“I’m researching Cayman Islands gold storage options and want to know if this is a recommended location for holding investment precious metals”

Bullion.Directory’s Ask Ally Service

Bullion.Directory’s Ask Ally Service

By Alison Macdonald

Commercial Editor at Bullion.Directory

George in North Dakota has a sizeable inheritance and is looking to secure a portion of this in gold. He is worried about local storage in the US and has started looking into options available in the near-offshore market.

It’s refreshing to hear more people embrace the idea of offshoring. Offshore gold storage, once a concept largely reserved for the ultra-wealthy or those steeped in international finance, has been steadily gaining traction among a broader range of investors.

The subject saw a huge growth in popularity in the years following the 2008 global crash, and again it’s seeing a massive resurgence in 2023/2024 in the post-pandemic years and during a time of heightened global unrest.

Why?

Moving investments offshore is about asset protection, risk diversification, and sometimes, a bit of peace of mind.

The Cayman Islands have made a massive impact on offshoring, emerging as a hotspot for gold storage, thanks to its location close to the US, it’s political stability, stringent privacy laws, and favorable economic environment.

Now when someone asks about Cayman Island Gold Storage, what they’re really asking about is the company SWP Cayman.

Now when someone asks about Cayman Island Gold Storage, what they’re really asking about is the company SWP Cayman.

Strategic Wealth Preservation (SWP) is nestled in the heart of the Cayman Islands and provides a tailored solution for those looking to keep their precious metals safe, secure, and accessible.

Thanks to SWP’s partnerships with many of America’s biggest and best-known bullion dealers, when most US investors start to look into offshore gold, the first company they discover tends to be SWP.

SWP offers a unique combination of modern security and traditional discretion, making it an attractive option for investors globally.

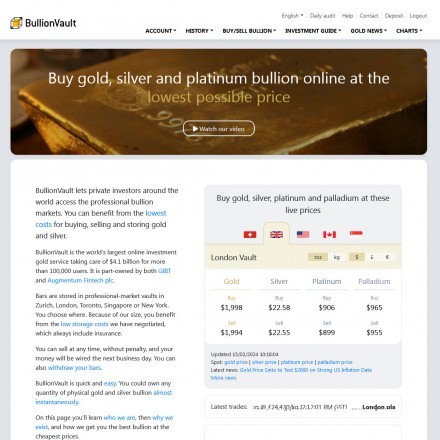

Top Rated Offshore Dealers:

Top Gold Storage Facility in the Cayman Islands?

Strategic Wealth Preservation stands out as a premier destination for those seeking to secure their gold and other precious metals. With a blend of state-of-the-art services and a strong focus on security, SWP is not just a storage facility; it’s a sanctuary for your investments.

Consistently one of Bullion.Directory’s top-rated offshore providers, the company’s customer satisfaction scores are truly best in industry, thanks to the dedication of their friendly staff, deep market knowledge and a strong foundation of trust and transparency.

At the core of SWP’s offerings is their commitment to providing 100% allocated and segregated storage.

This means each client’s assets are individually accounted for and stored separately, ensuring direct ownership and complete transparency. This approach is critical for those who seek the assurance that their investments are not just safe but also readily identifiable as their own.

The cornerstone of SWP’s security is its Class III UL rated vault.

The cornerstone of SWP’s security is its Class III UL rated vault.In the world of high-security storage, a Class III rating signifies a facility’s ability to withstand sophisticated penetration attempts, offering one of the highest levels of security available today.

The vault is designed to resist a range of threats, from physical break-in attempts to fire hazards. This level of security provides clients with the peace of mind that their assets are protected by some of the most advanced security measures in the industry.

Beyond its vault, SWP boasts a global storage network, allowing clients to diversify their storage locations. This network includes partnerships with other top-tier storage facilities around the world, offering clients the flexibility to store their assets in various geopolitical environments.

This global reach is not just about spreading risk; it’s also about accessibility and convenience for the international investor.

In essence, SWP Cayman is more than just a place to store gold; the company provides a comprehensive solution for safeguarding precious assets, underpinned by robust security, international reach, and a deep understanding of the needs of modern investors.

The Allure of Cayman Islands Gold Storage

![]() The Cayman Islands, are as much renowned for their serene beauty and their financial prowess. As such, they offer an ideal haven for gold storage, drawing investors with their unique combination of benefits.

The Cayman Islands, are as much renowned for their serene beauty and their financial prowess. As such, they offer an ideal haven for gold storage, drawing investors with their unique combination of benefits.

Whilst their close proximity to the US make Americans the region’s most typical customers, Cayman Islands gold storage draws wealthy clients from all over the world who are looking for a safe and secure internationalized footprint.

- Political and Economic Stability: One of the key attractions of the Cayman Islands is their stable political climate and robust economy. Unlike many regions that are prone to economic turbulence and political unrest, the Cayman Islands offer a haven of stability. This ensures that investments stored here are less likely to be affected by the kinds of geopolitical upheavals that can impact markets elsewhere.

- Stringent Privacy Laws: The Caymans are known for their stringent privacy laws, which extend to financial holdings. For investors seeking discretion and confidentiality in their investments, this is a significant draw. These laws ensure that personal and financial information remains protected, a feature highly valued in the realm of asset protection.

Strategic Geographic Location: Geographically, the Cayman Islands are strategically positioned. As I mentioned, for North American investors, in particular, they offer proximity and accessibility that other offshore locations may not. This makes visiting and managing assets more feasible, blending convenience with offshore benefits. After all who doesn’t enjoy combining business with pleasure!

Strategic Geographic Location: Geographically, the Cayman Islands are strategically positioned. As I mentioned, for North American investors, in particular, they offer proximity and accessibility that other offshore locations may not. This makes visiting and managing assets more feasible, blending convenience with offshore benefits. After all who doesn’t enjoy combining business with pleasure!

Together, these factors make the Cayman Islands an alluring choice for storing gold, offering a blend of security, privacy, and accessibility that is hard to match.

Advantages of Storing Gold with SWP Cayman

Allocated and Segregated Storage:

SWP Cayman’s approach to storage is both allocated and segregated, ensuring each client’s assets are individually managed and stored. This means that when you store gold or other precious metals with SWP, they are specifically allocated to you and kept separate from assets belonging to other clients.

SWP Cayman’s approach to storage is both allocated and segregated, ensuring each client’s assets are individually managed and stored. This means that when you store gold or other precious metals with SWP, they are specifically allocated to you and kept separate from assets belonging to other clients.

This approach not only provides an added layer of security but also ensures clarity in ownership. In the event of any financial turbulence affecting the storage facility, your assets remain identifiable as yours, offering a clear legal claim.

Compliance and Security:

At SWP, compliance with international standards is a cornerstone of their operation. This adherence to global norms in asset storage provides an added layer of trust and reliability. The facility’s security measures are robust, incorporating advanced technology and stringent protocols to safeguard the assets.

From controlled access to constant surveillance, every aspect of security is meticulously managed. Moreover, comprehensive insurance coverage further protects the stored assets, covering risks like theft or damage, thus providing clients with peace of mind.

This comprehensive approach to security and compliance makes SWP Cayman a trusted name in the industry for those seeking a secure and compliant offshore gold storage solution.

Cayman Islands Gold Storage for Offshore IRAs

Strategic Wealth Preservation (SWP) plays a pivotal role in the realm of offshore Gold IRAs.

Strategic Wealth Preservation (SWP) plays a pivotal role in the realm of offshore Gold IRAs.

Their services are tailored to meet the unique requirements of American citizens looking to include physical gold in their retirement portfolios while benefiting from offshore storage – and thanks to partnerships with many top Gold IRA providers, SWP are a no.1 pick in the market.

Catering to U.S. Investors for Gold IRA Storage

SWP understands the specific needs of U.S. investors in terms of compliance, security, and accessibility. They offer a seamless process for incorporating physical gold into IRAs, which is in line with IRS regulations.

For American investors, this means the convenience of diversifying their retirement assets with gold, coupled with the advantages of offshore storage. SWP’s expertise in these areas simplifies the often complex process of adding gold to IRAs.

Benefits and Logistics of Offshore Storage for Gold IRAs

Storing Gold IRA assets offshore, especially in a jurisdiction like the Cayman Islands, comes with several benefits. Firstly, the political and economic stability of the Caymans adds a layer of security to the investment. Secondly, the stringent privacy laws in the Cayman Islands ensure that the details of an investor’s IRA holdings remain confidential, between the investor and the IRS.

From a logistical standpoint, SWP makes the process of transferring gold to offshore storage straightforward. They handle the nuances of transportation, insurance, and secure storage. This service provides U.S. investors with an opportunity to geographically diversify their retirement assets while enjoying the stability and security of a reputable offshore jurisdiction.

For American citizens, this means not only diversifying their investment portfolio but also securing their retirement assets in a stable, secure, and private environment. SWP’s role in facilitating this for Gold IRAs is crucial, offering a bridge between U.S. investors and the benefits of offshore gold storage.

For American citizens, this means not only diversifying their investment portfolio but also securing their retirement assets in a stable, secure, and private environment. SWP’s role in facilitating this for Gold IRAs is crucial, offering a bridge between U.S. investors and the benefits of offshore gold storage.

Pros and Cons of Offshore Gold Storage

I’m a firm believer in diversification: of investments, of precious metals and of storage locations. Being offshore takes location diversity to a whole other level – but it isn’t for everyone.

Pros of Offshore Gold Storage

- Diversification of Risk: Storing gold offshore diversifies geopolitical risk. If domestic conditions become unstable, your offshore investment remains secure in a different jurisdiction.

- Enhanced Security: Offshore facilities can offer advanced security measures beyond what might be available domestically.

- Political and Economic Stability: Many offshore locations, such as the Cayman Islands, are known for their stable political and economic environments, providing a safe haven for assets.

- Confidentiality: Offshore jurisdictions typically offer greater privacy, which can be a crucial consideration for investors seeking discretion.

- Tax Advantages: Depending on the jurisdiction and the investor’s personal circumstances, offshore gold storage can offer certain tax benefits as well as different reporting standards

Cons of Offshore Gold Storage

- Complexity and Regulation: Navigating the laws and regulations of offshore gold storage can be more complex than domestic storage, especially when going it alone. Saying that in many cases investors offshore needs are met by the domestic bullion dealer they normally work with.

- Accessibility: While offshore storage is secure, it may not be as readily accessible as domestic options, which could be a concern in situations where quick access to gold is needed. Think travel restrictions such as during the pandemic…

- Costs: Often, the costs associated with offshore storage, including transportation, insurance, and storage fees, may be a little higher than domestic options. Certainly your costs of flying out to look at your metals will be more than visiting your local bullion depository.

Perception Issues: There can sometimes be a negative perception or stigma attached to offshore storage, which some investors might find concerning. Thanks to movies and the media, there’s either a touch of sketchyness, or a sprinkling of excitement with offshore, that you don’t tend to find at your city bank.

Perception Issues: There can sometimes be a negative perception or stigma attached to offshore storage, which some investors might find concerning. Thanks to movies and the media, there’s either a touch of sketchyness, or a sprinkling of excitement with offshore, that you don’t tend to find at your city bank. Gold IRA Compliance: SWP adheres to the stringent requirements set forth for Gold IRAs, particularly in terms of storage and reporting. Their facilities meet the standards required by the IRS for Gold IRA storage, ensuring that investors are in compliance with U.S. tax laws.

Gold IRA Compliance: SWP adheres to the stringent requirements set forth for Gold IRAs, particularly in terms of storage and reporting. Their facilities meet the standards required by the IRS for Gold IRA storage, ensuring that investors are in compliance with U.S. tax laws.- Local and International Regulations: SWP also complies with local Cayman Islands regulations as well as international standards for precious metals storage. This adherence ensures that the facility operates within the legal framework, offering security and legitimacy to its clients.

- Security Protocols: SWP’s high-class security measures, including their Class III UL rated vault, provide robust protection against physical threats to stored assets. This level of security is a crucial factor in safeguarding investors’ gold holdings.

- Insurance and Liability: Comprehensive insurance coverage is another key aspect of SWP’s commitment to investor protection. This insurance provides an added layer of security, covering potential risks like theft or damage to the stored assets.

- Transparency and Accountability: SWP maintains a policy of transparency and accountability in its operations, providing clients with clear information about their stored assets and any associated fees or procedures. This openness is vital in building trust and ensuring that investors’ interests are prioritized.

- Reputation and Track Record: Research the provider’s history and reputation in the market. Look for reviews or testimonials from other investors, and consider the provider’s experience in handling gold storage.

- Security Measures: Evaluate the security protocols of the storage facility. Inquire about their vault specifications, surveillance systems, and any additional security measures they employ.

- Compliance and Insurance: Ensure the provider is compliant with local and international regulations. Check if they have comprehensive insurance coverage for the gold stored, protecting against theft, damage, or other risks.

- Accessibility and Convenience: Consider the ease of accessing your gold. Some investors might prefer locations closer to home for convenience, while others might prioritize strategic geopolitical locations.

- Do Thorough Research: Gather as much information as possible about the storage facility and its operations. This can include reading online resources, speaking to other investors, or consulting financial advisors.

- Visit the Facility: For me this is a big one, but if possible, visit the storage facility to get a firsthand impression of their operations and security measures.

- Evaluate Customer Service: Good customer service is crucial. Assess how the provider handles inquiries, their responsiveness, and their willingness to provide detailed information about their services.

- Compare Options: Don’t hesitate to compare different providers. Look at their services, fees, and any value-added services they offer to determine the best fit for your needs.

Weighing these pros and cons is essential for any investor considering offshore gold storage. It’s about balancing the benefits of security and diversification with the practicalities of accessibility and cost.

Top Rated Onshore Depositories:

Regulatory Compliance and Investor Protection

Strategic Wealth Preservation places a strong emphasis on regulatory compliance and investor protection, key aspects that are crucial for those looking to store gold, particularly for Gold IRA purposes.

Ensuring Compliance with Regulatory Requirements

Measures to Protect Investors’ Interests

SWP’s adherence to regulatory compliance and its focus on investor protection are central to its operations, providing assurance to clients that their investments are secure and managed within a robust legal and ethical framework.

Choosing the Right Offshore Gold Storage Provider

When selecting a provider for offshore gold storage, it’s crucial to consider various factors to ensure your assets are secure and managed effectively.

When selecting a provider for offshore gold storage, it’s crucial to consider various factors to ensure your assets are secure and managed effectively.

We currently list 40 offshore bullion dealers and facilities with a growing number of options in locations like Dubai, Switzerland, Singapore, Hong Kong, and Canada, making the right choice requires careful consideration.

No matter the location you choose to go for, Bullion.Directory recommends the following factors to play it safe in any move offshore…

Factors to Consider

Tips on Assessing Reliability, Security, and Customer Service

Choosing the right offshore gold storage provider is a decision that should be based on thorough research, careful consideration of security and compliance, and an assessment of your personal investment needs and preferences.

Conclusion: Is Cayman Islands Gold Storage For You?

The suitability of the Cayman Islands for gold storage is underscored by several key factors. The region’s political and economic stability, combined with stringent privacy laws and strategic geographic location, make it an ideal choice for investors seeking secure offshore gold storage.

The suitability of the Cayman Islands for gold storage is underscored by several key factors. The region’s political and economic stability, combined with stringent privacy laws and strategic geographic location, make it an ideal choice for investors seeking secure offshore gold storage.

Strategic Wealth Preservation elevates this appeal with its Class III UL rated vault, comprehensive security measures, and a strong commitment to regulatory compliance and investor protection.

The growing trend of offshore gold storage reflects a shift in modern investment strategies towards diversification and risk management. Now you do have a growing range of options available globally, including in Dubai, Switzerland, Singapore, Hong Kong, and even Canada, but for many Americans the Cayman Islands remain a top choice.

In conclusion, storing gold in the Cayman Islands, particularly through providers like SWP, offers a blend of security, privacy, and compliance that aligns well with the needs of contemporary investors. This approach to gold storage plays a significant role in modern investment portfolios, offering a strategic option for those looking to safeguard and diversify their assets.

Alison Macdonald

Ask Ally, is your direct line to gold investment wisdom. Alison “Ally” Macdonald, with her extensive experience and sharp tongue, cuts through clutter to offer honest, insider takes on your gold investment questions.

Need insights or industry secrets? Ally’s ready to deliver, combining professional expertise with a smattering of Glasgow patter. Get ready for straightforward, expert guidance from a one-time gold shill turned good guy. Ask Ally Today

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply