Gold Prices Rise vs. Falling Dollar as Covid Stimulus and ‘Fractious Policy’ Hit Stocks

Bullion.Directory precious metals analysis 21 October, 2020

Bullion.Directory precious metals analysis 21 October, 2020

By Adrian Ash

Head of Research at Bullion Vault

“There appears no definite clarity which shorter-term traders can price into the precious metals market,” says Singapore brokerage Phillip Futures.

“Long term investors have shifted focused on what the November election outcome means for stimulus later, with a Democrat victory seen boosting gold’s sentiment with a very large stimulus package.”

While Democrat Speaker of the House Nancy Pelosi reportedly “made progress” in stimulus talks overnight with Treasury Secretary Steve Mnuchin, Republican Senate majority leader Mitch McConnell advised President Donald Trump against agreeing to any pre-election deal, says the New York Times.

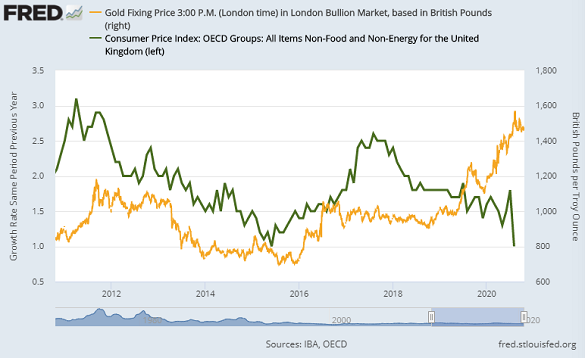

With the UK government meantime over-ruling the local mayor of major northern city Manchester yesterday, and imposing its highest “tier 3” anti-Covid restrictions without agreeing a financial aid package, the UK gold price in Pounds per ounce today fell as longer-term interest rates rose, falling back to unchanged for the week so far at £1470.

Other government bond prices also fell with equities – as did crude oil prices – pushing up 10-year interest rates most notably for Greece (up to 2-week highs at 0.91%), the UK (1-week highs at 0.23%) and the US (3.5-month highs at 0.82%).

Negative yields meantime continued for debt from Germany, France, the Netherlands and Switzerland, but Japan’s 10-year borrowing rates rose to 2-week highs near 0.03% after turning positive this March for the first time in 14 months.

Euro gold edged higher to €1621, but also showed no change for the week to date while Dollar prices rose $25 from Sunday to $1924 per ounce.

Unlike in the Eurozone, “The time is not right” for negative interest on overnight rates in the UK, said Bank of England policy-maker Dave Ramsden in a speech today, but “they are certainly in the policy toolbox for potential use in future.”

The UK government’s borrowing costs have now risen 5 basis points since Friday night’s downgrading by credit ratings agency Moody’s took the world’s 5th largest national economy further below the “triple A” rating it lost after the Brexit referendum in 2016.

Cutting the UK’s sovereign debt rating one notch to Aa3 from Aa2, Moody’s pointed to London’s worsening public deficits, plus what it called the “diminished quality of the UK’s legislative and executive institutions in recent years” as well as “the self-reinforcing combination of low potential growth and high debt in a fractious policy environment [amid] economic, fiscal and social challenges.”

“I like gold and it has done very well this year, despite the collapse in demand for gold in India,” says analyst Christopher Wood to ETMarkets.com.

“The reason is the very aggressive, extremely stimulating monetary and fiscal policies announced by the US Fed and the ECB in response to this pandemic.”

This article was originally published hereBullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply