Saxo Bank: Bullish case for gold keeps getting stronger

Bullion.Directory precious metals analysis 28 March, 2023

Bullion.Directory precious metals analysis 28 March, 2023

By Peter Reagan

Financial Market Strategist at Birch Gold Group

Hansen is unsure on whether the Federal Reserve will be forced to abandon its fight against inflation, but in the same analysis presents a very compelling argument in favor of it. As he notes, the generally awful U.S. yield curve inversion has approached its worst level since 2001 following the latest hike. (Note: This “yield curve inversion” is significant because it’s the best indicator we have of imminent recession.)

Markets are now pricing in a 1.5% cut in Fed funds rates in the next 15 months.

It’s an interesting forecast on the markets’ part. Can the Fed really hold off so long? And when the Fed throws in the towel on the inflation fight and cuts rates, will the U.S. dollar have anything left in the tank anymore?

Hansen mentions how the recent drop in Treasury yields encouraged gold buying. Sometimes this is a puzzling concept – if you want a safe haven investment, why would you think Treasury bonds at all? The truth is, for institutional investors, Treasury bonds are the equivalent of an everyday American stuffing cash under a mattress.

Treasurys are considered one of the most conservative paper-based investments. And don’t forget this is a “safe haven” available with just a few clicks of a mouse. Honestly, it’s tempting to call Treasury bonds an imaginary safe haven, and certainly not safe – however, in an economy where all value is derived from consensual hallucination and faith, who am I to say that one imaginary investment is better than another?

Considering its recent surge in price, though, is gold still a reliable safe haven? Hansen reminds us that gold already hit its all-time high price in Australian dollars, and flirted with its all-time high in both U.S. dollars and euro. However, that surge of “safe haven” Treasury buying we mentioned strengthened the dollar a bit – in other words, the gold price today is being restrained somewhat by a momentarily-stronger dollar.

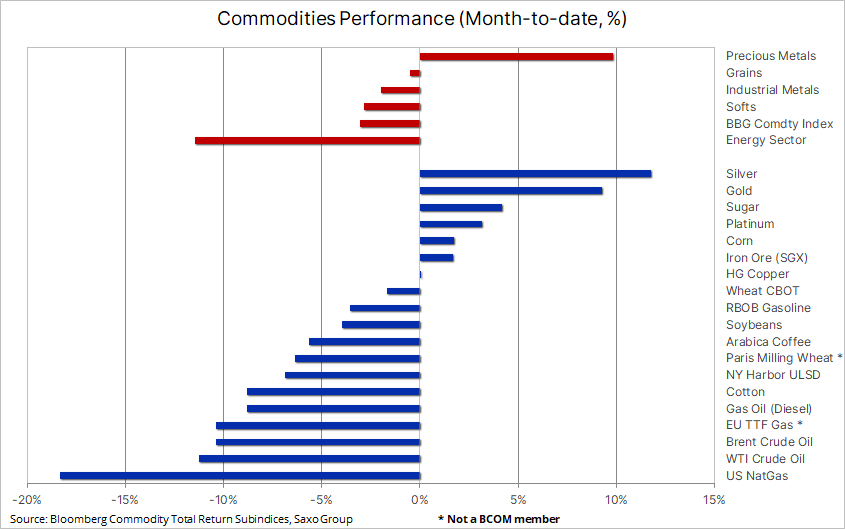

Many investors, usually hedge-fund types, talk up general commodities as both great diversifiers and inflation-resistant investments. Hansen wrecks that hypothesis with a simple chart:

via Saxo Bank

What’s going on? Here’s my analysis:

The entire energy sector is experiencing demand destruction based on inflation and an imminent recession.

Industrial metals (iron, copper, nickel and the like, as opposed to precious metals) are pro-growth investments, relying on industrial demand. They’re pricing in imminent recession.

“Softs” refers to commodities that are grown, rather than mined (food, lumber, cotton and so on). Why are they uniformly plunging, too? I’ll hazard a guess – demand destruction from surging prices, coupled with imminent recession.

Yes, the same few words appeared over and over in my analysis – “demand destruction” means people stopped buying the item in question. “Imminent recession” needs no further explanation.

How the recent bank failures will continue raising gold’s price

It’s easy, if not outright tantalizing to get caught up in the banking crisis as-it’s been presented. Credit Suisse and now Deutsche Bank and UBS? In fact, I was shocked to read this morning that Wall Street was optimistic “perhaps because they got through a weekend without another bank collapsing.”

When that’s your basis for optimism, you’re in rough shape!

Alasdair Macleod thinks this crisis in private banks is a setup. They’re the fall guys for something much worse.

That something, explains Macleod, is a global financial system that runs entirely on credit. We like to think of cash as money, if for no other reason, than for convenience’s sake. But that’s really not what cash is. Cash, or banknotes, are the collateral of central banks (just as stocks are collateral of private banks and other corporations). So when the credit system begins to implode and investors are dumping private bank collateral, what should we expect of central bank collateral?

Well, obviously, not much — especially since it’s become the duty of central banks to bail out private banks.

Essentially, Macleod argues, bailouts are a zero-sum game. Bank losses are replaced by central bank collateral – which, effectively, reduces the value if all the central bank’s other collateral. That might not sound dramatic at first. Then, when we remember that the Federal Reserve’s collateral is called the U.S. dollar? That’s a recipe for inflation.

It’s exactly as Dr. Ron Paul said in his 2009 masterpiece End the Fed: our banks exist in an environment where they profit during good economic times and have “third parties” to socialize their losses during bad economic times. Those “third parties” are Americans – and “socialize their losses” means that you and I pay the bills for the cleanup of bank disasters.

Let me just point out that no other industry in the nation works this way. Only banks! Only banks have convinced our leaders that, to allow them to bear the consequences of their own bad decisions would destroy the economy. To hear a bailout-begging bank CEO explain it, banks are the only thing preventing us from living in caves and hunting feral squirrels for dinner. Without banks, civilization itself would cease to exist. Nonsense!

But that’s their story. And it’s certainly working for them. Meanwhile, the rest of us are forced to “socialize their losses,” which means a currency whose purchasing power declines, year after year.

What’s the solution? Macleod doesn’t side with Dr. Paul and say we should give up on central banks. Perhaps he realizes that’s just too unlikely. Instead, he says:

For individuals, there is only one escape from the inevitable destruction of the value of credit. And that is to get out of the collapsing credit system altogether. The collapse may appear slow today, but at some indefinable stage in the future, it will become sudden.

The corporeal, as opposed to incorporeal form of credit is gold. It is credit without any counterparty. It is credit only in the sense that it is the unspent product of labour and profit. This distinction allows us to define gold as the only stable medium of exchange, or true money. Gold has been money since the end of barter.

Gold and silver are the only forms of money that can’t be printed at will – the only stable mediums of exchange over the centuries. They’ve outlasted hundreds of unbacked currencies, and will outlast thousands more.

Credit comes and goes, but gold is there forever.

Gold in India hits record high over concerns coming from the West

Gold’s recent surge to its all-time high in India prove that concerns over the global financial system are in fact global. As if we needed a reminder, also that gold is internationally viewed as a safe haven.

Indians hardly need reminding that gold is a store of value. In the Asian nation, the view of gold as money is commonplace and makes the staunchest Western gold bugs look tame by comparison.

Rahul Kalantri, VP of Commodities at Mehta Equities, says the Indian investor’s reason to buy gold is very much in alignment with Western sentiment. All the more so, since there hasn’t been a pullback of the kind we’ve seen in domestic markets.

The 60,000 rupee for 10 grams price that represents the all-time high is, according to some, actually a dip in the making. Anuj Gupta, Vice President of Commodity and Currency Research at IIFL Securities, says the current level will end up being an entry point over the coming month as the metal tests Rs62,000 for 10 grams.

Gupta, who says all eyes are on Fed policy decisions and possible shifts, says the U.S. dollar price for gold to look out for falls between $2,050 and $2,080.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply