QE in Europe will do exactly what it did in the US and Japan… not work!

Bullion.Directory precious metals analysis 22 January, 2015

Bullion.Directory precious metals analysis 22 January, 2015

By Christopher Lemieux

Senior Analyst at Bullion.Directory; Senior FX and Commodities Analyst at FX Analytics

Perhaps, the leak of potential European Central Bank (ECB) action yesterday of €50 billion per month for at least a year gave a platform for which Draghi could “beat” expectations. As mentioned this morning, the ECB will implement a €60 billion per month quantitative easing program until at least September 2016. The markets moved slightly as much of this has already been priced in.

See, the problem with quantitative easing is that it is inherently useless.

It is a tiny band-aid central bankers place over gaping wounds. It never fixes structural problems, and it only puts capital into unproductive investments.

There is a reason why it did not work in the US and Japan, and it is because instead of capital flying into the real economy, it is piled into equities, bonds and the like.

Nevertheless, ECB President Mario Draghi follows his colleagues footsteps in hopes to drive inflation higher.

Oh, that didn’t work in the US or Japan either. “We see sustained adjustment in the path of inflation which is consistent with our aim of achieving our aim of inflation rates close to but below two percent,” said Draghi. Why would the eurozone be any different?

Let the purchasing power deterioration begin! The citizens of the eurozone has watched the EURUSD fall from 1.40 last year to 1.478, currently.

Gold in euros and dollars are moving higher, along with the dollar. Traders will look to hedge central banking with safety.

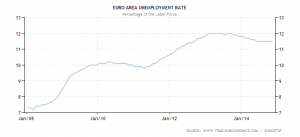

The structural issues with the eurozone:

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply