Beware, the Fed’s tightening of monetary policy could lift real interest rates! For gold, this poses a risk of prices wildly rolling down.

Bullion.Directory precious metals analysis 04 February, 2022

Bullion.Directory precious metals analysis 04 February, 2022

By Arkadiusz Sieroń, PhD

Lead Economist and Overview Editor at Sunshine Profits

First, quantitative easing tapering. The asset purchases are going to end by early March. To be clear, during tapering, the Fed is still buying securities, so it remains accommodative, but less and less. Tapering has been very gradual and well-telegraphed to the markets, so it’s probably already priced in gold. Thus, the infamous taper tantrum shouldn’t replay.

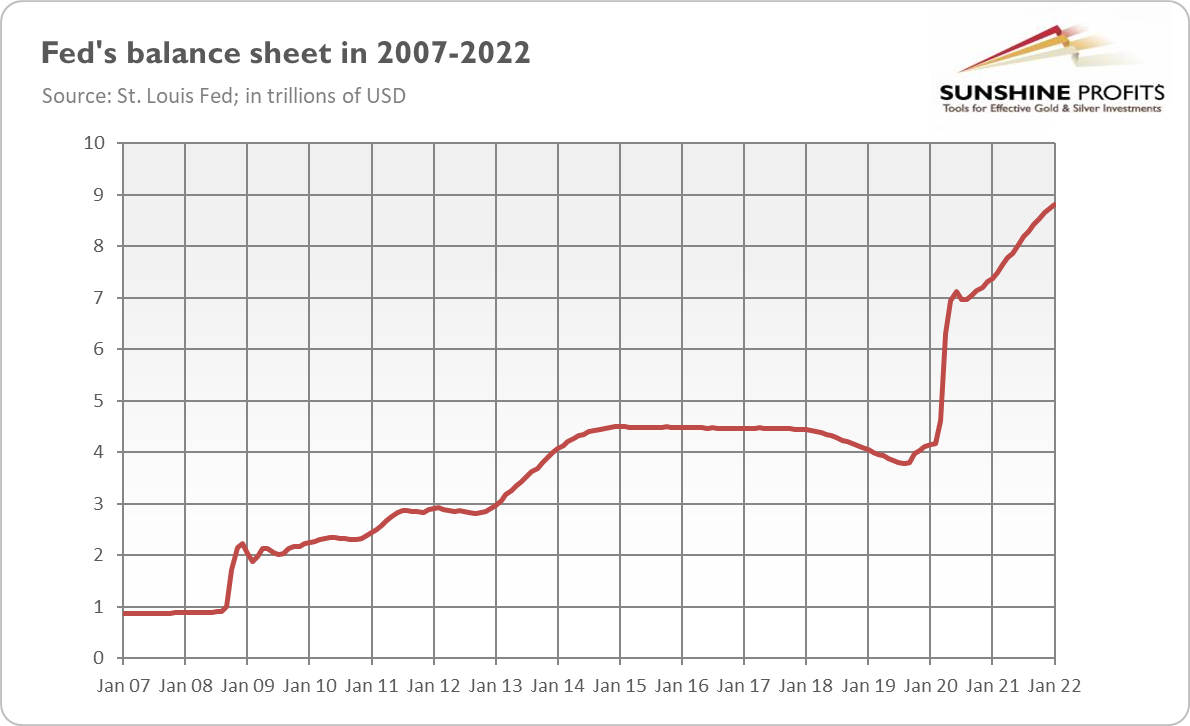

Second, quantitative tightening. Soon after the end of asset purchases, the Fed will begin shrinking its mammoth balance sheet. As the chart below shows, it has more than doubled since the start of the pandemic, reaching about $9 trillion, or about 36% of the country’s GDP. It’s so gigantic that even Powell admitted during his January press conference that “the balance sheet is substantially larger than it needs to be.” Captain Obvious attacked again!

In contrast to tapering, which just reduces additions to the Fed’s holdings, quantitative tightening will shrink the balance sheet. How much? It’s hard to say. Last time, during QT from 2017 to 2019, the Fed started unloading $10 billion in assets per month, gradually lifting the cap to $50 billion.

Given that inflation is now much higher, and the Fed has greater confidence in the economic recovery, the scale of reduction would probably be higher. The QT will create upward pressure on interest rates, which could be negative for the gold market.

However, QT will be a very gradual and orderly process. Instead of selling assets directly, the US central bank will stop reinvestment of proceeds as securities run off. As we can read in “Principles for Reducing the Size of the Federal Reserve’s Balance Sheet”,

The Committee intends to reduce the Federal Reserve’s securities holdings over time in a predictable manner primarily by adjusting the amounts reinvested of principal payments received from securities held in the System Open Market Account.

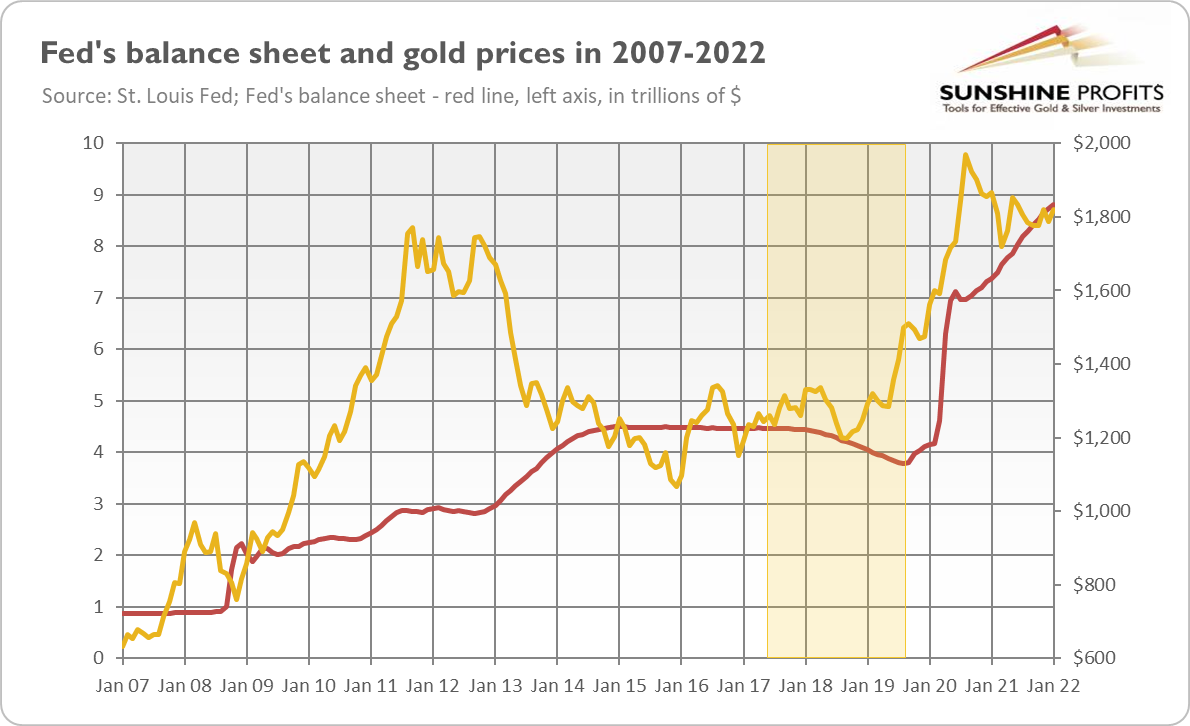

What’s more, the previous case of QT wasn’t detrimental to gold, as the chart below shows. The price of gold started to rally in late 2018 and especially later in mid-2019.

Third, the hiking cycle. In March, the Fed is going to start increasing the federal funds rate. According to the financial markets, the US central bank will enact five interest rate hikes this year, raising the federal funds rate to the range of 1.25-1.50%.

Now, there are two narratives about American monetary policy in 2022. According to the first, we are witnessing a hawkish revolution within the Fed, as it would shift its monetary stance in a relatively short time. The central bank will “double tighten” (i.e., it will shrink its balance sheet at the same time as hiking rates), and it will do it in a much more aggressive way than after the Great Recession. Such decisive moves will significantly raise the bond yields, which will hit gold prices. However, in this scenario, the Fed’s aggressive actions will eventually lead to the inversion of the yield curve and later to recession, which should support the precious metals market.

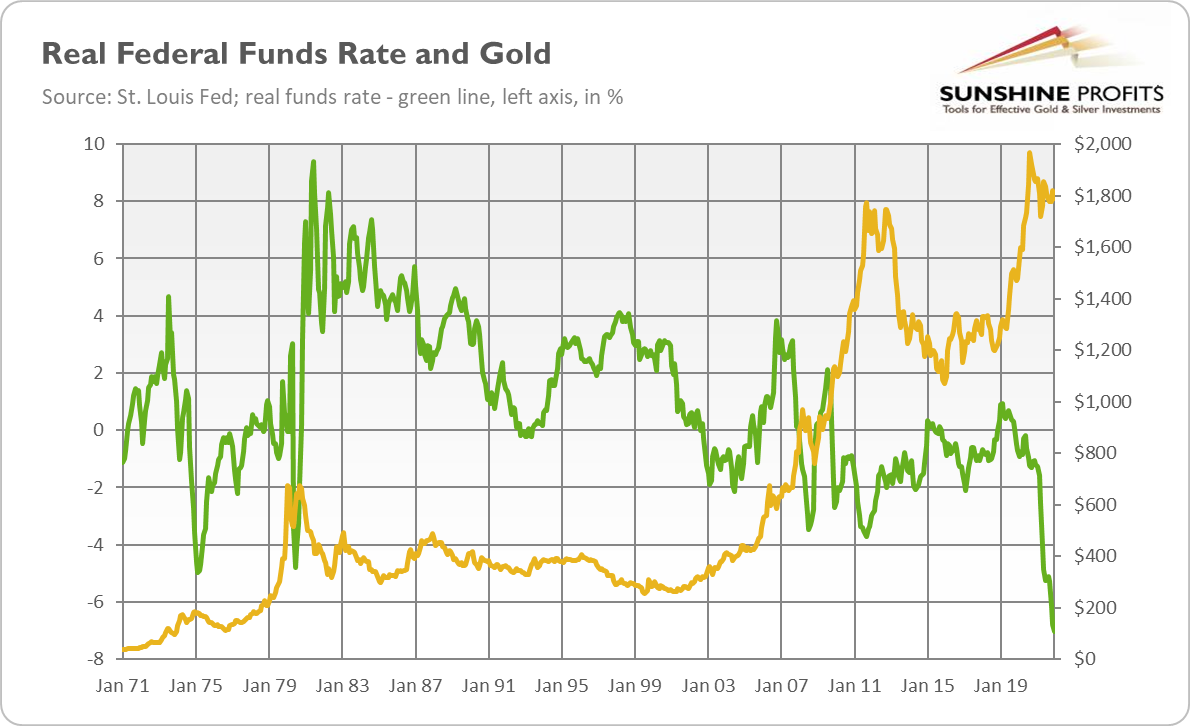

On the other hand, some analysts point out that central bankers are all talk and – given their dovish bias – act less aggressively than they promise, chickening out in the face of the first stock market turbulence. They also claim that all the Fed’s actions won’t be enough to combat inflation and that monetary conditions will remain relatively loose. For example, Stephen Roach argues that “the Fed is so far behind [the curve] that it can’t even see the curve.” Indeed, the real federal funds rate is deeply negative (around -7%), as the chart below shows; and even if inflation moderates to 3.5% while the Fed conducts four hikes, it will remain well below zero (about -2%), providing some support for gold prices.

Which narrative is correct? Well, there are grains of truth in both of them. However, I would like to remind you that what really matters for the markets is the change or direction, not the level of a variable. Hence, the fact that real interest rates are to stay extremely low doesn’t guarantee that gold prices won’t decline in a response to the hiking cycle.

Actually, as the chart above shows, the upward reversal in the real interest rates usually plunges gold prices. Given that real rates are at a record low, a normalization is still ahead of us. Hence, unless inflation continues to rise, bond yields are likely to move up, while gold – to move down.

Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

This article was originally published here

Leave a Reply