Gold trades near $1,930 as analysts are divided on the next big move

Bullion.Directory precious metals analysis 30 January, 2023

Bullion.Directory precious metals analysis 30 January, 2023

By Peter Reagan

Financial Market Strategist at Birch Gold Group

As he tells us, the report of inflation slowing its climb seems to have had a negative effect on gold for the week.

Strangely, many commenters seem to forget how rapidly gold’s price can move. When we compare the measure of price volatility (beta in finance jargon), gold is incredibly stable compared to equities. Gold’s beta of 0.07 means its price moves about 1/14th as much as the equity market. That’s the kind of stability you want from a safe haven, store-of-value asset class.

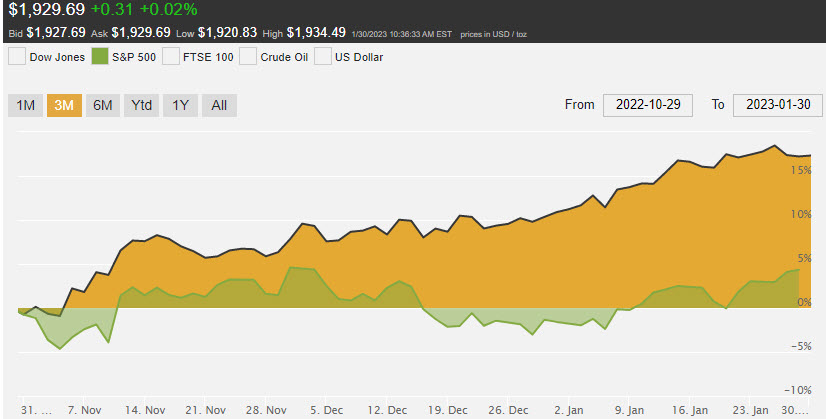

On the other hand, gold’s low volatility doesn’t say anything about its overall trend. Just for fun, let’s take a look at gold’s price over the last three months:

Gold price vs. S&P 500, 10/29/2022 – 1/30/2023.

Recently, there’s been a very clear trend in gold’s price. Low volatility plus a strong upward trend is a recipe for slow, steady price growth. You’re looking at an 18% increase in gold compared to a 5% increase in the S&P 500 – in just three months.

That’s not enough for some people. Despite its performance as a store of value throughout 2022, despite its exceptional three-month performance, we’re seeing stories attempting to explain why gold isn’t rising even higher, even faster.

Well, maybe we can glean something useful from these stories.

According to Wagner’s analysis, gold’s price would be higher except for the most recent inflation report, which declined to 4.4% from 4.7% year-over-year. He uses an extremely complex chart with candlesticks and moving averages and support lines to support his case – but the chart is irrelevant.

Wagner’s story is a simple one: gold goes up when inflation rises, and doesn’t when inflation declines.

Let’s explore this idea… Official inflation reports are questionable at best. You might remember what Ron Paul says about official inflation reports. Recently, the Bureau of Labor Statistics (BLS) announced they’ll change their inflation measuring methodology yet again. So how much can we truly believe whatever gauge the Federal Reserve uses?

Regardless! Because inflation seems to be “cooling” (continuing to destroy the dollar’s purchasing power, just not quite as quickly as before), Wagner things sentiment will turn against gold. Lower inflation means gold will lose, right?

Only for those who can’t do math. Inflation is cumulative. The purchasing power of the dollar doesn’t recover unless inflation goes (and stays) negative – that’s called “deflation,” a phrase you might not be familiar with because it’s virtually unknown in the modern world.

Imagine inflation goes to 0% tomorrow. Gold’s price no longer appreciates thanks to a weakening dollar. What forces would exist to support gold then?

- Its historic track record as a store of value (gold doesn’t rely on any central bank for its intrinsic value)

- Its status as a safe haven in times of economic crisis

- Demand – from global central banks, institutional investors and private investors

The fact is, gold doesn’t need inflation to be a store of value or a safe haven. True, gold demand does increase during times of high inflation or economic crises. The major forces that push gold’s price higher are loosely connected to one another. They can operate independently.

All this is to say, I don’t think we need to use a complicated chart to tell a story about why gold “only” rose 18% in the last three months. Maybe Wagner has something useful to say – but if so, I couldn’t quite figure out what it was.

Gold and palladium were the winners in 2022 – why did silver and platinum lag?

The London Bullion Market Association released its annual average prices for each of the four IRA-approved precious metals, and there’s no denying the results: while gold and palladium held up, silver and platinum lagged. Why?

Gold’s performance last year – well, we just discussed it. I won’t repeat myself – except to add that gold is seeing the best January in over a decade.

Palladium’s average of $2,112 last year is significant, up 7% over the 2021 average price. Should palladium really be trading above gold? That has been a big question for some time, and the answer, for the time being, is yes. High prices did little to reduce demand, and all that really seemed to matter is that Russia produces nearly half of the world’s palladium. Here we have a straight-forward story of inelastic demand meeting supply constraints – and the result is higher prices.

What can we say about platinum? Having once enjoyed palladium’s spot above gold (nearly 2.5x higher per oz in 2008), in 2022 platinum averaged $960/oz. When will it get respite? We know it’s extremely scarce and has been on the tail end of a massive, regulations-driven bear market for nearly a decade. Expectations are that platinum will rise again – it’s just that nobody can tell us when.

Then there’s silver, with a decidedly low average of $21.73 last year. That doesn’t tell the whole story, though – silver’s price ranged from $26.50 to below $18/oz. last year. That’s significant volatility! Remember that finance metric, beta, I mentioned previously? Well, silver has a beta of 0.79 – still lower than equities, but ten times higher than gold’s volatility.

That volatility, depending on your perspective, either offers bargains and opportunities – or a gut-churning roller coaster ride. It all depends on your perspective. The volatility hasn’t been denting demand. The U.S. Mint had significant challenges meeting demand for silver coins, in fact – while both Perth Mint and the UK’s Royal Mint reported historic if not record demand.

What’s next for silver? I don’t know – although I do expect investor demand to remain high, and industrial demand to remain high. Whether that will lead to increased production, though, I have no idea. I do know that silver supply is less elastic than gold’s supply – most gold comes from dedicated gold mines, whereas a significant amount of silver is recovered as a by-product from industrial metal mines (primarily zinc, copper and lead).

Overall, it looks to be an interesting year for silver!

If we ignore a recession, does it go away?

Analyst Alasdair Macleod tackles the question of economic recession in his vigorous style. The last two instances when economic conditions were this bad in the U.S., massive quantitative easing was the only thing that kept the economy moving. While this worked, each time, it set the stage for a larger, more destructive bubble to follow…

Now, Macleod asks a question that seems to be one everyone should be asking, yet nobody wants to. Is the U.S. really going to print more money to counter the damage caused by printing money?

Besides his fondness of alcohol, we’ll remember Finance Minister and European Commission President Jean-Claud Juncker for the timeless quote:

When it becomes serious, you have to lie.

Macleod, too, is of the opinion that the government’s not reporting inflation honestly, and that the reality is much worse. (Your individual expenses will tell the only story that really matters for you and your family.) He outlines in some detail how the Bureau of Labor Statistics is now being used to undersell what was already an inflation 50% higher than official reports. And remember, the BLS is openly telling us they’re changing how inflation will be measured. Which makes me wonder: what aren’t they telling us?

In line with this, we’ve seen a lot of refusal to acknowledge that there is a recession, to the point of questioning what’s necessary to acknowledge there is one. An Empire Manufacturing report of -32.9 for last month doesn’t seem to have had what it takes.

Macleod uses basic math to conclude that the U.S. deficit will hit $3.5-$4 trillion this year alone, which could easily become $5T if countries continue to dump Treasuries with the same rate as they have. And I have to say, it’s shocking how quickly the word “trillion” loses its meaning after repetition.

It took the U.S. two centuries to burden itself with the first $1 trillion in debt. Two centuries. In the forty years since, that debt has increased 30-fold. Think about that for a minute. Maybe owning U.S. Treasury bonds made sense forty years ago (when interest rates were in the teens). But today?

Does anyone actually expect the U.S. to settle its debts in any meaningful way?

And as the bond market declines, as the Treasury Department desperately flogs its IOUs at home and abroad to an increasingly skeptical customer base, what safe haven will investors turn to?

History knows the answer. And those who buy gold today for an uncertain tomorrow know, too.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Leave a Reply