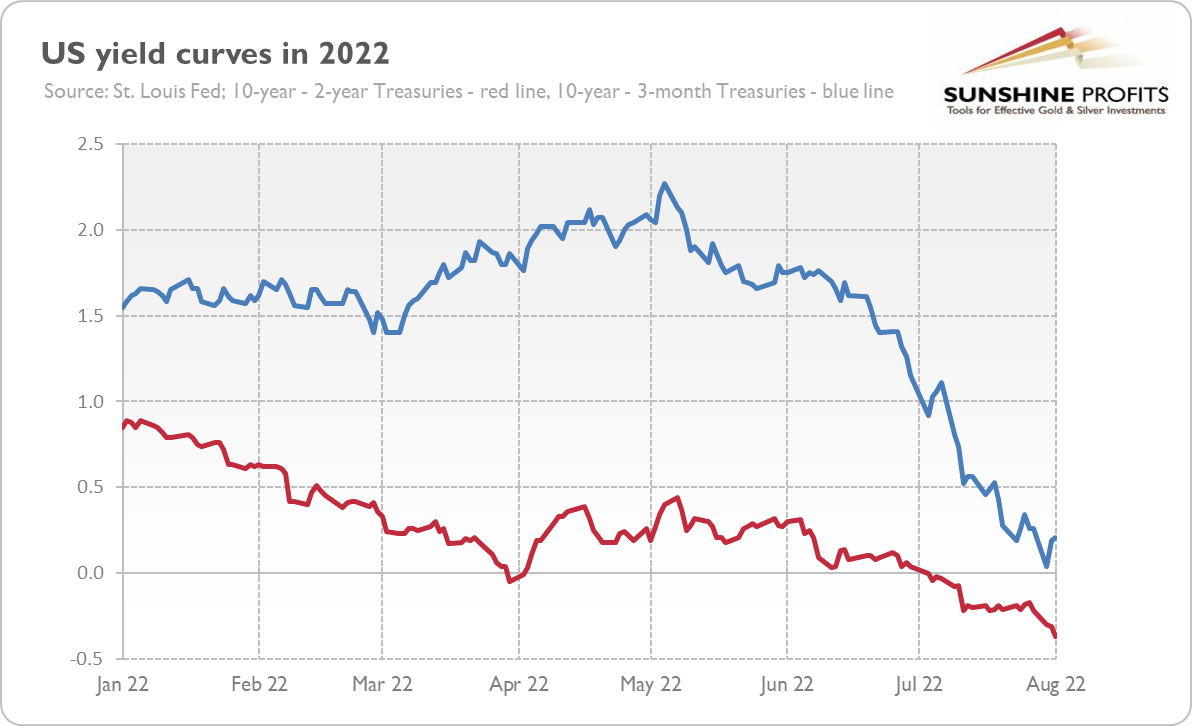

This is also what is suggested by the yield curve. The spread between 10-year and 2-year Treasury bonds (red line) has already fallen deeply into negative territory, while the spread between 10-year and 3-month Treasuries (blue line) will probably do it soon, as the chart below shows.

However, who actually cares – except the politicians – about the labels? The economy may be in a recession or not, but one thing is clear: the state of the economy is not good and it’s getting weaker. Just look at the Atlanta Fed’s projection of GDP in the third quarter. According to the GDPNow model estimate from August 1, the real GDP growth (seasonally adjusted annual rate) in the Q3 of 2022 will be 1.3%, down from the 2.1% projected on July 29. It doesn’t bode well, does it?

The same scenario was in late 2007, when economic data was already looking bad, but the pundits disagreed with statements that the US was headed into a recession. People always try to deny their problems – until they become undeniable some time later.

Implications for Gold

What does it all mean for the gold market? Well, gold – as a safe-haven asset – usually thrives during recessions. In recent weeks, the yellow metal rebounded from about $1,700 to about $1,760, as the chart below shows.

One reason for this upward move was a more dovish FOMC meeting than expected. Another driver could be renewed tensions between China and Taiwan, but gold could also start to smell recession.

To be clear, it’s too early to declare a new bull market in gold. Gold needs a full-blooded recession or an economic crisis that would trigger a lot of fear and force the Fed to ease its monetary stance.

Please be prepared that gold could decline substantially before it starts its new rally.

In my view, the last FOMC meeting reduced the odds of a large decline, but the sell-off at the beginning of a crisis phase is still very likely, as it was in 2008 and in 2020.

Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply