A labor market so frail that it is led by the elderly.

Bullion.Directory precious metals analysis 3 October, 2014

By Christopher Lemieux

Senior FX and Commodities Analyst at FX Analytics

I love grandma, but her friends are stealing all the jobs! A bit of satire, while the entire labor market’s strength is held into question… again.

Following the non-farm payrolls report, I tried to focus on how the quality of jobs were lacking in this employment “recovery.” Low-skill, low-wage jobs have been at the forefront. One would think these positions were being filled by teens in high school or maybe even the college grads who have not found suitable work. It’s not, it’s our grandparents.

I had CNBC on as background noise (I still question, why?), and I kept hearing an argument about the changing demographic whenever the 38-year low labor participation level was brought up. Perma-bulls love to mention that the US is getting older, and those doing so are living out their golden years in retirement – wrong!

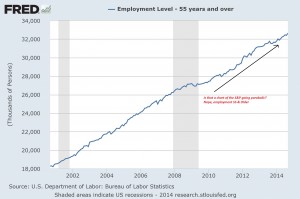

So, in order to support my case, I did a simple search on the Federal Reserve’s FRED database. And what I found is shocking. The prime working years are classified as age 25 to 54. This is when one would graduate college and earn the primary bulk of their income, usually gradually increasing throughout the years. Well, growth in this key demographic is lackluster (but it adds 100 points on the DOW every time). From the low made in 2011, following the Great Recession, until last month’s August report, the level of employed individuals within this demographic is comparable to levels seen in 1997.

Those “analysts” who say the participation rate is low because of an aging population should get back to reality, quickly. Employment 55 and older is parabolic. It was so dramatic I thought I accidentally typed in ‘S&P” in the search box. It looks like more and more retirement age workers need employment based out of necessity when a “high-yield” savings issued a .3 percent rate or a 5-year CD brings in a cool 1.81 percent. That’s a whopping .1 percent above the latest consumer price index (CPI) figure. Baby boomers can’t retire because they’re broke.

And now we have algorithms running risk higher and Mark Zandi in a euphoric bliss, check this figure out: 230,000 out of the 248,000 jobs added in September were those aged 55 and older, living out those golden years as a Wal-Mart greeter for $8.50 an hour. Teens made up 45,000, while there was a 72,000 decline in college-aged workers and a 10,000 drop in the key 25-54 age demographic.

Obama and his administration will take these headlines to the bank. All those jobs his team have created. Since the labor force mass exodus began in late 2007, there have been a net-addition of 5.5 million jobs added for senior citizens. The key demographic lost 2.04 million jobs.

When the financial media will push through the headlines is anyone’s guess, but this is not stable and will turn out poorly.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply