The latest employment report strongly supports the Fed’s hawkish narrative. Surprisingly, gold has shown remarkable resilience against it so far.

Bullion.Directory precious metals analysis 08 February, 2022

Bullion.Directory precious metals analysis 08 February, 2022

By Arkadiusz Sieroń, PhD

Lead Economist and Overview Editor at Sunshine Profits

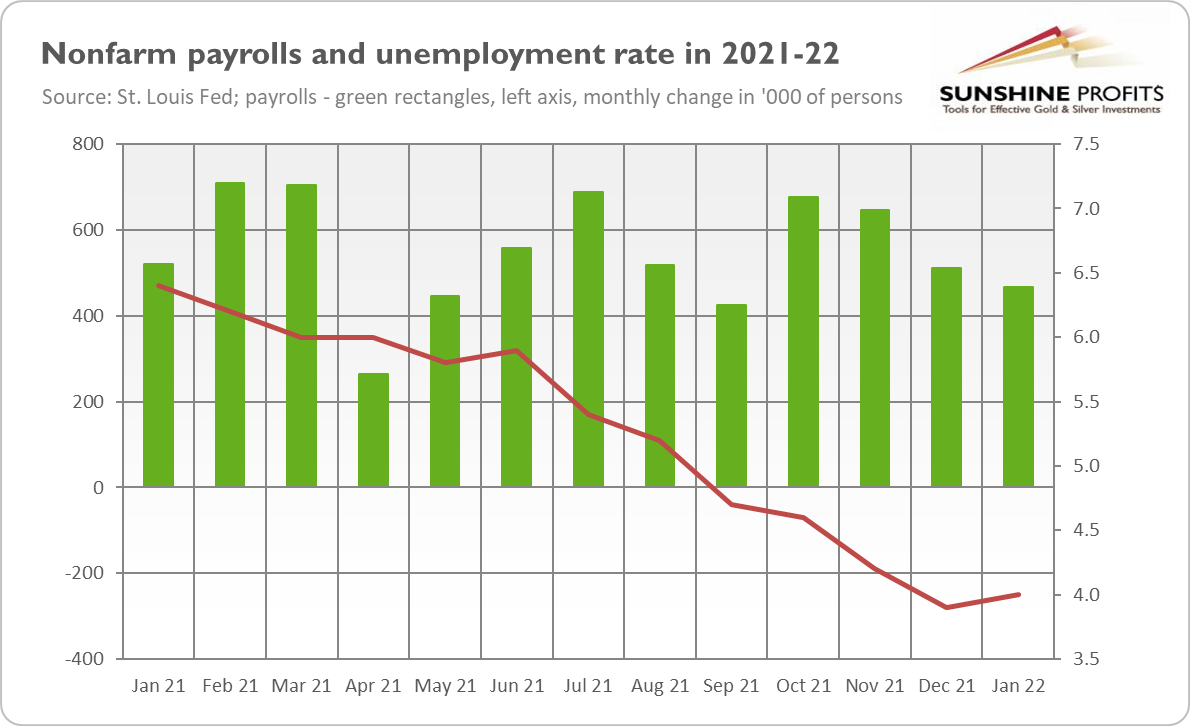

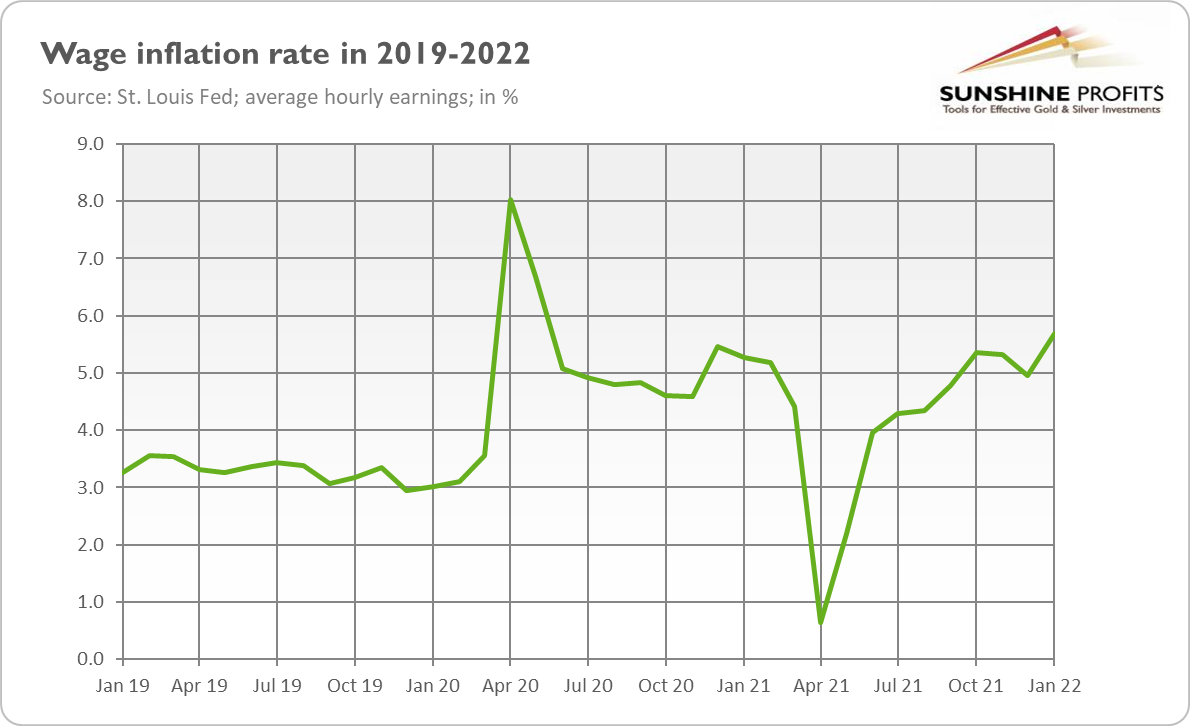

The unemployment rate increased slightly from 3.9% in December to 4% in January, as the chart above shows. However, it was accompanied by a rise in both the labor force participation rate (from 61.9% to 62.2%) and the employment-population ratio (from 59.5% to 59.7%). Last but not least, average hourly earnings have jumped 5.7% over the last 12 months, as you can see in the next chart. It indicates that wage inflation has intensified recently, despite the surge in COVID-19 cases that was expected by some analysts to dent demand for workers.

Hence, the January employment report will cement the hawkish case for the Fed. Rising wages will add to the argument for decisive hiking of interest rates, while the surprisingly strong payrolls will strengthen the Fed’s confidence in the US economy.

Implications for Gold

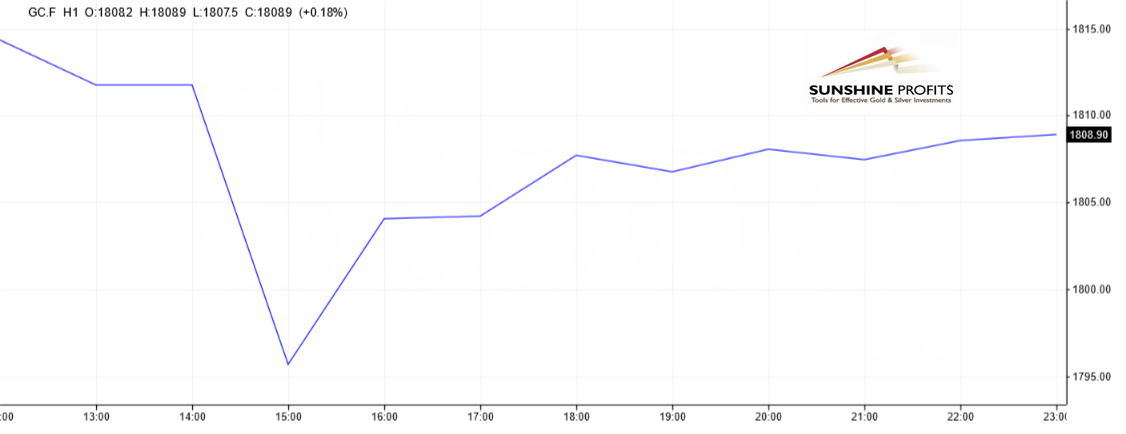

What does the latest employment report imply for the gold market? The unexpectedly high payrolls should be negative for the yellow metal. However, while gold prices initially plunged below $1,800, they rebounded quickly, returning above its key level, as the chart below shows.

Gold’s resilience in the face of a strong jobs report is noteworthy and quite encouraging. After all, the report strengthened the US dollar and boosted market expectations of a 50-basis point hike in the federal funds rate in March (from 2.6% one month ago to more than 14% now). Such a big move is unlikely, but the point is that financial conditions are tightening without waiting for the Fed’s actual actions. In the past, gold disliked strong economic reports and rising bond yields and showed a negative correlation with nonfarm payrolls, but not this time. More generally, although long-term fundamentals have turned more bearish in recent months, gold has remained stuck at $1,800.

However, last week, two factors could have supported gold prices. The first was rising volatility in the equity market. The S&P 500 Index dropped almost 500 points, or 10%, in January, as the chart below shows. Although it has recovered somewhat, it still remains substantially below the top, with the tech sector experiencing weakness. On Thursday, the shares of Meta, Facebook’s parent company, plunged more than 20%.

The second potentially bullish driver was last Thursday’s meeting of the ECB’s Governing Council. The central bank of the Eurozone was more hawkish than expected. Christine Lagarde acknowledged inflationary risks and said that she had become more concerned with the recent surge in inflation. According to initial estimates, the annual inflation rate in the euro area amounted to 5.1% in January 2022, the highest since the common currency was created. Lagarde also backed off her previous guidance that the interest rate hike was “very unlikely” in 2022. The ECB’s pivot – the central bank opening the door for the first rate increase since 2011 – boosted the euro against the greenback.

The bottom line is that gold has made itself comfortable around $1,800 and simply doesn’t want – or is not ready – to go away in either direction, at least not yet. The battle between bulls and bears is still on. I’m afraid that, given the relatively aggressive monetary and financial tightening, the sellers will win this clash and gold will drop before the bulls can regain control over the market.

However, recent gold’s resilience indicates that there is an underlying bid in the markets and bulls are not giving up.

Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

This article was originally published here

Leave a Reply