$2,100: The most remarkable all-time high for gold in the last decade

Bullion.Directory precious metals analysis 04 December, 2023

Bullion.Directory precious metals analysis 04 December, 2023

By Peter Reagan

Financial Market Strategist at Birch Gold Group

Instead, Sunday evening, gold smashed through its old records to set a new all-time high of $2,148.99 within the first half-hour of trading.

That was a stunning development and media outlets worldwide are struggling to keep up.

For example, days-old Western media still reports gold’s former all-time high, set back in 2020 (which was 3.5% lower than the new figure). Gold opened at $2,110 in domestic markets. Now we’re watching its price settle in at a newer, higher level.

We feel comfortable dubbing this the most impressive and remarkable all-time high in the last decade. It’s going to be very tempting to say that it’s because gold gained $150 in a week and seemingly ignored the notion of resistance points on its way up. But that’s not why we’re so impressed by these gains.

Rather, it’s that there has been no black swan event or even a significant news item to propel them.

Some say that gold is supposedly gaining due to rate cut hints, but that’s actually not the case. Just the opposite: others have pointed out that gold is surging amid hawkishness from the Federal Reserve, which is true. The latest comments by Fed Chair Jerome Powell suggest that the Fed is open to more rate hikes soon.

So not only is gold not surging on any “good news”, it’s doing so in what should be a pretty unsupportive environment. This kind of price action can only happen with outstanding fundamentals, and it signals what should be obvious to everyone: that gold is pent-up and waiting to break out.

Gains for gold during periods of peace and relative stability are the most telling. They aren’t panic-driven, but rather represent real demand based on perceived risk. So when gold gains $150 in a slow news week, everyone should pay attention.

This is also the second time this year that gold has done so, the first instance being the climb from $1,650 to $1,800 and then $1,900. Then, as now, nobody could agree on why gold is going up. Interestingly, while the $1,900 level had plenty of calls for a correction. That remains to be seen.

We recently quoted a bullish, if moderate forecast which said gold would end 2024 above $2,100. Is gold going to end 2023 above $2,100, and if it does, what could possibly happen next year when the hiking cycle truly starts to ease? For a market that isn’t necessarily known for thrills, gold might have the most of them now out of any asset.

Let me just add this warning, as I find myself doing so often these days…

Intra-day price movements can be very exciting. They can also be rather dispiriting. Generally speaking, though, it’s a mistake to focus on changes in today’s gold price. The long-term trend is clear – daily, monthly or even yearly price fluctuations aren’t much more than noise.

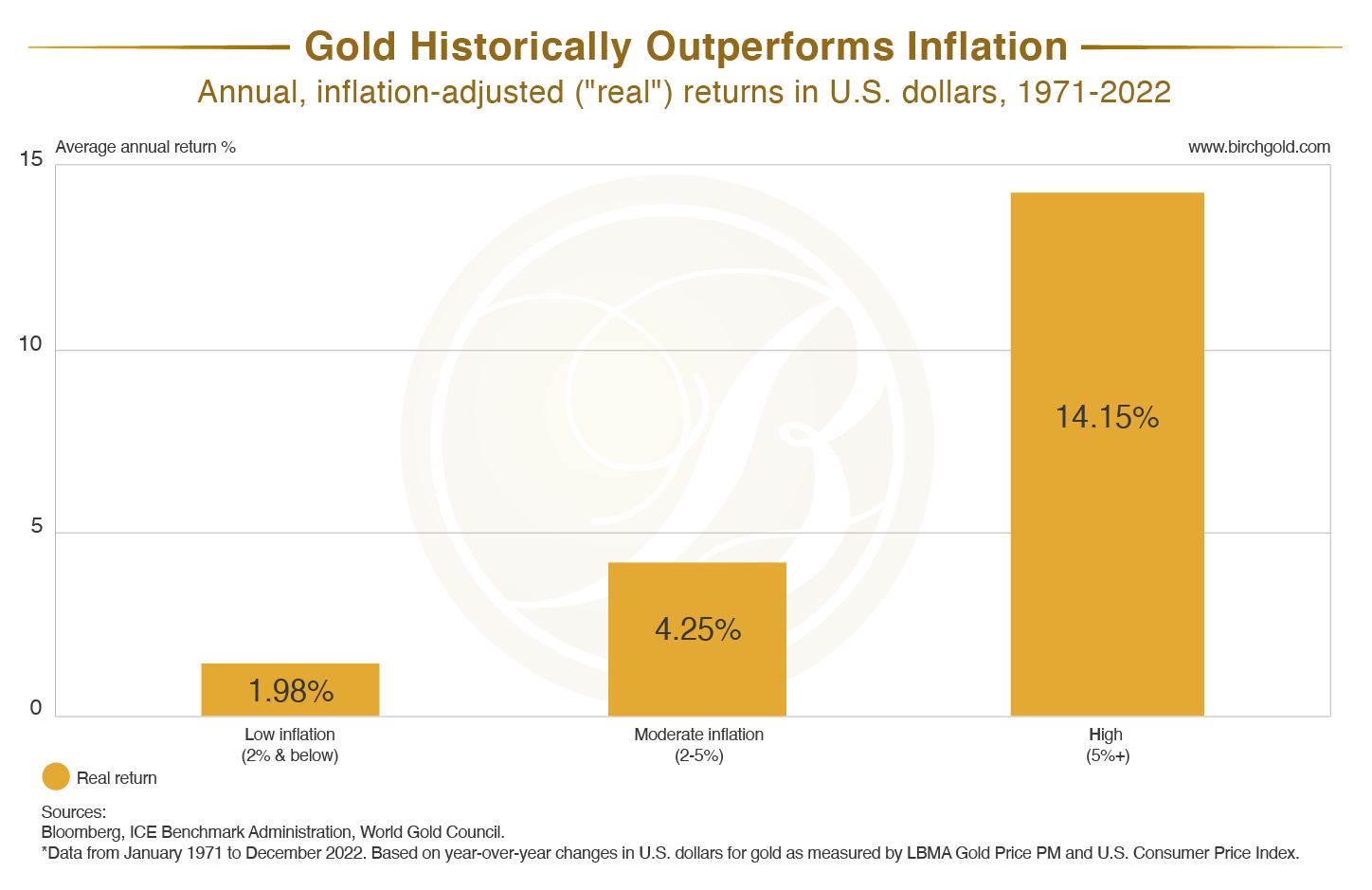

This chart is far more important than any price chart:

Let’s not forget it.

The federal government’s debt solutions are almost unbelievably bad

We’re glad to have someone attempt to answer the question of how exactly governments plan to deal with debt. With just our national debt approaching $34 trillion, it’s very much a question that’s hanging in the air.

But because we all know that there is no solution, and that modern money is a one-way street down, it’s almost become a subject few dare touch.

Taxes, despite having impoverished a large part of the world populace, aren’t cutting it.

Debts are uniformly rising, as are their interest payments. The Heritage Foundation described a couple options, which boiled down to just two: Hyperinflation or a “debt jubilee.”

You probably know all about the first. The government prints new money to pay off old debt – and newly-printed money is worth less than the debt, so it’s sort of a win? Unless you happen to live in the hyperinflationary nation (ask Argentina). After all, one of the reasons we have inflation to begin with is so the government has an easier time servicing its debt. Now, that’s not the official line but it’s true nonetheless.

Hyperinflation, in addition to eliminating debt, destroys first the purchasing power of the nation’s currency, then the nation’s economy. It’s the sort of thing any government can do once – then the pitchforks and torches come out.

The same is true of a debt jubilee. This is an ancient idea, dating back at least 4,000 years. Even the book of Leviticus says:

Consecrate the fiftieth year and proclaim liberty throughout the land to all its inhabitants. It shall be a jubilee for you; each of you is to return to your family property and to your own clan.

A debt jubilee is nothing more than a reset. A do-over. A social “let’s pretend this didn’t happen.” Burn the ledgers and start from scratch – mortgages annulled, student loans forgiven and credit card balances reset to zero.

You could think of it as an act of philanthropy, or an illegal autocratic cancellation of millions of contracts between borrowers and lenders. Sometimes, revolutions lead to a sort of lightweight debt jubilee – like in 2003, when Saddam Hussein’s regime in Iraq was toppled and most of the nation’s foreign debt was forgiven.

Or in 1917, after the Bolshevik coup d’état turned the Russian Empire into the USSR and Chairman Lenin simply repudiated the former government’s debts.

But a debt jubilee in the ancient, Biblical sense? How could this play out in today’s world?

Would the American government decide to default on its debts, or all governments? What about the debts of individual citizens? Corporations? Cities, counties and states? Would lenders have any rights at all, or would they simply be screwed?

A debt jubilee is a fantasy scenario. We only recently discovered that President Biden’s attempt to offer a narrow debt jubilee on student loan debt was unconstitutional.

So why are we even discussing it? Spend five minutes browsing the International Monetary Fund’s Global Debt Database and you’ll see. The world’s debt-to-GDP ratio (it would be debt-to-income if we were talking about an individual) sits at 238% — well above the crisis levels Carmen Reinhart and Kenneth Rogoff established in their masterpiece This Time Is Different: Eight Centuries of Financial Folly.

To call the present situation unsustainable might be the understatement of the century.

It’s no wonder that, in this world where virtually every financial asset is an IOU or a promise to pay, that gold is hitting all-time high prices per ounce. Debt may, in fact, be gold’s primary tailwind. Debt, especially sovereign debt, drives central banks towards inflation, which in turn wipes out the currency – but can’t touch gold’s intrinsic value.

So the greater the debt pile, the stronger the overall bullish case for gold.

A word of warning for those who are eyeing today’s APYs and licking their chops. Ask yourself how exactly am I being repaid for the risk I’m taking? If the answer is, in rapidly-depreciating currency, then perhaps your savings belong in the only uninflatable, unhackable and unprintable financial asset that you can hold in your hand?

Of course, I’m referring to physical gold.

The average American household needs an extra $11,434 annually just to get by

I’ve spent some time recently talking about the difference between GDP and prosperity.

I’m not the only one covering the topic, either…

Take a look at this study done by the U.S. Senate Joint Economic Committee. It found that Americans need an additional $11,434 annually (on average) to maintain the same standard of living as they enjoyed in January 2021. The study doesn’t appear to beat around the bush in regards to this translating to basic necessities.

This data is absolutely staggering, to be sure. How many Americans are earning between $1,000-$2,000 a month or thereabouts in their daily jobs? It doesn’t leave one with a particularly comfortable amount of disposable income. And yet, these people need to double their income to get by.

The Biden administration attacked these findings, apparently turning it into a Democrat versus Republican debate. Does the Federal Reserve have a political affiliation? Because if not, we have to wonder why. These figures are the result of central bank policies. Inflation is attributed to lockdowns, but it’s actually the central bank that printed the stimulus money.

Regardless of the party, the Federal Reserve always maintains its inflationary policies and insists that a 2% inflation rate is good and promotes economic growth. If having inflation is so supportive of economic growth, then why does there appear to be so little money going around, including for the federal government?

In a recent interview, Marc Faber went over many important points regarding economics, governments, markets and more. As he notes, central banks abandoned their purpose of regulating their economies in favor of their citizens as far back as the 1980s. Modern central banks primarily exist to deliver money for the government to spend.

Faber explains that budget deficits are inflationary by nature. The greater the deficit, the more we can expect loose monetary policies. One might argue that the deficit is ballooning up faster than the debt itself, as it leapt from $1 to $2 trillion in a fairly short period of time.

With this in mind, Faber unsurprisingly likes gold, silver, but also platinum as ways to escape inflation, which the famed economist believes will become a permanent fixture in the decades ahead. He also reminds us that physical precious metals allow their owners a degree of independence from damaging monetary policies and other forms of government tyranny.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Analysts might be be surprised, but for those who have been closely watching the trends, it simply reflects the growing concerns over inflation, geopolitical tensions, and market volatility. I’m not alone in thinking this surge in gold might just be the beginning of the new era we’ve been forecasting for so long…