On Thursday May 12, the price of silver fell about a buck. But…

Bullion.Directory precious metals analysis 13 May, 2022

Bullion.Directory precious metals analysis 13 May, 2022

By Keith Weiner

CEO at Monetary Metals

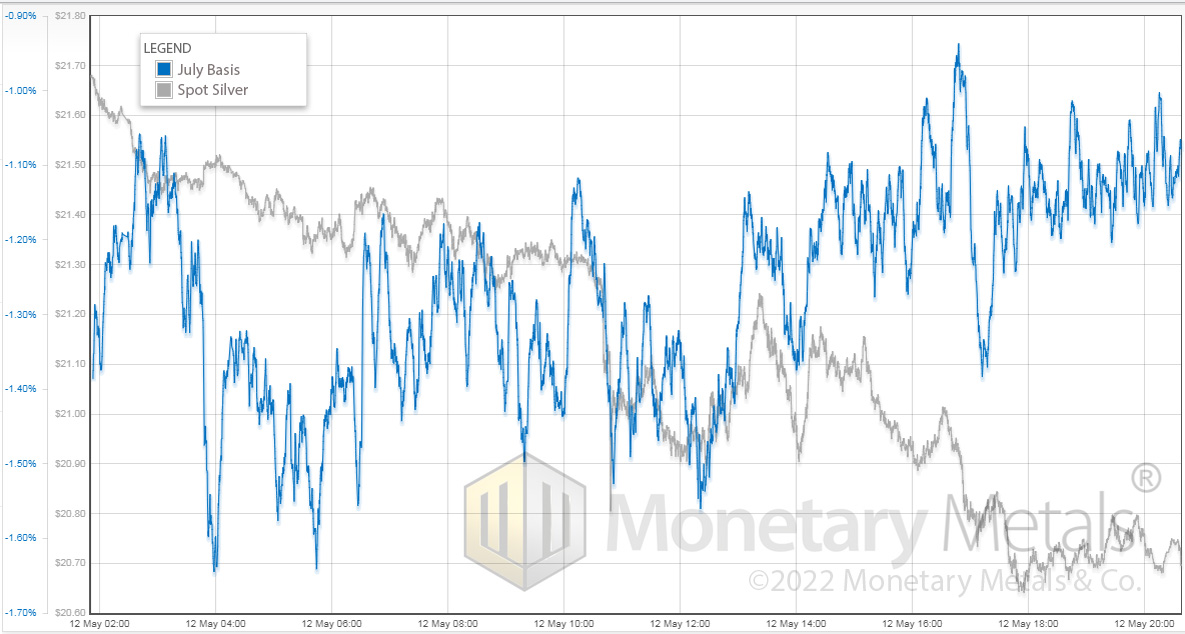

However, here we are using it for a different, simpler purpose. We want to see the relative moves in the spot price and the near futures contract price (i.e. July).

The day was mixed. Before noon (times are GMT), the basis is volatile but tends to fall with the falling price. The basis drops from around -1.1% to -1.5%. But after noon, something changed.

We see falling price and rising basis. The basis tends to follow the shape of the price line, but wends its way up as the price continues to fall. The day ends, with the basis at or above the level where it began, but the price is far below.

The Basic Theory Behind the Market Complexity

There is a theory which is often touted in the precious metals community. According to this theory, the banks sell futures to manipulate the price.

That is, they do so without means or intent to deliver the metal. There’s lots we could say about this, but for today let’s focus on one thing.

The price of a futures contract did not move relative to the price of metal.

If the banks were dumping paper contracts, then the price of these contracts would move down relative to spot. As we see on this chart, that is not how the action went down on Thursday. The conspiracy mongers don’t want you to see this chart.

Markets are complex. There is not only a large number of participants, but also a large variety in the kinds of participants. It’s not “stackers vs. banksters”.

That’s what makes it so fascinating to study them, and to trade when you can find a good setup.

Keith Weiner

Keith Weiner is founder and CEO of Monetary Metals, the groundbreaking investment company monetizing physical gold into an interest-bearing asset, paying yields in gold, not paper currency.

Keith writes and speaks extensively, based on his unique views of gold, the dollar, credit, the bond market, and interest rates. He’s also the founder and President of the Gold Standard Institute USA. His work was instrumental in the passing of gold legal tender laws in the state of Arizona in 2017, and he regularly meets with central bankers, legislators, and government officials around the world.

This article was originally published here

Leave a Reply