The U.S. economy isn’t a light switch that can be flipped on and off at will. Yet that didn’t stop the majority of state governors from turning off their economies in 2020 — causing financial misery for tens of millions of people.

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

An economic framework called Modern Monetary Theory (MMT) governs the financial world today, but fails to account for the consequences of its practices. In fact, MMT is leading us to an extremely dangerous financial situation that could blow up at any time.

Full Article →Since the pandemic began a year ago, the term “new normal” has become part of the American lexicon. Not “new” as in better or improved. But rather “new” as in contrast to the way things used to be. Much of the mainstream discussion argues that returning to the “old” normal isn’t likely to happen. Things like pre-pandemic employment, closer-to-normal price inflation, and less economic uncertainty just aren’t on the map.

Full Article →In a recent interview, Digix co-founder and COO Shaun Djie spoke about the comparisons between gold and bitcoin, the metal’s role in the monetary system and what investors can expect in short-term economic conditions.

Full Article →IRAs Bridge the Social Security Income Gap

We’ve reported many reasons why you should not rely solely on Social Security to fund your golden years. Those reasons are in addition to the official advice that Social Security is only designed to replace about 40 percent of your pre-retirement income. Which naturally might get a retirement saver to think: “What about the other 60 percent?”

Full Article →Gold Price to $2,000 in 2021: BoA Analysts

Bank of America sets a 2021 gold price target of $2,000, why silver could jumpstart the next precious metals bull cycle, and thefts of catalytic converters from cars are on the rise, driven by high prices in platinum and palladium.

Full Article →Yellen Forces Fed to Begin Downsizing from $7.5 Trillion

The Fed attempts to maintain control of various rates (including inflation, unemployment and long-term interest rates) through its monetary policy decisions. In the past, poor choices arguably led to both the dot-com bubble and the Great Recession. But that’s old news.

Full Article →Near-Zero Rates Sound Good (Until This Happens)

In some cases, the idea of a “near-zero interest rate” is a good thing. For example, if you qualify for 0% interest when you buy a car, you save money…

Full Article →Weekly News: US Mint All Out of Silver and Gold

Stories include: U.S. Mint can’t keep pace with demand again, Goldman chief calls silver a supercharged version of gold, and amateur prospector unearths a long-lost golden treasure from Medieval times.

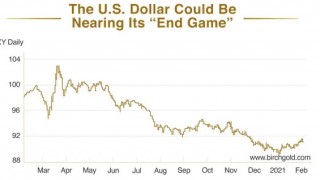

Full Article →Is the U.S. Dollar Nearing the “End Game”?

Jim Rickards said back in 2016: “The dollar won’t lose its reserve currency status overnight” — and he was right. But a new and disturbing signal could finally be revealing the end game.

Full Article →Weekly News: Silver Skyrockets on Retail Thrust

Stories include: Day traders piling into silver as analysts predict $50 price, gold’s reign as the top asset, and $400 million of civil war gold buried in Pennsylvania might have come to the surface.

Full Article →Potentially Catastrophic Inflation Surge Slips Under Radar (Until Now)

You’ve read about housing market bubbles, stock bubbles, and even credit bubbles. But the next bubble you’re about to discover could be even more dangerous, and may have even more far-reaching consequences.

Full Article →Does America REALLY Have a Retirement Crisis?

Because no matter what the headlines say, tangible physical assets can act as a hedge against inflation and diversification helps protect your savings no matter which direction the stock market heads. Take the steps you need to keep your retirement on track with a “sleep well at night” savings strategy.

Full Article →What Will Biden Mean For Retirement Plans?

When it comes to Social Security, taxes, and especially 401(k) plans in general, it goes without saying that Joe Biden has very different plans than President Trump.

Full Article →Fed Return to ‘Inflation Nation’ Could Increase Retirement Risk

Think of retirement savings like a football team: Making money is your offense and protecting your savings is your defense. Despite the potential for much higher price inflation (no matter how high it actually goes), gold and silver are looking good as potential hedges against the future of “Inflation Nation.”

Full Article →A very risky stock market and ballooning government debt should all keep investors close to gold, especially as the latter issue grows worse amid efforts to stimulate the economy in the wake of the pandemic

Full Article →The US FedCoin Takes Another Step Closer to Reality

How far in the future FedCoin will launch remains to be seen, but it sure seems like the U.S. is closer to the first major overhaul of the monetary system (and your private life) in decades.

Full Article →$3,500 could be the next long-term target for gold, the dollar’s status as the global reserve currency could be slipping, and gold’s jump looks to have come from unexpected sources.

Full Article →Stories include: The Fed is in no position to respond to the spike in inflation, Swiss hedge fund is offering clients a precious metals shield against inflation, and Michigan jeweler launches his own Treasure Quest.

Full Article →If people aren’t paying the bill that puts a roof over their head, that doesn’t paint a pretty picture for the state of the U.S. economy. Sadly, it looks like that picture could be taking shape right now.

Full Article →According to a study by the Consumer Finance Protection Bureau (CFPB), almost half of Americans do not have enough savings to maintain original spending levels past the first five years of their retirement.

Full Article →The fact the Fed is buying corporate bonds at all signals favoritism toward big existing players — indebted lumbering behemoths that can’t innovate. It’s not as if the Fed is going to take the largesse it creates from thin air and spread it around to a plucky but capital-starved startup, right?

Full Article →Part of the 2010 Dodd-Frank Act, the “Volcker Rule” was intended to prevent big banks from taking irresponsible risks. But in spite of an already-uncertain economy, regulators are now proposing to ease these rules…

Full Article →In another episode of “Strange 2020”, banks have become flush with deposits. But not in the way you might expect. In one month, deposits grew by $865 billion, which beat the record for an entire year

Full Article →As if Social Security didn’t already have enough challenges ahead, we now have yet another complication. Not surprisingly, it’s a ripple effect from COVID-19. Before coronavirus hit the scene, experts agreed that if nothing was done, Social Security would be facing a 21% cut by 2035.

Full Article →The national debt currently looks like a runaway freight train. Not only is it clocking in at $26.1 trillion at the moment, but it has made the jump of the last few trillion dollars fast… Really fast.

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.