Precious Metals Market Report

Thursday 09 March, 2017

Fundamentals and News

Gold Tumbles as ADP Jobs Surge Bolsters Fed’s Case to Hike Rates

Gold futures drop to lowest in five weeks after a report showing a strengthening U.S. job market bolsters prospects for an interest-rate increase at next week’s FOMC meeting.

Contract for April delivery -0.6% to settle at $1,209.40/oz at 1:46 pm on the Comex in N.Y, after falling to $1,206.40, lowest intraday since Feb. 1

ADP says private payrolls +298k in Feb., most in almost three years, vs forecast for 187k

“ADP is telling us it’s almost a 100 percent certainty we’re going to see a Fed hike,” says Frank Cholly, a senior market strategist at RJO Futures in Chicago

“That’s the reason we see the market moving lower”

Bloomberg Dollar Spot Index +0.4%

U.S. 10-year yields climb to highest since December

Gold dropped below the 50-day moving average of $1,210.45, suggesting the rout may not be over

That’s showing “even more technical weakness in this case,” Cholly says

Investors pricing in 100% bet the Fed will raise borrowing costs at March 14-15 meeting

Gundlach Sees ‘Old School’ Fed Doing Sequential Hikes

In other precious metals:

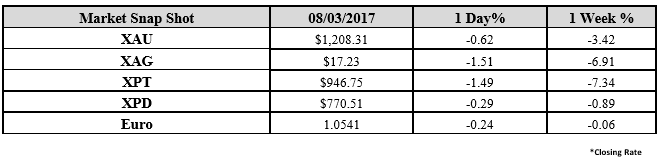

Silver futures for May delivery -1.4% to $17.298/oz

Platinum futures for April delivery -1.2% to $949.50/oz

Palladium futures for June delivery -0.6% to $770.40/oz

(*source Bloomberg)

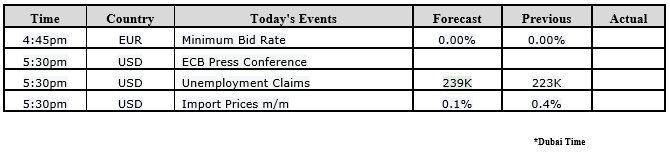

Data – Forthcoming Release

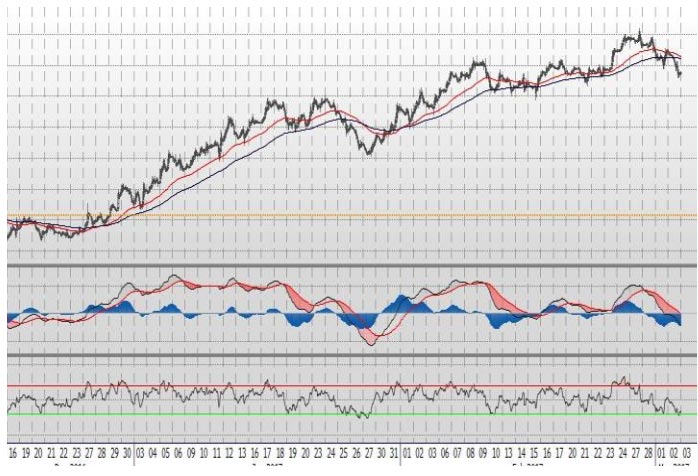

Technical Outlook and Commentary: Gold

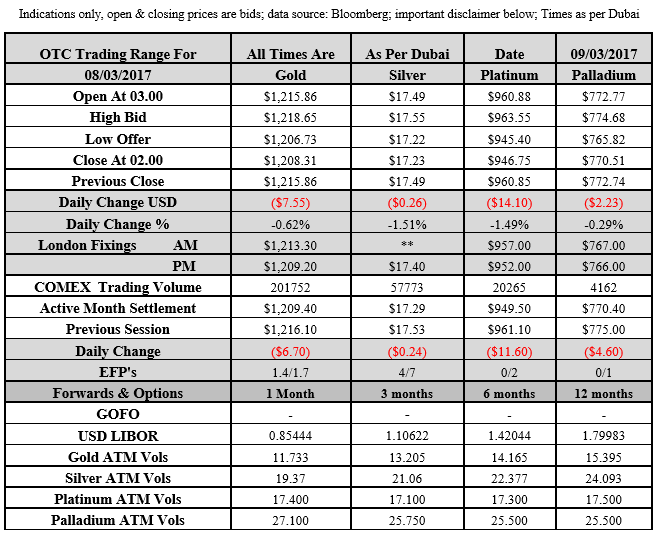

Gold for Spot delivery was closed at $1208.31 an ounce; with loss of $7.55 or 0.62 percent at 2.00 a.m. Dubai time closing, from its previous close of $1215.86

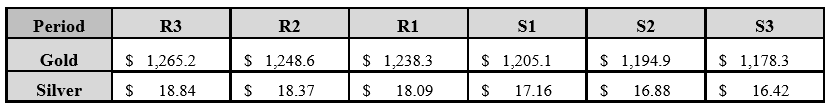

Spot Gold technically seems having resistance levels at 1238.3 and 1248.6 respectively, while the supports are seen at $1205.1 and 1194.9 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $17.23 an ounce; with loss of $0.26 or 1.51 percent at 2.00 a.m. Dubai time closing, from its previous close of $17.49

The Fibonacci levels on chart are showing resistance at $18.09 and $18.37 while the supports are seen at $17.16 and $ 16.88 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply