The American Economy is Now Collapsing Under Bidenomics

Bullion.Directory precious metals analysis 27 December, 2023

Bullion.Directory precious metals analysis 27 December, 2023

By Peter Reagan

Financial Market Strategist at Birch Gold Group

The truth was actually pretty dire back then, as an increasing percentage of Americans were struggling to afford putting food on their tables. In fact, they still are right now.

Just recently, one economist even tried to justify the poor Bidenomic performance in an Atlantic article, emphasizing that people have more money now:

“Collectively, there’s still this coming to grips with the idea that we’re never going back to 2019,” Joanne Hsu, the director of consumer surveys at the University of Michigan, told me. “We’re in a new normal now, and we’re still adjusting to what that new normal feels like.” In this unfamiliar post-inflationary territory, people seem to care more about how much things cost than about how much money they have, even if economists insist that those things are symmetrically important.

The Atlantic appears to be criticizing people who are more concerned with rising costs than rising incomes. Yet costs have risen faster than incomes. So is it any wonder people are focused more on costs?

The reality is, most Americans don’t “have money” like Hsu and others suggest and, according to Bankrate, it’s mainly because of inflation:

Sixty-eight percent of people are saving less due to inflation or rising prices — up from 49 percent last year — followed by rising interest rates (48 percent) and change in income or employment status (44 percent).

Jim Rickards also shared a bit more reality about the current inflationary economy that consumers have been suffering under:

Here’s the reality and here’s the political narrative: Reality is that prices have been going up at the fastest rate in 40 years and they are still going up.

Inflation (on an annualized basis) was 9.1% in June 2022, 4.9% in April 2023, 3.7% in September 2023 and 3.1% in November 2023 (the most recent data available).

It’s true that the rate of inflation is coming down, but prices are still going up. They’re going up at a slower rate but they’re still going up.

Not only that, but past price increases are locked in so new price increases are applied to a higher base. This is killing American consumers.

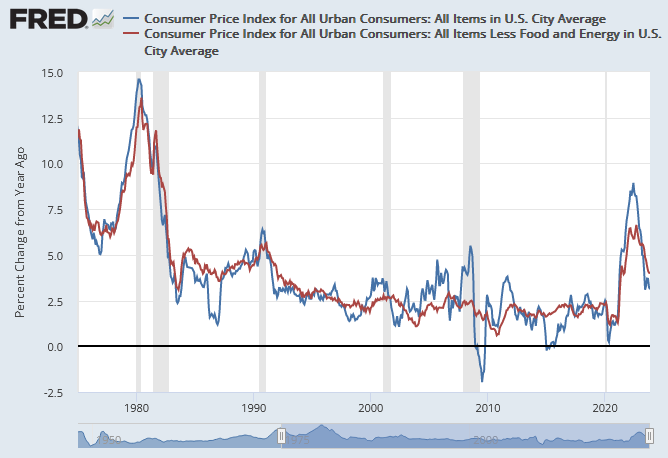

The inflationary reality that Mr. Rickards shared is reflected in clear terms on the official chart below, which shows inflation for both “all items” and “all items less food and energy” for comparison:

As you can clearly see on the chart above, inflation heated up noticeably during each of the recessions that occurred over the last four decades (1980s, 1990, 2000, and 2008).

But the Biden-era inflationary period also stands apart from others, which could help explain the rest of the economic “reality” we’re going to shed light on now.

Bidenomics is now a dirty word

According to official data, consumer sentiment is in the tank. An article on CNBC partly explained what that means:

Yet closely watched survey data from the University of Michigan shows consumer sentiment, while improving, is a far cry from pre-pandemic levels. December’s index reading showed sentiment improved by almost 17% from a year prior, but was still nearly 30% off from where it sat during the same month in 2019.

If recovering from the lowest consumer sentiment recorded in decades is supposed to be some sort of “success” for Bidenomics, that isn’t saying much.

It already appears like consumers know reality better than media pundits and economists do. But there’s more to the story…

News flash: “Many households are far from well-off”

Thanks mainly to still-rising interest rates and housing price increases that both started accelerating across the nation during the Biden era, Americans are still reeling.

In fact, a recent article warns that most households can expect that same scenario well into 2024:

Of course, this sunnier scenario of staying afloat financially without much difficulty does not apply to all Americans. The Bank of America economists note that when it comes to how savings and housing affordability have been distributed since the pandemic, many households are far from well-off.

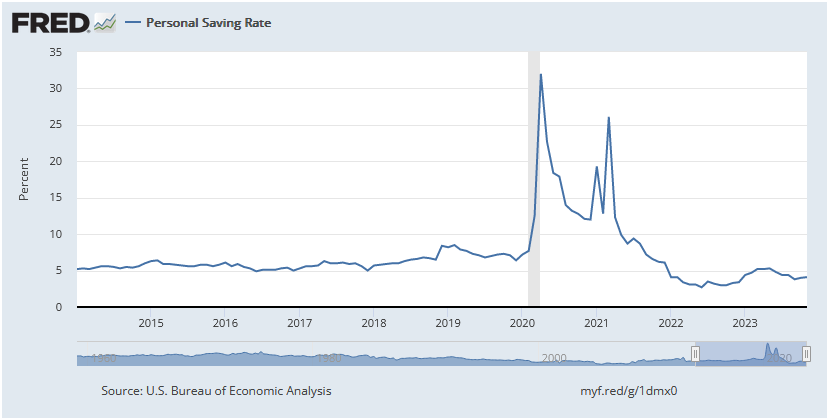

As you can see from the chart below, the official personal savings rate for households across the country is lower than it has been in decades, thanks primarily to inflation:

You can also see that most of the pandemic-era stimulus cash has run dry, so it remains to be seen how much longer consumer spending will prop up the economy.

Now might be a good time to consider ways to preserve your retirement savings.

Inflation-proof your retirement savings

To hedge against prices that are still on the rise, you need to preserve your purchasing power. Fortunately, both physical gold and silver have been fantastic stores of value, preserving wealth against the corrosive effects of inflation.

Diversifying your long-term savings with physical precious metals offers a number of benefits – wealth preservation is just one of them.

But don’t wait too long. Every day, deficit spending and money-printing take a bite out of your savings. Take control of your financial future while you still can. Learn how to trade your expiring paper money for real, physical precious metals in our free kit.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Leave a Reply