How to Calculate the Time Value of Your Retirement Savings

Bullion.Directory precious metals analysis 13 July, 2023

Bullion.Directory precious metals analysis 13 July, 2023

By Peter Reagan

Financial Market Strategist at Birch Gold Group

Each has its advantages, and here’s a general summary of maximizing your savings using a 401(k) plan:

If you have a 401(k), one of the big questions is whether to make pre-tax or Roth contributions — and the answer may be complicated, experts say.

While pre-tax 401(k) contributions reduce your adjusted gross income, you’ll owe levies on growth [also known as “taxes”] upon withdrawal. By comparison, Roth 401(k) deposits won’t provide an upfront tax break, but the money can grow tax-free.

Some 80% of employer retirement plans offered Roth contributions in 2022, compared with 71% in 2018, according to a recent Vanguard report based on roughly 1,700 retirement plans.

We’ve covered this aspect of retirement planning in greater depth. You can learn more about the different types of IRA accounts here. And you can read up on the pre-tax versus post-tax decision here.

Today I want to discuss a different concept to factor into your retirement tax planning. This one’s important, and it can make a world of difference to your financial security…

The time value of money

If you’re a regular reader, you’ve read the following:

It’s virtually impossible to plan for tomorrow’s expenses in today’s dollars.

That aphorism is important because of a well-known economic concept called the time value of money (TVM). In a nutshell:

The time value of money means that a sum of money is worth more now than the same sum of money in the future.

The principle of the time value of money means that it can grow only through investing so a delayed investment is a lost opportunity.

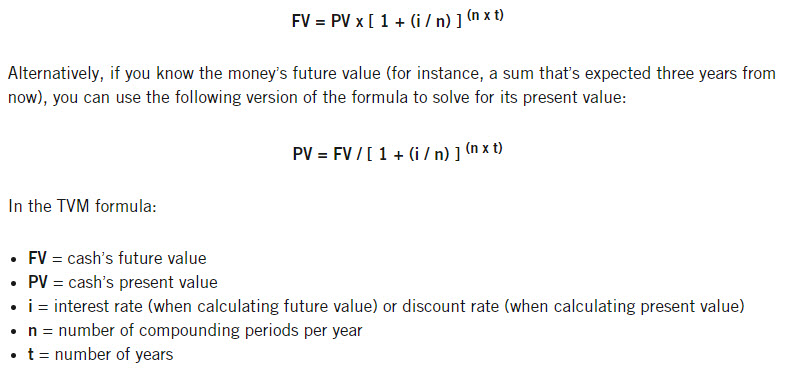

The formula for computing the time value of money considers the amount of money, its future value, the amount it can earn, and the time frame.

It’s a pretty straight-forward concept…

Would you rather have $20 right now, or in three weeks?

This one’s easy: now, obviously.

Okay, but would you rather have $20 right now, or $21 in three weeks?

That’s a harder decision. TVM is a tool we can use, in the words of the Harvard Business School, to, “’translate’ all future cash to its present value.”

This seems like a useful tool, doesn’t it? Two small problems…

First, the formula is less than user-friendly:

Formula for calculating the time value of money, via Harvard Business School

We could work around that if we needed to (Excel is amazing).

Second, our old friend inflation makes this calculation meaningless. As Investopedia reminds us:

Inflation has a negative impact on the time value of money because your purchasing power decreases as prices rise.

So how does inflation affect your decision to contribute pre- or after-tax dollars to your retirement savings?

Inflation and the time value of money

While CPI, or “headline inflation” which includes food and energy prices, finally eased to “just” 3% in June after 24 months of historic year-over-year increases…

The measure of inflation that doesn’t include food and energy prices, called core inflation, is still running near a 38-year high (and has been for the last six months).

This means the “tax no one voted for,” has been robbing Americans of their wealth every month since May 2021, and hasn’t let up yet (and no “disinflation,” either). Ironically, the Fed usually favors reporting “core” inflation rather than CPI, because it’s usually noticeably lower. But right now it isn’t.

In the TVM formula, the variable i indicates the prevailing risk-free interest rate – what you’d get if you deposited your cash in a savings account. In order to account for inflation, we have to adjust i to reflect inflation…

- Average savings account APY: 0.58%

- Headline inflation (official numbers): 3.0%

- Therefore, our effective real (inflation-adjusted) interest rate is-2.42%.

Today, at least – who knows what it will be next month? No one knows.

Consider – the expected inflation rate has never risen above 3% for the last twenty years. Even when headline inflation soared to three times that.

No one knows what inflation will be. We could simply guess, but as I just pointed out, most people’s guesswork when it comes to inflation isn’t very accurate.

So the whole concept of the time value of money doesn’t live up to its promise.

However, there is some light at the end of the tunnel…

How to preserve today’s value for tomorrow

Two big reasons physical precious metals could help you hedge against inflation (and by extension, preserve your buying power) are:

- They help retain value – Precious metals have intrinsic value (their value is based on their utility as well as supply and demand), they tend to retain their value over time.

- They have historically acted as a hedge against inflation – While the U.S. dollar’s purchasing power continues its century-long decline, the value of precious metals like gold and silver tends to be much more consistent.

Both reasons explain why physical gold and silver could help stabilize your savings and calculate tomorrow’s expenses in today’s dollars. Regarding pre- or after-tax contributions, ask yourself, Are my taxes likely to go up once I’m retired?

You can get all the information you need about both gold and silver for free to make an informed decision right here.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Leave a Reply