It’s official: Inflation is easing up from the historic pace it reached back in June 2022.

Bullion.Directory precious metals analysis 18 January, 2023

Bullion.Directory precious metals analysis 18 January, 2023

By Peter Reagan

Financial Market Strategist at Birch Gold Group

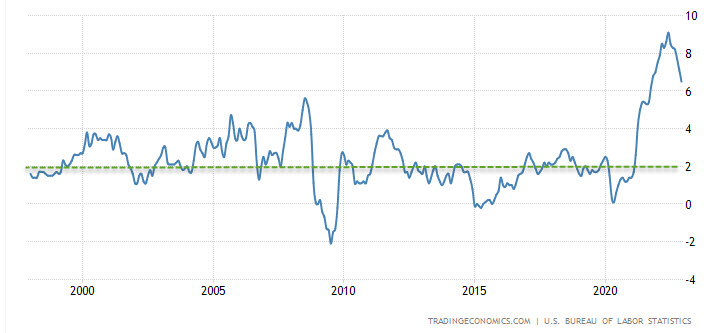

You can see the last five years of inflation reflected on the line graph below. Note that I’ve added a green line indicating the Federal Reserve’s 2% target, just to highlight exactly how far away it is:

Modified, original chart via Trading Economics

Naturally, this “inflation is under control” story is what the Biden administration is currently running with (as any POTUS would, from either side of the aisle). Specifically, on December 13th, the President announced:

We learned last month that the inflation rate came down, down more than experts expected. In a world where inflation is rising in double digits in many major economies around the world, inflation is coming down in America.

Unfortunately, that narrative isn’t telling us anything remotely close to the full story.

A more complete picture starts with examining the specific categories of goods and services that are seeing the highest price increases. A handful were summarized in a recent analysis provided by a Heritage Foundation analysis, and it doesn’t look good:

New data released Thursday showed prices have risen 13.7% since President Biden took office, as measured by the consumer price index (CPI).

Note the analysis is measuring price increases over all 24 months of the Biden administration. That does make sense – because, even when inflation is transitory, its damage is permanent.

The Heritage Foundation report continues:

The overall price level declined 0.1% last month but increased 6.5% in 2022, a year which saw four-decade-high inflation. Even as the increase in the CPI slows, many consumer staples remain highly elevated compared to the start of the Biden administration: eggs are up 189.9%, ground beef 21.1%, gasoline 44.3%, electricity 21.3%, transportation services 19.5%, and housing 11.8%.

Again, it’s notable these price increases are measured over 24 months. (Most CPI reports are limited to just one year – which, to be honest, disguises the damage.)

Imagine going to the grocery store and thinking a dozen eggs would cost $3, only to find out they are priced at a staggering eight dollars a dozen when you get there!

Unfortunately, this isn’t a thought experiment. This is reality.

High inflation robs retired Americans of their fixed income, namely their Social Security benefits – even when their payments are adjusted for inflation.

These cost of living adjustments (COLAs) simply can’t keep up…

Social Security COLA falls short (again)

How has the economic slowdown affected retirees? One way has to do with inflation and how it punishes those people and families struggling to make ends meet on a fixed income.

Normally, the Social Security Administration attempts to account for inflation by providing an annual cost of living adjustment (COLA).

Unfortunately, even during periods of “normal” inflation, the COLA lags behind. It doesn’t help that the mainstream media portrays it as a “raise.” (It isn’t.) On top of that, these aren’t “normal” economic times.

As expected, the COLA evaporated from the start of the pandemic through 2022, and has cost retirees big time:

Average Social Security benefits fell short of inflation by about $1,054 from the start of the pandemic through 2022, according to a new analysis from the non-partisan senior group. That excludes Medicare Part B premiums, which are typically deducted directly from Social Security benefit checks. It’s going to be extremely difficult for people to recover. So will retirees who rely on Social Security for income finally catch up in 2023 after record high inflation?

Unlikely. Even if inflation ran ice-cold over the next few months (which, let’s be honest, it won’t), they’d still be behind.

That’s because purchasing power lost to inflation would have to have a COLA for every single month that inflation ran hot.

That isn’t going to happen. Not a good situation for retirees.

What about the rest of us, those still in the workforce? Turns out retirees aren’t the only ones paying the price…

Inflation cost the average American family $7,400

What would you do if you suddenly found an unexpected $7,400 in your bank account?

Would you save it? Invest it? Spend it on a well-deserved vacation?

For most of us (me included!), deciding what to do with such an unexpected windfall is pretty easy.

Now, imagine the opposite – you’re paying for groceries and your debit card is declined. You try again – declined. Confused, you log into your bank account with your phone and discover, to your shock, your balance is $7,400 lower than you thought.

How would you feel? What would you think? Would you be confused, angry?

Let me be clear: This is EXACTLY what inflation has done over the past 24 months. One final extract from the Heritage Foundation report:

Prices have risen so much faster than wages that the average family has lost $6,000 in purchasing power. As the Federal Reserve belatedly raises interest rates to fight the very inflation it helped cause, interest rates are rising fast, increasing borrowing costs by $1,400. Combined with falling real wages, the average family has effectively lost $7,400 in annual income since Biden took office.

Instead of changing your bank balance, money-printing has diluted your purchasing power – prices go up, and your purchasing power vanishes without a trace.

Most people don’t understand inflation, how it works or why it matters. They think more money means more wealth. (In fact, when that “more money” comes from expanding the money supply by deficit spending, “more money” just reduces the purchasing power of every other dollar in the world.)

If you haven’t already considered diversifying your savings with inflation-resistant investments, I respectfully urge you to do so right now. While you’re at it, ask yourself whether owning the “ultimate asset” might help you protect your wealth…

“Gold is the ultimate asset and the ultimate money”

If you’re looking for a strategy for coping with high inflation, you certainly aren’t alone!

Retired Merrill Lynch broker Stewart Thomson has a recommendation:

The bottom line: Gold is the ultimate asset and the ultimate money. If governments use fiat money, investors need to own lots of gold because the governments will inevitably spend excess fiat and borrow too much of it, devaluing the purchasing power of the citizens over time.

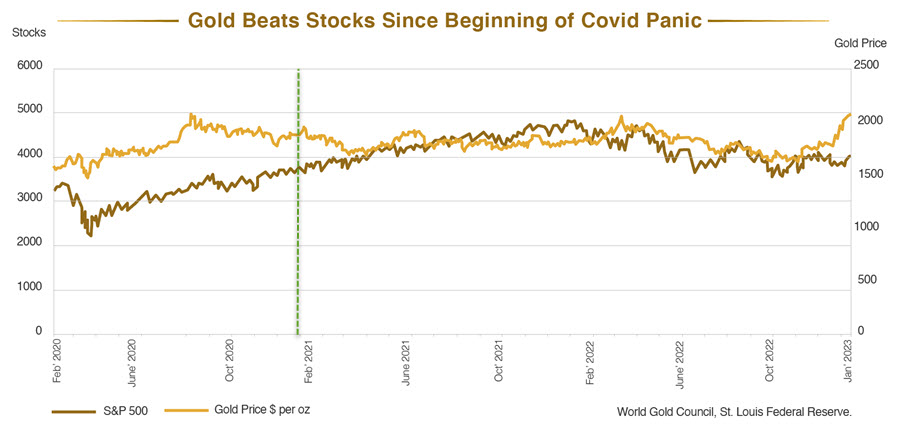

So how has the gold price responded recently? Let’s take a look…

(Note: I added a green line approximating the date President Biden was inaugurated.)

Inflation may be transitory – although, based on historical evidence, it’s more likely to last for the next ten years – but physical gold and silver are forever.

Whether you’re looking for ways to protect your current or future purchasing power from devaluation from inflation, a Precious Metals IRA might be exactly what you need.

If diversifying with physical precious metals isn’t right for you, please make it a priority to insulate yourself and your family from rising prices.

Considering how much we’ve already lost, doing so now seems like a prudent choice.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Leave a Reply