As the COVID-19 pandemic has shown, it is worth being better prepared for a possible crisis. Does that mean it pays to have some gold up your sleeve? I have to confess something. I always laughed at preppers. C’mon, who would take these freaks seriously?

Full Article →Inflation: “Greatest Long-Range Danger Apart from Nuclear War”

I’m not encouraging you to believe U.S. inflation this time around could lead to the collapse of America. But I think it is good to take the words of Charlie Munger to heart and recognize the potential of inflation to have a significant impact on economies and personal savings.

Full Article →Energy Shock: Ukraine Crisis to Push Inflation Higher

Fuel costs have already been soaring due to oil and gas supply constraints and inflationary pressures. The national average for a gallon of regular unleaded is $3.55 – some parts of the country are paying closer to $5.00 per gallon. Now the threat of full-scale war in Ukraine is sending risk premiums in futures markets even higher.

Full Article →Gold a Shelter as Russia Invades Ukraine

The war has begun: after a few weeks of tense situation, Russia has taken a radical step and started an invasion of Ukraine. How will this affect gold? Well, risk aversion has soared amid the conflict. Equities are plunging while safe-haven assets are soaring.

Full Article →Can Gold Outperform – Even During a Rate Hike Cycle?

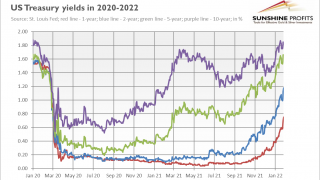

One good thing that can be said about this is that rate hikes get priced in far ahead and in succession. As far as the markets are concerned, three rate hikes have already happened. But that’s where speculators stop doing gold any favors.

Full Article →The Zugzwang Position

It’s a funny bull market, this gold thing. Unloved by the mainstream commentariat, who desperately cry “barbarous relic”, and by the bitcoin bettors, who call it an “ugly yellow rock”, its price is now with a hair’s width of the all-time high. $1,905, as this Report is being written…

Full Article →When The Russian Bear Roars Will It Wake Gold Bulls?

The current military tensions and the Fed’s sluggishness favor gold bulls, but not all events are positive for the yellow metal. What should we be aware of? It may be quiet on the Western Front, but quite the opposite on the Eastern Front. Russia has accumulated well over 100,000 soldiers on the border with Ukraine

Full Article →Warning From Canada: Financial Freedom Under Attack

In an unprecedented move sidestepping normal due process guarantees, Trudeau ordered banks, insurance companies, and even cryptocurrency exchanges to close the accounts of anyone deemed to be involved in the Freedom Convoy.

Full Article →High Inflation or Recession: Analyst Says Gold’s Got You Covered Either Way

A funny thing is happening on the way to higher interest rates: The price of gold and silver also is moving higher. Since the beginning of the month, the spot gold price has increased by 4% and silver has jumped by about 4.5%. And this is amid all the talk of rate increases coming faster and in larger quantities…

Full Article →Gold is Going Up On Fed Interest Rises

There are many who believe that when interest rates go up, gold gets weaker. The truth is, that gold can rise with interest rates and can also rise with the markets. What’s important to remember is that beyond all the economic fundamentals, asset prices go up or down based on the inflows and outflows of money.

Full Article →Inflation Peak: High Risk or Golden Opportunity?

If only you weren’t in a coma last year, you would have probably noticed that prices had been surging recently. For instance, America finished the year with a shocking CPI annual rate of 7.1%, the highest since June 1982

Full Article →Is it Worth Adding Gold to Your Portfolio in 2022?

Gold is an excellent portfolio diversifier, as it is negatively correlated with risk assets, and – importantly – this negative correlation increases as these assets sell off. Hence, adding gold to a portfolio could diversify it, improving its risk-adjusted return, and also provide liquidity to meet liabilities in times of market stress.

Full Article →What Investors Get Wrong About Gold’s True Value

In his new research paper, Wharton finance and economics professor Urban Jermann proposed that investors and market participants have been misinterpreting the true value of gold as an investment asset. In particular, more attention should be paid to…

Full Article →Inflation Shoots Above 1980 Peak

Americans get fed a lot of BS when it comes to price inflation. Prices in the U.S. are rising faster than they were in the late 1970s when gasoline shortages triggered an economic crisis. Today, supply chain disruptions and exploding prices are also nearing crisis levels.

Full Article →Could China & Russia Speed Up Dollar Drop?

Both China and Russia play hugely important roles in the global economy. Both face economic sanctions from the United States. And both are eyeing long-term strategies for shifting the locus of global trade away from the Federal Reserve Note “dollar.”

Full Article →The ECB Awakens. Will Gold Feel The Force?

The ECB has awoken from its ultra-dovish lethargy. Lagarde opened the door to an interest rate hike, which gave the European Central Bank a hawkish demeanor. Does it also imply more bullish gold?

Full Article →What started as a small website run and managed by a few gold-obsessed friends has grown to a scale none of us could ever have imagined – and we’re SO pleased it’s been such a useful tool to so many investors – but we need to make some changes to cope with this growth…

Full Article →Is Valentines Day Cancelled?

Has the Supply Chain Crisis Killed Romance? Expressing our love could be in danger due to recent flower shortage. It’s one thing not to be able to buy toilet paper, but now expressing our love is in danger when we can’t buy flowers.

Full Article →It’s 2022: Will You Protect Your Retirement Account With the #1 Choice?

What if this was one of your publicly declared New Year’s resolutions: “This year I’m going to protect my retirement account.” Here’s the thing – the moment you say it out loud, you and everyone around you will wonder why you’ve waited even this long to do something that clearly is so important.

Full Article →State Reserve Funds Dangerously Exposed to Inflation

The recent explosion in inflation rates caused by runaway debt-funded federal spending and Fed money printing has sparked renewed interest in state legislatures in the role gold and silver play in hedging against systemic risks.

Full Article →Strong Payrolls Can’t Knock Gold

The latest employment report strongly supports the Fed’s hawkish narrative. Surprisingly, gold has shown remarkable resilience against it so far – especially given that the surprisingly good nonfarm payrolls came despite the disruption to consumer-facing businesses from the spread of the Omicron variant of the coronavirus.

Full Article →UBS: Gold is ‘Tried-and-Tested Insurance’

UBS strategists said that gold’s “tried-and-tested insurance characteristics” had again shined brightly, especially compared to other common portfolio diversifiers, including digital assets such as bitcoin. (Recently, bitcoin’s price has been more closely correlated with stocks than previously, reducing its effectiveness as a hedge.)

Full Article →Why Fed Note Decline is FAR Worse than Reported

Americans are waking up to some uncomfortable truths. One of these is the fact that government bureaucrats and the corporate media regularly lie about what is going on in the world. The real inflation numbers may be close to double what’s reported officially. Alternative data sets are out there, but, predictably…

Full Article →Will the Fed Tighten Gold?

Beware, the Fed’s tightening of monetary policy could lift real interest rates! For gold, this poses a risk of prices wildly rolling down. The first FOMC meeting in 2022 is behind us. What can we expect from the US central bank this year and how will it affect the price of gold?

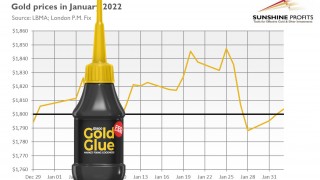

Full Article →Gold Ended January Glued to $1800 – Will it Ever Detach?

What does gold’s behavior in January imply for its 2022 outlook? Well, I must admit that I expected gold’s performance to be worse. Last month showed that gold simply don’t want to either go down (or up), but it still prefers to go sideways, glued to the $1,800 level.

Full Article →Crisis Ahead: New National Debt Milestone

The U.S. reached a $30 trillion milestone this week. Instead of signifying a great achievement, though, it serves as a dire warning for American workers, investors, and retirees.

Full Article →2022 Gold Outlook

In the full Outlook Report, we take an in-depth look at the market players, dynamics, fallacies, drivers, and finally give our predictions for gold and silver over the coming year. Our unique analysis of precious metals, encapsulated in our Supply and Demand model, is a true signal in an otherwise very noisy market.

Full Article →Gold Defended $1800 Bravely. Then Gave Up.

The evil FOMC published its hawkish statement on monetary policy. Gold fought valiantly, gold fought nobly, gold fought honorably. Despite all this sacrifice, it lost the battle. How will it handle the next clashes?

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.