It’s a well-known fact by now that the Social Security Trust Fund is in big trouble. It’s also a fact that without a reasonable solution by 2034, retirees will face a serious reduction (20-25%) to their monthly Social Security benefit. The last time the trust fund was depleted like this was back in 1982.

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

The Incoming Gold Shortage Nobody Is Talking About

This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: How a slight rebalancing to savings could shake the gold market, more bullish forecasts for gold and gold’s movement other currencies hints at its future trajectory. Will there be enough gold to go around?

Full Article →Powell Scolds Biden “The Debt is Unsustainable”

There really is no way to sugarcoat the current debt trend. It’s already insane (and it’s going to get worse) Following is even more data that further confirms the fact that the total debt load for the American economy is unsustainable. The debt also appears to have caught the attention of central bankers (in a meaningful way this time).

Full Article →Global Currency Shift as Dollar Cannibalizes Itself

This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Global de-dollarization as a major driver of gold prices, gold demand statistics for 2023, and how silver is becoming more industrial by the day. A safer safe haven: The U.S. dollar is losing ground to gold…

Full Article →“Tax Relief Act” Exposed: Something’s Ominous…

As it stands right now, it appears like Biden’s entire first term will have been plagued by varying degrees of unacceptable price inflation. No matter how the corporate media spins it, he just can’t seem to lead the country out of this persistent economic trend. The rate of price inflation is easing, but core inflation remains at a pace not seen since the early 1990s.

Full Article →The 4 Financial Scams to Watch Out For in 2024

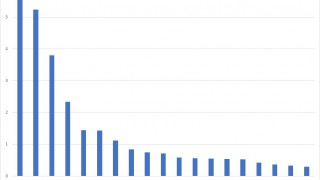

In 2023, fraudulent activities inflicted over $7 billion in losses to American consumers within the first nine months, up 5% from the year before. Financial scammers are quick to adopt new technologies to steal money from their targets. Thanks to the rapid growth of artificial intelligence tools, criminals can now perfectly copy your loved one’s voice

Full Article →Analysts Say Gold About To Have A Massive Bull Run

This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: CPM Group says 2024 and 2025 will be even better for gold, why silver stayed dormant in 2023, and gold is getting pricey in Egypt…

Full Article →We Regret to Inform You, Janet Yellen is at it Again.

We regret to inform you, Janet Yellen is at it again. This time, it appears like she’s campaigning for another Biden term by highlighting his economic “success.” After all, he probably needs all the campaign help he can get. Yellen’s “strategy” isn’t all that novel. She seems to be starting by leveraging Biden’s infrastructure spending but…

Full Article →Nearly Everyone Falls For These Two Savings Traps

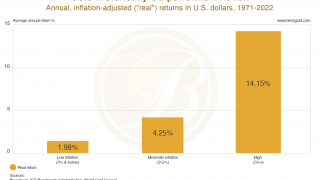

While quite a few personal finance pundits have suggested that savers can expect a 12% annual return, when you incorporate the impact of volatility and inflation, 7% is a more accurate historical estimate for an aggressive investor and 5% would be more realistic for a more conservative saver.

Full Article →A Little Good News on Inflation Doesn’t Cover the Bad

After 3 years of relentless (sometimes historic) inflation, it’s about time some good news made its way through the economic carnage. Some categories of goods have finally moved into deflationary pricing. That is, a handful of items are starting actually decline in price. Better late than never, even though all consumer price inflation isn’t deflationary just yet.

Full Article →Two Undeniable Gold Trends Coming In 2024

This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Are the comparisons with 2008-2011 in gold holding up? The World Gold Council’s 2024 outlook for gold and China’s gold-buying streak extends to 14 months…

Full Article →The Bidenomics Job Creation Myth

The White House is busy leveraging the media to tout the headline 216,000 jobs that were added in December. That was a whole lot more than the 170,000 economists predicted. The administration is eager to tell you this is a strong finish to 2023’s spectacular job growth. Bidenomics is winning! Lets look more closely at the propaganda…

Full Article →This week, Your News to Know rounds up the latest top stories involving precious metals and the economy. Stories include: A decade of gold in review, forecasters call for $2,200 gold in 2024 and physical gold bullion is coming to a retail store near you. With a decade of Your News to Know), we felt like doing an overview of the stories that stood out the most.

Full Article →The American Dream vs. Bidenomics… This Is Getting Ugly

Back when inflation was heating up to historic levels in July 2022, President Biden tried to downplay inflation as “unacceptably high” but “not as bad as it looks.” The truth was actually pretty dire back then, as an increasing percentage of Americans were struggling to afford putting food on their tables. In fact, they still are right now.

Full Article →There is a phrase you will hear a lot over the coming decade: Artificial Intelligence (AI). Not that you haven’t heard it already. But thanks to multiple major breakthroughs in 2017, like how language is used across different AI development efforts, innovation has accelerated at a breakneck pace. And there’s no sign of it slowing down.

Full Article →Why Gold and Silver Just Surged

This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Reflecting on recent gold price changes, China’s obsession with safe-haven gold and could central banks break last year’s gold buying record?

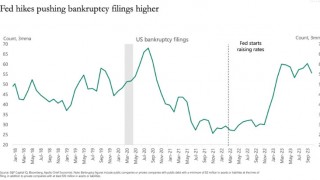

Full Article →Bidenomics is Bankrupting the Nation

Back in July, we reported on the Bidenomic “pay cut” of $5,600 per year that every American has suffered during Biden’s term. Unfortunately, the failures of Biden’s economic policies are starting to pile up. They’re almost impossible to ignore already. The media won’t be able to put a positive spin on it for much longer…

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Gold passes $2,100 to post a new all-time high, the only two solutions to the global debt crisis aren’t applicable, and a recent government study returns some very rough inflation data.

Full Article →Despite President Biden’s insistence that the U.S. is experiencing the “greatest economic recovery ever,” the evidence suggests otherwise. In fact, the U.S. economy could be heading for one of the most painful periods of economic turmoil of the last 15 years. And it’s all thanks to the disastrous policies known as “Bidenomics.”

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Gold’s downside doesn’t sound so bad these days, where we are on the 1970s track, and gold demand surging as Indian buying returns to pre-pandemic levels.

Full Article →With all of the unanswered questions floating around in today’s economy (like “When will the recession start?), one thing is fairly certain – Today’s economic uncertainty is likely to stick around for a while. With that in mind, at some point you might wonder if you’ve saved enough to enjoy a comfortable and stress-free retirement in the face of that uncertainty…

Full Article →This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Gold as sentiment-driven as ever, $34 silver soon, and U.S. Mint’s gold sales have already outpaced last year’s figures. The U.S. federal government is indebted by over $33 trillion, and it matters…

Full Article →Dollar Weakness Could See Gold Surge to $2500

Experts forecast a shaky dollar will send gold to $2,500 next year. This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Gold forecasts ahead of the election, Powell feints as U.S. economy crumbles, and Kuwait bolsters its place on the list of gold consumers.

Full Article →Why US Heading Into Another Great Depression

First it was the COVID economic panic that started in March of 2020. Then it was Biden’s disastrous mishandling of the military withdrawal from Afghanistan in 2021. Almost immediately following that disaster, the Biden administration went on a multi-trillion-dollar deficit spending spree that dramatically worsened inflation. Not long after, Biden led …

Full Article →If you want to build a house that can withstand the test of time, you can’t have a weak foundation. So you have to build a solid foundation. The same idea holds true for your financial “house.” Your retirement savings plan has to be built on a strong foundation. Don’t spend money you don’t have – Live within your means!

Full Article →Central Banks Making HUGE Gold Moves

This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Central bank gold buying on track to shatter last year’s record, a different take on gold’s price and who wants a gold token instead of physical gold? 2023 may set another new record for central bank gold buying

Full Article →Why When Investors Sour on Risk, They Buy Gold

This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Gold doesn’t want to leave $2,000, how the U.S. government has indebted you by around $100,000, and Canada releases 2023 coin from single-source mine, while firms like Citi are resuming the purchase of Russian metals

Full Article →BRICS Pay Propels Half the World into Dedollarization

If you don’t already realize that dedollarization is happening, there’s no clearer proof than BRICS Pay. BRICS Pay is a new blockchain-based payment system that enables members of the BRICS countries (Brazil, Russia, India, China, and South Africa) and their partners to make financial transactions in a whole new way.

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.