Gold holds $2,000 as analysts watch coming prices

Bullion.Directory precious metals analysis 27 November, 2023

Bullion.Directory precious metals analysis 27 November, 2023

By Peter Reagan

Financial Market Strategist at Birch Gold Group

In reality, we appear to be on gold’s usual inching-upwards trajectory. Past relative dovishness from the Federal Reserve, little has really happened for gold to move from $1,800 then $1,900, and now above yet another resistance level.

A trader who ponders gold’s near-term bullish and bearish targets shows us why these are some exciting times to be a gold bull. Listed are $1,987, $1,954 and $1,932 as declining resistances, the latter being the most extreme. On the opposite side, $2,009, $2,032 and $2,049 are all upside points that rely on varying degrees of optimism.

In case you missed it, the gold market now sees the mid-$1,900/oz price point as correction territory. (Dissatisfaction with today’s gold price is the primary way gold investors tell us gold should be considerably above $2,000/oz right now.)

As always, it’s easy to forget to praise gold for the safe-haven store of value role it’s played over the months (or years, or decades, depending on the particulars of your initial gold purchase). Here’s a quick recap of recent events:

- Gold’s price rose in spite of the most aggressive interest-rate-hiking cycle in 50 years.

- Just one year ago, in November 2022, gold flirted with $1,600/oz – and today we’re calling a 25% increase to $2,000/oz the “new normal”?

- Oh, and lest we forget, 2023 central bank gold buying of 800 tons is 14% ahead of 2022’s all-time record-setting year!

A jump from $1,600 to $1,900 with little bombast? That’s good, but we want to see the thing above $2,000 already.

Outside of pegging resistances and underscoring likely correction points, the $1,900 level seems to have all but disappeared from traders’ minds. They are fully immersed in the possibilities that the $2,000-$2,100 range opens.

Indeed, the more time spent inside this range, the more reassurance there will be for gold investors who may have found gold’s absence from this target underwhelming.

Are we facing another lost decade? What role does gold play?

Over the last few years, comparisons between today’s economy and that of the disastrous 1970s virtually became a cottage industry.

There were obvious parallels: steep inflation, a rarely-as-aggressive Federal Reserve and a pervasive economic malaise – the unsettling suspicion that everything would not be okay. If a second “lost decade” were in fact upon us, we could expect gold to repeat its impressive performance.

So, are the 2020s a replay of the 70s?

To answer that, we’ll first have to figure out where exactly on the comparison timeline we are. If we’re assuming it’s a day-by-day comparison, then we have to remember that we have yet to hit the worst on this timeline.

In the 1970s, there were two periods of high inflation. The second, more intense and difficult to deal with, came after a three-year struggle in which the Fed seemingly managed to rein in inflation. With its foe conquered, the Fed then proceeded to cut interest rates (as it always does), triggering economic chaos that would last into the 1980s.

There’s no shortage of those willing to debate how much rates will be cut and how soon. The only story you’ll hear in virtually any mainstream media outlet goes like this:

- There was a pandemic, which caused inflation

- The Fed raised interest rates

- Inflation went away but now, American families are struggling because their mortgage rates and credit card bills are too high

- So the Fed must cut interest rates, the sooner the better

If you’re a regular reader, you know just how much this version of the story leaves out. It’s not intended to educate, though – it’s essentially propaganda for quantitative easing, a return to the zero-interest-rate policies of the last 15 years. Much of America, from the boardrooms to the kitchen tables, have forgotten how to navigate an economic environment where credit isn’t free, where debt has consequences…

Yes, the average EFFR over the last 70 years is about 4.63%. Yes, at 5.25% the current interest rate is only barely into restrictive territory. YES, low interest rates encourage debt accumulation, asset price inflation and consumer price inflation…

Personally, I believe the Federal Reserve’s independence isn’t much more than a polite fiction – and that the federal government’s skyrocketing debt service payments will necessitate a Fed “pivot” back to lower interest rates sooner rather than later. (Regardless of what Chairman Powell says at press conferences.)

Should my prediction come true, we’d be following the 1970s script pretty closely. In other words, we’re right on the cusp of yet another struggle with double-digit inflation due to monetary policy blunders.

However, there are some key differences to note here. Here’s what happened last time, in a nutshell:

Facing 12% inflation, like today the Fed furiously hiked rates. Which did bring down inflation for a couple years. At the cost of a savage recession as the private sector was choked off — note that, like today, government spending didn’t fall, just private spending. In the first quarter of 1975 the economy contracted by 5% annualized, reported at the time about twice that.

This scared the Fed, which is constantly walking a tightrope between public anger about the inflation they cause and public anger about the recessions they cause. So the Fed pulled back and allowed rates to plunge once again into negative territory.

This sent inflation soaring again… This second inflation was actually much worse than the first, lasting almost twice as long – more than 5 years versus the original 3 years – and hitting even higher levels of price increases. [emphasis added]

It’s interesting to note that the idea of permanent inflation was a concern back then, just as it is today. I have no doubt economic wonks postulated the Fed’s 2% target was obsolete. The social backlash – well, it’s a matter of public record:

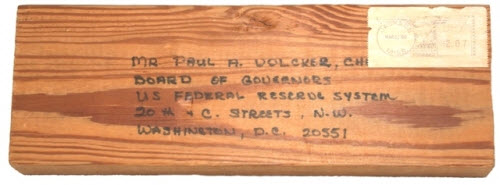

During his tenure, Volcker experienced more political attacks and public protests than any other Fed Chairman, mostly due to the effect of his high interest rates on the construction and agricultural industries. In protest, farmers blockaded the main office of the Board of Governors with their tractors.

The important lesson here is stagflation didn’t go away on its own! The Fed pushed interest rates into the double digits and kept them there for five consecutive years. Rates peaked at 22% in 1980.

Even that didn’t crush inflation – which flared up again during the early 80s attempt to “normalize” the interest rate. Another two-year span of double-digit interest rates finally drove a stake through the vampire’s heart.

So forgive me if I don’t believe that a year and a half of interest rates barely above the historic average are going to cure what ails us.

Even so, the entire mainstream media and all of Congress keep demanding to know, “When will rates come down?”

The answer will very likely be, sooner than they should’ve.

What should we expect from gold, then? History tells us:

The 1970s were brutal for workers, they were brutal for households struggling to buy food, and it was brutal for investors – adjusting for inflation, [most assets] didn’t recover until 1995. They held up better than dollars, of course, which never recovered.

Meanwhile, gold went up 15-fold, even faster than oil. Silver went up 8-fold.

The problem, really comes down to one thing – that the Fed’s response to the boom-and-bust cycle perpetuates the cycle itself.

…in 110 years the Federal Reserve has never brought down inflation at this pace without a deep recession.

And when that recession hits, 110 years of Federal Reserve says they’ll respond exactly exactly how they did in 1975: With rate cuts that launch a second stagflation.

Could it be even worse? Sure…

When the recession happens, the Fed will respond as they always do. They’ll depreciate the dollar through money-printing, bailouts, collateral-free “loans” to distressed institutions (including our own federal government!) Business as usual. The only thing that changes is just how much purchasing power our dollars lose. An increased cost of living is a small price to pay to stave off complete economic collapse, after all.

And, if the inflation numbers look too bad, there’s always the option of changing the methodology. (Ron Paul has a few words to say about fudging inflation numbers.) Whether or not the Fed officially updates their 2% inflation target, we might soon hear public debates over whether a 15% inflation rate is really so bad. I mean, complete economic collapse sounds really frightening. Argentina’s inflation rate averaged 190% over the last 80 years – could be worse, right?

The post-gold-standard monetary experiment careens from one disaster to another. We can’t completely opt out – however, it’s vital to remember that gold still exists, even though the gold standard is long gone. For those of us who remember what security, stability and value stand for? Gold will continue to reward us.

Indian gold demand hits 31-month high

India imported 123 tons of gold in October to satisfy citizens’ demands during a renewed jewelry season.

The figure is nearly double the 77 tons imported last October, which itself was rather impressive, considering the annual gold demand has averaged 66 tons for many years now.

Festival season coincided with a curiosity of sorts, which came about in the form of lower premiums. India, like China and other gold markets heavily vested on the physical side of things, has seen a premium that acts somewhat independently of its Western cousins.

The trigger for the sharp increase in purchases came in the form of lower gold prices around the start of October, the most affordable price in seven months. A Mumbai-based bullion dealer explained:

Jewelers were operating with lower stocks and were eager to replenish at the reduced price levels observed in October.

Demand for investment gold (gold coins and bullion bars, as opposed to gold jewelry) is strong. Buyers stand ready to make the most of opportunities to add to their stockpiles at a “discount” price.

Now, gold’s price has been doing so well in the Western markets that we probably don’t think of October as a standout month. Yet local markets have a widely variable premium over spot price. In other words, spot price is only relevant if you can buy gold at spot price.

India’s gold market is very sensitive to premiums. This reveals what is perhaps a more prudent approach to owning tangible assets. The average Indian gold buyer isn’t much like the typical American gold buyer:

In a country where access to banking facilities has been limited – especially across large swathes of rural India – gold has historically been the investment of choice… [Gold] retains a special place in the hearts of the Indian population. It is much more than a precious metal. It is has deep cultural significance, it is what will make beautiful wedding jewellery, it is a safe haven in times of distress, and it is a hedge against inflation.

Indian households believe in saving – some 30% of GDP overall. When compared to the global average of 27% (or to the U.S. savings level of 18%), it’s clear that saving is more important there than here.

In the U.S. the decision to invest in gold often involves a single large move (typically later in life). Now, there are some real benefits to this approach – economies of scale come into play. Like most purchases, you’ll usually get a better price with a single large purchase.

In Asia generally and India specifically, gold investment is not one big purchase. Instead, buyers tend to dollar-cost average. They buy gold whenever it’s affordable, in smaller quantities, and stash it away for the long term. There’s not much thought given to selling, either.

Gold’s long-term store-of-value tends to be passed on as a legacy to loved ones.

The gift of a stable financial foundation is prized well above today’s spot price.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Looks like it’s sticking there this time… next stop 2100 and we’re off to the moooooooooooon

Well Derren – we’ve hit $2100 as you predicted. Moon here we come!