Smoldering Inflation is Flaring Up Once Again

Bullion.Directory precious metals analysis 15 September, 2023

Bullion.Directory precious metals analysis 15 September, 2023

By Peter Reagan

Financial Market Strategist at Birch Gold Group

After a short period of cooling off, inflation is heating up again on multiple fronts. One rather unexpected price surge will make budgeting a challenge for many people for the second half of the year.

We’ll start with the latest official inflation update for August:

Inflation posted its biggest monthly increase this year in August as consumers faced higher prices on energy and a variety of other items.

The consumer price index, which measures costs across a broad array of goods and services, rose a seasonally adjusted 0.6% for the month, and was up 3.7% from a year ago, the U.S. Department of Labor reported Wednesday.

When inflation increases after months of corporate media celebrating the “end of the great inflation,” as you’d expect, there are many attempts to put lipstick on the pig.

Here’s one I found hilarious:

Excluding shelter from CPI would have resulted in an annual increase of only about 1%, according to Lisa Sturtevant, chief economist at Bright MLS.

See – if we were all homeless, the cost of living wouldn’t be so high!

In other words, “If prices didn’t go up so much, inflation would be lower.”

Don’t waste your time looking for insights in statements like that.

Americans must grapple with the reality that housing prices have surged 30% in the last 2 ½ years, and rent payments have risen 25%. Like food (up 20%) or energy (electricity up 21%, gasoline up 72%), shelter is a basic necessity.

To say the cost of living shouldn’t consider basic necessities? That’s truly a desperate attempt to beautify the pig.

Yes, everything costs more (especially necessities)

Let’s take a deeper look at the current food and energy prices too, so we can get the full picture of just how bad this new inflation situation is.

While food inflation “cooled” a little more in August, it’s still the highest it’s been for almost a decade, and is still eating away at the savings of hard-working Americans.

Now it’s officially heating up again, which will increase the bill at the grocery store:

On a monthly basis, food prices went up by 0.2% in August, the same pace as in the previous month.

Energy inflation is also heating up again, and even more rapidly than food prices, thanks mostly to higher prices at the gas pump and fuel oil costs:

On a monthly basis, energy prices jumped 5.6% in August, an increase that included a 10.6% surge in gasoline and a 9.1% rise in fuel oil.

The surge in gasoline prices is likely to continue because Biden has already drained the strategic petroleum reserve (mainly to score political points), and OPEC recently cut production.

But draining the reserve further is no longer an option – although it treated one symptom, it didn’t address the underlying disease.

Inflation is much more than just monthly price increases

Charles Bilello recently posted a snapshot of what inflation has done to prices over the last 3 years:

By the looks of it, some of the price increases have been obliterating some Americans’ paychecks for the last 36 months.

Remember, inflation is cumulative. It’s nonsensical to celebrate a “mere 0.3%” monthly increase in prices – that’s 3.6% per year, nearly double the Fed’s target.

In addition, the real cost of inflation gets much worse once you take a peek behind the curtain and see how it’s impacting real people…

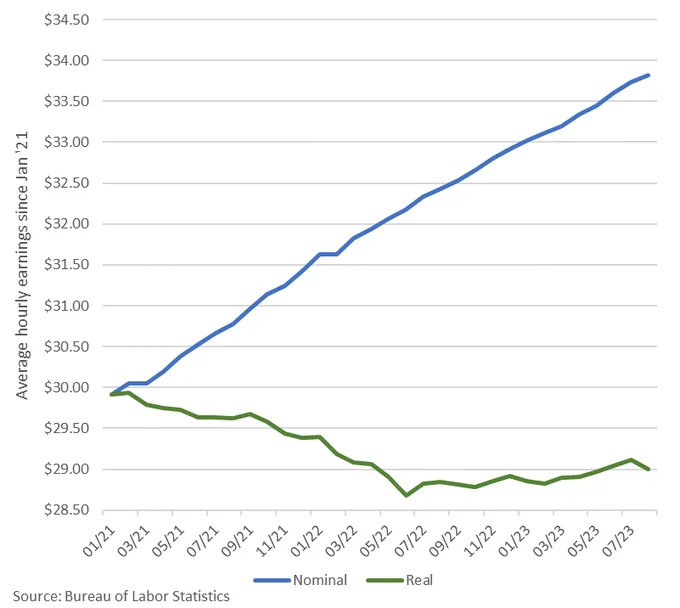

First, wages only grew 14.7% during the same 3-year time frame.

At face value, that increase partly accounts for the massive price increases of everyday living for necessities like shelter, gas, utilities, electricity and food.

That’s what most people think…

In reality, real, inflation-adjusted hourly earnings (green line below) erases all wage growth and a whole lot more:

But let’s not forget, inflation reports have become more political propaganda than economic update.

Over the last 40 years, the Federal Reserve has tweaked and tampered and “fine-tuned” inflation reporting so much it’s almost useless. See John Williams’s critique for more details.

If we rely on actual cost of living measurements, CPI is currently 12.5%.

But that’s way too high… If the government admitted inflation is really that severe, they’d be voted out of office.

Yes, inflation is lower today than its recent peak – and that’s good news, regardless of the measurements you use.

That might not last long, though…

Producer prices signal even higher prices around the corner

If the prices consumers are paying now weren’t bad enough, inflation is also heating up at the producer level (again), accelerating by a seasonally-adjusted 0.7% in August.

That kind of price inflation upstream of consumer prices, the producer price index (PPI) generally signals higher prices down the road.

For example, energy PPI accelerated by a staggering 10.5% in August alone, which is a rate that is ten times more than any month over the last year.

Here is an official summary that hints at what’s to come in the next few months:

Over 70 percent of the August rise in prices for processed goods for intermediate demand can be traced to a 41.1-percent jump in the index for diesel fuel. Prices for gasoline; jet fuel; natural, processed, and imitation cheese; fats and oils; and for particleboard and fiberboard also advanced.

Yes, that’s a strange combination (diesel fuel and imitation cheese?). What it tells us is that manufacturers are facing a “whack a mole” situation from month to month. There’s no confidence in price changes from month to month, which makes business and logistics planning an exercise in finger-crossing and crystal-ball gazing.

We expect heating bills and gasoline prices to skyrocket during fall and winter.

So prepare your budget and savings accordingly, especially if you own a vehicle that runs on diesel.

Overall, we’re seeing numerous red flags warning us that, after two years of historic inflation, this economic agony will continue well into 2024.

Are your savings inflation-resistant?

Like we’ve warned numerous times before, inflation could stick with us for quite a while (6-20 years, with a median of 10 years based on comparable historical episodes). It’s smart to plan for the long-term right now, because the longer you wait, the worse it gets.

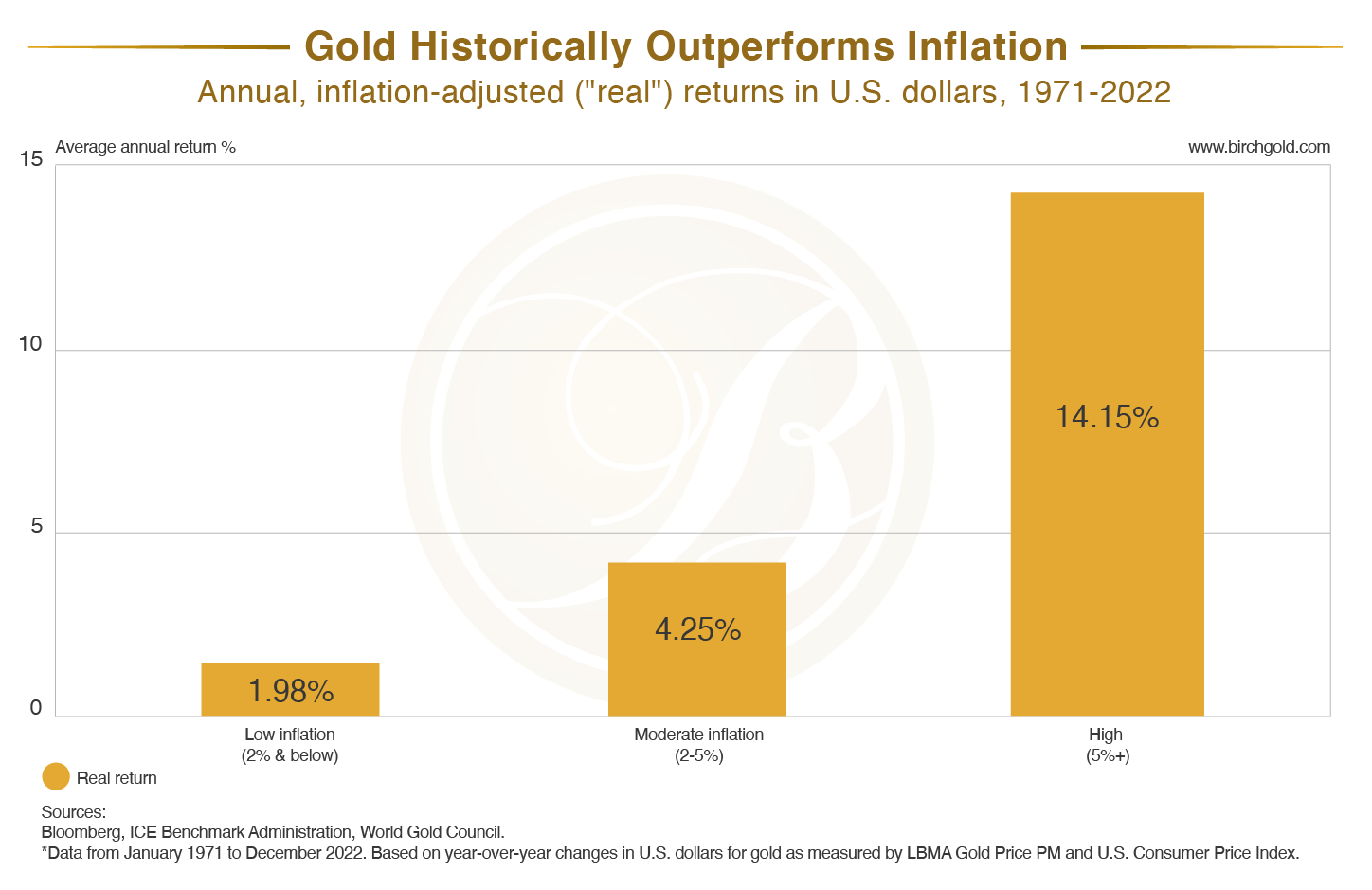

Since its price was unchained in 1971 physical gold has been outperforming inflation:

This is only one reason why you should consider diversifying your savings with physical gold and silver. You can learn more about the benefits of physical precious metals here.

Along with other inflation resistant investments, these precious metals could help preserve your retirement savings, and even grow your wealth.

Thankfully, information about precious metals including gold and silver is available in a convenient free kit. Knowledge is power, so take your financial future into your own hands and educate yourself so you can make an informed decision.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply