Back in July, we reported on the Bidenomic “pay cut” of $5,600 per year that every American has suffered during Biden’s term.

Bullion.Directory precious metals analysis 15 December, 2023

Bullion.Directory precious metals analysis 15 December, 2023

By Peter Reagan

Financial Market Strategist at Birch Gold Group

So, let’s start with the basics. Washington Monthly published a piece that revealed why people’s incomes are still suffering as we close out 2023:

Before taking account of inflation, Americans’ per capita disposable income—including government transfers (checks for veterans, Social Security checks, and unemployment, for example) but after taxes—has increased by 5.2 percent under Biden, from $57,875 in January 2021 to $60,898 in October 2023. But after adjusting for inflation, per capita disposable income is down by 8.1 percent.

To be sure, two rounds of government stimulus checks were sent to most households in the early months of Biden’s term because of the pandemic jacked up people’s incomes. But because they were temporary, people’s incomes fell when the checks stopped.

Next up, the Mises website shed light on the unsustainable economic situation brewing right now, which could potentially include another round of red-hot inflation:

“The Philadelphia Fed’s manufacturing index is in recession territory. The Leading Indicators index keeps looking worse… Temp jobs were down, year-over-year, which often indicates approaching recession. Default rates are rising. ”

“These factors all point toward a bubble that is in the process of popping. The situation is unsustainable, yet the Fed cannot change course without reigniting a new surge in price inflation.”

Finally, we have an article on Yahoo! Finance that revealed a dangerous “default cycle” starting, which could mean major company failures over the coming months:

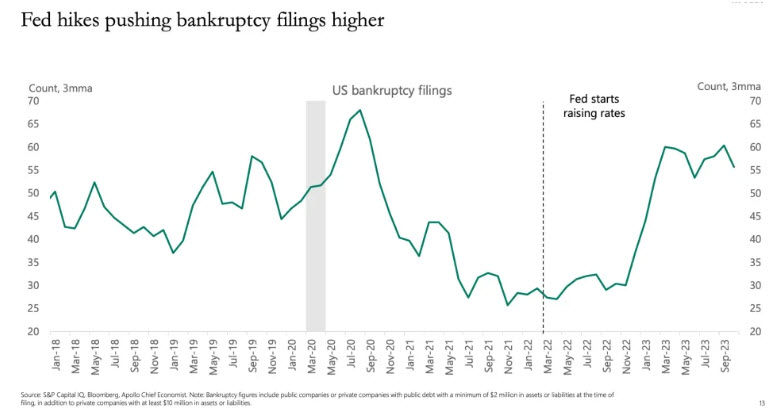

“With the Fed keeping rates higher for longer, higher debt costs will continue to weigh on earnings and interest coverage ratios over the coming quarters, and all companies will experience higher refinancing costs,” economists led by Torsten Sløk wrote in a credit market outlook released on Saturday.

Which is all to say that borrowing money has become too expensive for firms and a lot more of them are going to default.

“A default cycle has started with bankruptcy filings rising, and default rates will continue to rise over the coming quarters…”

That amounts to inflation destroying incomes, a multi-faceted economic bubble that could pop, and default rates indicating major company failures. You could already make the case that a near-term recession is possible.

Those indicators alone don’t bode well for Bidenomics.

But, unfortunately, once you examine the data that backs up the claims above, then things appear to be much worse…

The ongoing failure of Bidenomics (in charts)

If the disaster that economic pundits are alluding to above doesn’t cause alarm about the performance of Bidenomics thus far, then the real-world data that follows might make you stop and think.

First, bankruptcies that skyrocketed during the COVID pandemic are actually on the rise again, thanks in part to Fed rate hikes:

via Business Insider

Next, official manufacturing data for November 2023, including the main “diffusion index” are also still pointing to a recessionary economy:

Manufacturing activity in the region continued to decline overall, according to the firms responding to the November Manufacturing Business Outlook Survey. The survey’s indicator for general activity rose but remained negative. The indicator for shipments turned negative, while the indicator for new orders was positive but low. The employment index suggests steady employment overall, and both price indexes indicate overall increases in prices. The future indicators suggest that firms’ expectations for growth over the next six months remain subdued.

The diffusion index for current general activity increased 3 points but remained negative at -5.9 this month. This is the index’s 16th negative reading in the past 18 months. […] The diffusion index for future general activity fell from 9.2 in October to -2.1 in November, its first negative reading since May.

Making things a bit more concrete, the current Leading Economic Index has also convinced the Conference Board to stick its neck out and predict a short recession (which could turn out to be a longer one):

The Conference Board Leading Economic Index® (LEI) for the U.S. fell by 0.8 percent in October 2023 to 103.9 (2016=100), following a decline of 0.7 percent in September. The LEI contracted by 3.3 percent over the six-month period between April and October 2023…

The Conference Board expects elevated inflation, high interest rates, and contracting consumer spending—due to depleting pandemic saving and mandatory student loan repayments—to tip the US economy into a very short recession. We forecast that real GDP will expand by just 0.8 percent in 2024.

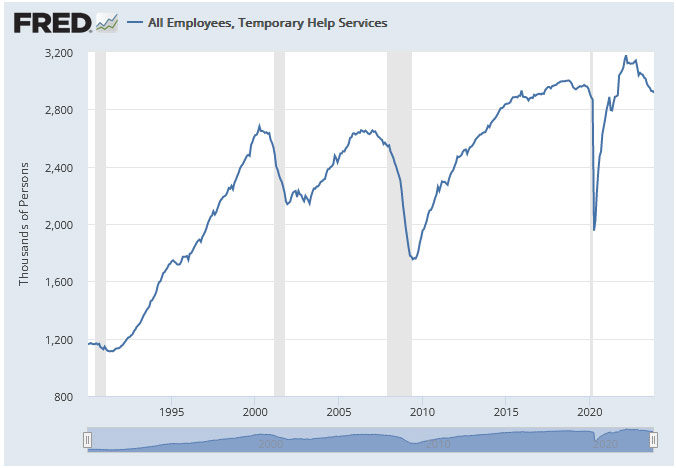

Even the little-known economic signals are hinting at an incoming recession. In this case, temporary jobs are tanking. As you can see from the chart below, each time that those jobs tanked it preceded every major recession since 1990:

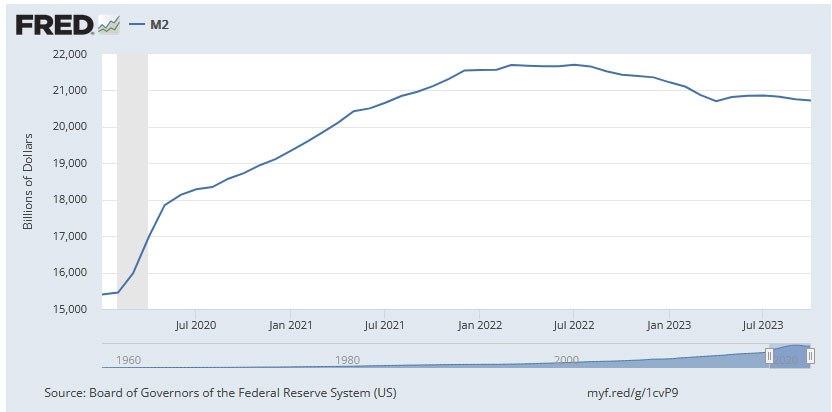

Finally, there’s the Federal money supply (M2), which is also shrinking, as you can see on the chart below.

This is virtually unprecedented in the last 50 years, as the money supply rarely plateaus, let alone shrinks:

In addition to what the Mises piece already pointed out above, here’s what it had to say about the shrinking M2 money supply (and it’s pretty dark):

Money supply growth can often be a helpful measure of economic activity and an indicator of coming recessions. During periods of economic boom, money supply tends to grow quickly as commercial banks make more loans. Recessions, on the other hand, tend to be preceded by slowing rates of money supply growth.

It should be noted that the money supply does not need to actually contract to signal a recession and the boom-bust cycle. As shown by Ludwig von Mises, recessions are often preceded by a mere slowing in money supply growth. But the drop into negative territory we’ve seen in recent months does help illustrate just how far and how rapidly money supply growth has fallen. That is generally a red flag for economic growth and employment.

After seeing the economic evidence that things could be in dangerous territory, the only thing left to consider is how to ride out any potential storm and preserve wealth.

After all, it seems fairly likely that things are only going to get much worse before they get any better.

Time for a retirement savings preservation plan?

Diversifying your retirement savings with precious metals like gold and silver could help you if you need to consider a safe-haven to store your money.

That’s because gold and silver have been historically proven to help preserve purchasing power (value), while they’re also considered inflation-resistant investments.

Bottom line: The best time to consider proper diversification is now. Among other options, that could help your retirement savings weather out almost any storm.

So don’t wait too long. Take back control of your financial future while there is still time. You can get the information you need to consider precious metals in our free kit.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Leave a Reply